BlackFin Tech Weekly — April 22nd, 2024

Every Monday, we publish a short digest which sums up last week’s Fintech activity

Hello FinTech Friends,

Welcome back to our newsletter! It has been a busy week with many new deal announcements. Notably, we have seen an increase in the number of deals in the digital assets space, both in our fundraising section as well as in our M&A section. Read on to learn all about the newest developments in the European Fintech scene!

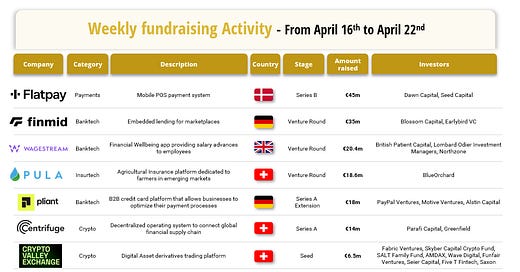

Last week we saw 15 official fintech deals in Europe for a total amount of €159.6m raised, with 5 deals in the UK, 3 in Switzerland, 2 in France, 2 in Germany, 1 in Denmark, 1 in Latvia, and 1 in Estonia.

Congratulations to Flatpay, the Denmark-based POS Payment solution provider, for securing an impressive €45 million in Series B funding, with Dawn Capital leading the round alongside Seed Capital and other investors. Applause also goes out to Finmid, the lending infrastructure player headquartered in Berlin, Germany, for raising a notable €35 million in Series A funding, supported by Blossom Capital and Earlybird VC. Lastly, we congratulate Wagestream , the financial wellbeing app headquartered in London, UK, for securing a substantial £17.5 million in funding, with British Patient Capital, Lombard Odier Investment Managers, and Northzone providing strong support.

Let’s dive in

Flatpay, the Denmark-based fintech specializing in POS payment solutions for small and medium-sized businesses (SMBs), has secured an impressive €45 million in Series B funding. Led by Dawn Capital, with robust participation from Seed Capital and other investors, this Series B round marks a significant milestone for Flatpay's growth trajectory. With a focus on simplicity and cost-effectiveness, Flatpay's platform offers SMBs no setup fees for terminals, no subscription fees, and a flat rate for all card types. Moreover, it provides comprehensive data dashboards, empowering businesses with valuable insights into their transactions. The influx of capital will propel Flatpay's mission forward, enabling further product development, expansion into new markets, and accelerated scaling up of its team.

Finmid, headquartered in Berlin, Germany, has recently secured a notable €35 million in Series A funding, signaling a strong endorsement by investors for its embedded financing solutions tailored for B2B platforms serving small to medium businesses (SMBs). Leading the round are Blossom Capital, Earlybird VC, and N26-founder Max Tayenthal, underscoring the confidence in Finmid's innovative approach to financial services. At the core of Finmid's offerings is a marketplace that gives SMBs immediate access to future revenues based on their sales history, alongside a streamlined B2B payments system facilitating seamless transactions. With this injection of capital, Finmid is poised to accelerate its growth trajectory by focusing on customer acquisitions and product development initiatives. Specifically, the funds will be channeled towards expanding and onboarding customers across core European markets, while also enhancing the user interface to ensure a seamless experience for all stakeholders.

Wagestream, headquartered in London, UK, has recently secured a substantial £17.5 million in funding, marking a pivotal moment in its mission to revolutionize financial empowerment for low and middle-income workers. This investment round, supported by British Patient Capital, Lombard Odier Investment Managers, and existing investor Northzone, underscores the confidence in Wagestream's innovative approach to addressing the financial needs of its user base. At the heart of Wagestream's offerings is its financial benefits platform, which enables users to access an interactive payslip, exercise flexibility in choosing their pay schedule, save directly from their earnings, and access various financial tools and resources. In line with its vision to become a 'complete financial platform', Wagestream is expanding its services to include a credit-builder card, shopping discounts, AI-powered coaching, and loans. The infusion of capital will fuel this expansion, allowing Wagestream to further diversify its offerings and solidify its position as a trusted partner in the financial well-being of low and middle-income workers.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Safe has announced the acquisition of Multis. Safe is a crypto infrastructure startup based in Zug, Switzerland, that provides smart wallets, among other products to its customers to allow them to own digital assets. In 2022, Safe had raised $100m from notable investors, such as Coinbase Ventures, Lightspeed and Tiger Global. Multis is an accounting automation solution for crypto businesses with over 100 clients. Multis was founded in 2019 and was part of one of Y Combinator’s batches. Most of the team is based in France, but Multis is incorporated in the US with some of the team based in California. Safe is looking to expand its product offering with the acquisition of Multis.

Read more

Last Wednesday, Huma Finance and Arf announced the merger of both companies. Huma Finance is a tokenization platform, which aims to revolutionize private credit. Huma Finance is US-based and was founded in 2022. Arf is a Swiss global transaction services platform for liquidity and settlements. With the merger, both companies aim to grow the blockchain-powered financial services space. The merged company will allow financial institutions using the platform to offer more seamless payments by removing working capital requirements.

Read more

And finally, here are the news that caught our eye last week:

Following past expansions in the LATAM markets, UK fintech Revolut just received a 45% valuation boost from Schroders, which now values the Fintech at $25.7 billion. Despite the increase, the new valuation still falls short of Revolut’s highest valuation in 2021. Revolut plans to invest $100 million in Mexico, focusing on hiring, debt coverage, and maintaining cash reserves.

Klarna debuts its credit card in the US, offering users up to 10% cash back on selected merchants via its app. With installment payment options and no annual or foreign transaction fees, Klarna's partnership with WebBank marks a significant stride in the fintech realm. The US expansion has already proven successful, solidifying its position as one of Klarna's top revenue-generating markets alongside Germany.

Canada pledges to enact open banking legislation by year-end, overseen by the Financial Consumer Agency of Canada (FCAC).

After a three-year investigation, the commitment gains momentum, aiming for implementation this year, with six core elements: governance, scope, accreditation, common rules, national security, and technical standards. While no specific date is set, the fintech sector urges swift action to avoid falling behind globally.

TabaPay, a prominent money-moving platform, is poised to acquire the assets of bankrupt Banking-as-a-Service provider Synapse.

Synapse faced financial difficulties, including layoffs due to losing a major client and shifting economic conditions. TabaPay, already serving over 2,500 clients across the US and Canada with its robust payment processing services, views this acquisition as an opportunity for growth.

Pending approval by the bankruptcy court, this deal promises to shape TabaPay's future trajectory.

Have a great week & see you soon!

Sources of the fundraising reports.