BlackFin Tech Weekly — April 29th, 2024

Every Monday, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome back to our newsletter! We have another interesting week behind us. One of Europe’s largest and most valuable Fintechs has extended its previously announced funding round by over €180 million. Furthermore, we also saw two news about the ever-wider spreading adoption of BNPL. Read on to learn about all the latest developments.

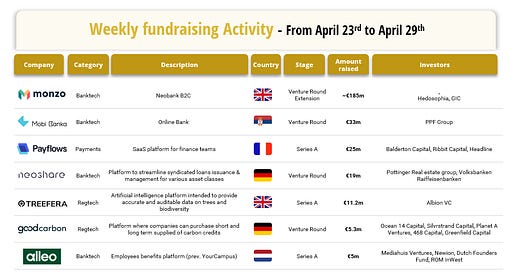

Last week we saw 11 official fintech deals in Europe for a total amount approaching €296m raised, with 4 deals in the UK, 3 in France, 2 in Germany, 1 in The Netherlands, and 1 in Serbia.

Congratulations to the UK-based Neobank Monzo, extending its previous round close to £500 million, with Hedosophia leading the current round alongside GIC. Applause also goes out to Mobi Banka, headquartered in Serbia and now rebranded as Yettel Bank, which has successfully secured €33 million in funding from PPF Group. Lastly, we extend our congratulations to the Paris-based Payflows. The SaaS platform is designed to streamline finance operations for businesses which secured an impressive €25 million Series A in funding in a round led by Balderton Capital, with Ribbit Capital and Headline also providing strong support.

Let’s dive in

Monzo, one of the leading worldwide neobanks based in the United Kingdom, has recently concluded a significant fundraising round, extending its previous round close to £500 million. Spearheaded by Hedosophia, renowned for backing tech giants like Airbnb and Uber, this fundraising effort saw participation also from GIC. With this infusion of capital, Monzo aims to fuel its expansion phase, focusing on international growth initiatives and potentially gearing up for a stock market listing.

Mobi Banka, headquartered in Serbia and now rebranded as Yettel Bank, has successfully secured €33 million in funding. Operated within the PPF Group, Yettel Bank is a digital lender offering banking services primarily through mobile applications. This investment round, led by PPF Group, will facilitate the rebranding efforts of Mobi Banka to Yettel Bank, including the enhancement of mobile application functionalities and investment in IT infrastructure.

Payflows, headquartered in Paris, has successfully raised €25 million in its Series A funding round. Led by Balderton Capital, with participation from Ribbit Capital and Headline, this investment marks a significant milestone for the company's growth trajectory. Payflows is a Software as a Service (SaaS) platform designed to streamline finance operations for businesses. It offers a solution that integrates various financial workflows and systems, providing real-time visibility, collaboration, and productivity enhancements. The funds raised will be utilized to further develop Payflows' platform, expand its capabilities, and support the company's growth initiatives, including market expansion and customer acquisition efforts.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Jupiter has announced the acquisition of Ultimate Wallet. Jupiter is Solana’s leading DEX aggregator. DEX stands for decentralized exchange and a DEX aggregator gives users access to different decentralized exchanges which allows for more competitive prices. Jupiter surpasses $10bn in trading volume per week regularly. The target, Ultimate Wallet is a self-custody crypto wallet firm, based in Berlin and co-founded by a previous Co-founder and CTO of Solaris Bank. It counted prominent VCs such as Lightspeed Venture Partners and Speedinvest, among its investors. With the acquisition, Jupiter seeks to build out its mobile capabilities and to launch its wallet soon. Ultimate’s service will be discontinued in the coming months.

Read more

Powens has announced the acquisition of Unnax. Powens was founded in 2012 in Paris, France, and is specialized in APIs to provide open finance solutions. Powens counts around 300 clients worldwide and has 90 employees. Unnax is based in Barcelona and was founded in 2016. Unnax is an embedded banking and open finance provider that is mainly operating in Spain and Mexico. Unnax holds an Electronic Money Institution license and serves over 60 clients. Behind the investment stands the growth equity firm PSG Equity, which is already invested in Powens. With the acquisition of Unnax, it seeks to build a leading player in the embedded banking and open finance space.

Read more

And finally, here are the news that caught our eye last week:

Uber and Klarna have joined forces to introduce innovative payment solutions for both ride-hailing and food-delivery services. This collaboration offers users in Germany, and Sweden the flexibility of choosing between immediate or deferred payments, aligning with the increasing demand for versatile digital payment methods.

This strategic partnership marks a significant step towards meeting evolving consumer preferences and ensuring seamless transactions across diverse markets.

Monese, the British Banktech targeting expats in London and Tallinn, is taking decisive steps to address financial challenges. Despite securing significant equity funding of £42.3 million during its Series C round in Q1 2022, the company faced a substantial increase in losses, totaling £30.5 million, up by 70% from the previous year.

In response, Monese is exploring various organizational and capital structures, balancing its original B2C business with its emerging B2B platform.

One, supported by retail giant Walmart, has unveiled its "buy now, pay later" (BNPL) loan service. This initiative allows customers to purchase high-value items at select U.S. stores and repay the amount in installments, positioning One to compete with established players such as Affirm.

The BNPL market is experiencing rapid growth, with projections indicating it could reach $75 billion in online spending by 2023.

Visa has launched open banking in the United States, leveraging the technology of Tink, which it acquired in March 2022 for €1.8 billion. This development enables U.S. users to securely connect their accounts and authorize trusted entities to access their financial data.

In Europe, Visa and Tink have already partnered with Adyen and Revolut. For the US launch, Visa has secured data access agreements with major players like Capital One or Fiserv to streamline financial operations.

Have a great week & see you soon!

Sources of the fundraising reports.