2024 IN FINTECH: The Big Wrap 🌯

Discover Fintech Wrap-Up, a newsletter about all things Fintech & Insurtech in Europe, by BlackFin Tech.

Welcome back BlackFin Tech aficionados!

As we cozy up to the end of another year, we delved into our rich repository of data once more. We've crunched the numbers and unearthed the key trends, milestones, and insights that defined the fintech landscape in 2024.

Here's your exclusive wrap-up of the year that was—and a glimpse of what's to come!

📊 WHAT SHAPED EUROPEAN FINTECH IN 2024

Disclaimer: all data is as of 16th of December.

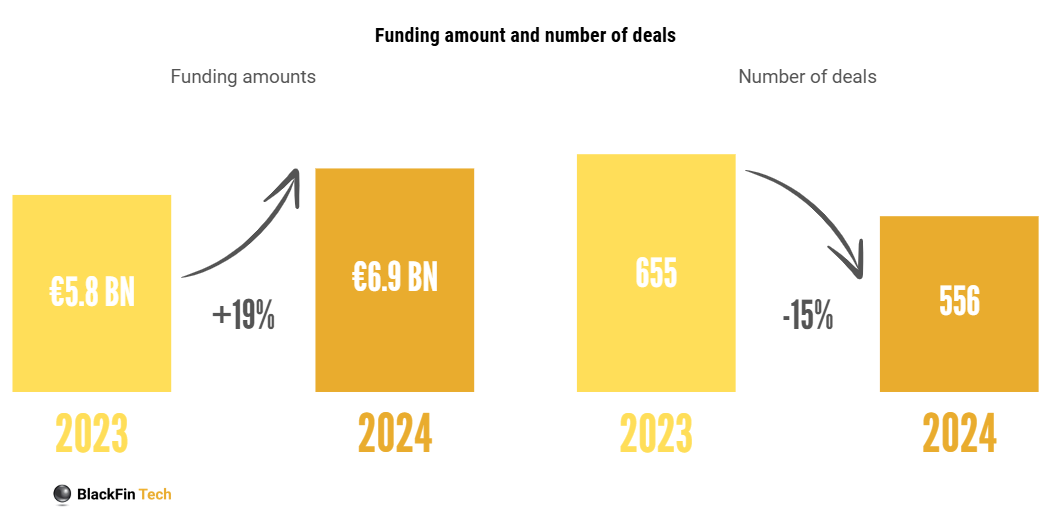

Amid the slowdown that began in 2022 and continued in 2023, the European fintech market has started to stabilize cautiously in 2024. The number of investments continues to decline, with 15% fewer companies raising funds this year, but the total funding amount has increased. In 2023, over 655 fundraising rounds took place, but this number dropped by 15% to 556 in 2024. Despite the decline in activity, total funds raised rose by 19% from €5.8 billion in 2023 to €6.9 billion in 2024.

Fewer fintechs are being funded, but larger sums are being injected — could this be a sign that the ecosystem is maturing?

Zooming in on 2024 👀

The F-Prime Fintech Index, a specialized financial index tracking the performance of fintech companies across various sectors, has outperformed key market benchmarks this year, including the Nasdaq, S&P 500, and Emcloud with a 48% YTD performance. However, the Fintech index has exhibited significantly greater volatility compared to these benchmarks.

The UK continues to lead the European fintech scene followed by France and the DACH region. Looking closely at each country, fundraising trends across Europe varied significantly by country. The UK, France, Switzerland, Denmark and the Netherlands recorded notable growth in total funds raised, whereas Germany and Spain experienced substantial declines. In contrast, Sweden, Italy and Belgium maintained relatively stable fundraising levels.

Total funding across all investment stages has remained relatively stable, but there has been a notable increase in funding for Series A, B, and C rounds.

Remarkably, three Series B rounds this year — Finbourne Technology, Osapiens, and Datasnipper — each raised €100 million or more, a milestone not reached by any Series B round in 2023.

Meanwhile, early-stage funding experienced a slight decline. This shift may signal a growing investor preference for more mature startups, which are perceived as less risky. The slowdown in early-stage funding is partly attributed to a reduction in the number of new startups and the renewed participation of late-stage and growth investors.

After a cautious 2023, marked by hesitancy toward inflated valuations, these investors have returned as valuations normalize to more attractive levels. This shift reflects a broader market maturity, with greater emphasis on sustainable growth and proven business models.

Sectoral Trends: Banktech and Insurtech on the Rise

There has been a resurgence in the amounts raised by Banktechs and Insurtechs, two flagship sectors of European fintech.

Looking more closely at Banktech, the sharp increase in investment amounts is partially explained by the mega fundraising of Monzo, the British neobank, which completed a two-part Series I (€410M in March and €193M in May).

Meanwhile, the rise in funding for Insurtechs was driven by two major fundraising rounds in France in the third quarter, totaling nearly €300M combined: the impressive fundraises of Alan and Akur8.

Conversely, a slight decline in terms of new deals was observed across almost all sectors, with Regtech standing out as a notable exception, maintaining deal activity at levels similar to last year.

⭐ What are 2024’s 10 biggest rounds? ⭐

The top 10 deals in Europe's largest fintech hubs show a relatively balanced distribution. Of these, equally 3 originated in the UK, in France and in Germany, and 1 in the Netherlands. The largest rounds were predominantly driven as already observed on the graph above by Banktech, Investment banking, and Insurtech companies.

From our perspective, what unites most of the companies listed above is their achievement of category leader status, which attracts late-stage/growth investors now eager to deploy their dry powder.

🍳 WHAT SHAPED 2024 AT BLACKFIN TECH

Portfolio news

🇫🇷👋 In September, Akur8 raised €100m in a Series C led by One Peak, bringing its total funding to €180 million. In addition to this funding round, Akur8 announced the strategic acquisition of Arius, an award-winning reserve management solution, which enhances its product portfolio and strengthens its position as a leader in the insurance sector.

🇳🇱💚 BIG things happened for our green champion Carbon Equity:

Jacqueline and her team opened a new office in Germany 🇩🇪

They launched a new climate infrastructure fund which raises €10M at first close 💰

They opened smaller tickets for investors in the Netherlands, who can now invest starting from €25k.

🇩🇪🍺 In October, we invited the CEOs of our buyout and fintech portfolio companies to Oktoberfest to strengthen the ties between the two strategies —because a good beer always helps!

🇬🇧💰 In October, Timeline announced great news: it surpassed £7 billion in assets under management (AUM) in 2024 and has been the fastest-growing business in its sector over the last three years, based on net asset growth and percentage increase.

🇫🇷👯♂️ In November, Agicap raised a €45m Series C led by AVP. With this new funding, we are confident that Agicap will strengthen its position as a leader in Europe and enhance its product, paving the way to becoming the global reference in cash management for mid-market companies.

🏅🏅 December is ranking season: Sifted revealed their 250 leaderboard, highlighting the most exciting startups across Europe... and 2 of our portfolio companies made the cut! Congrats to Formalize and Tuum 🙌

Team news

In September, Guillaume has joined our Paris office as a VC Analyst 🎉

Guillaume built his expertise in private equity and venture capital from his experiences at Eurazeo and The Invus Group in Paris, where he contributed to fundraising, due diligence and portfolio management. At Papernest, he supported the executive team in strategic business planning and market expansion.

We’re super excited to have him onboard!

🔮 Coming soon… our predictions for 2025!

It’s both a tradition and a collective teamwork: with every new year come BlackFin Tech’s finest Fintech & Insurtech predictions. This year, we’ve chosen a slightly different path… but we can’t share more just yet. Stay tuned!

On behalf of the entire team, happy holidays and see you next year! ✨