BlackFin Tech Weekly — April 2nd, 2024

(Almost) Every Monday, we publish a short digest which sums up last week’s Fintech activity. Hope you had a great Easter Monday!

Hello FinTech Friends,

Welcome back to our newsletter! We hope you had a joyful Easter weekend. Last week has been full of new deal announcements and news that shift the dynamics of some sectors within the financial services landscape. Let’s dive in and see what has happened throughout the last couple of days.

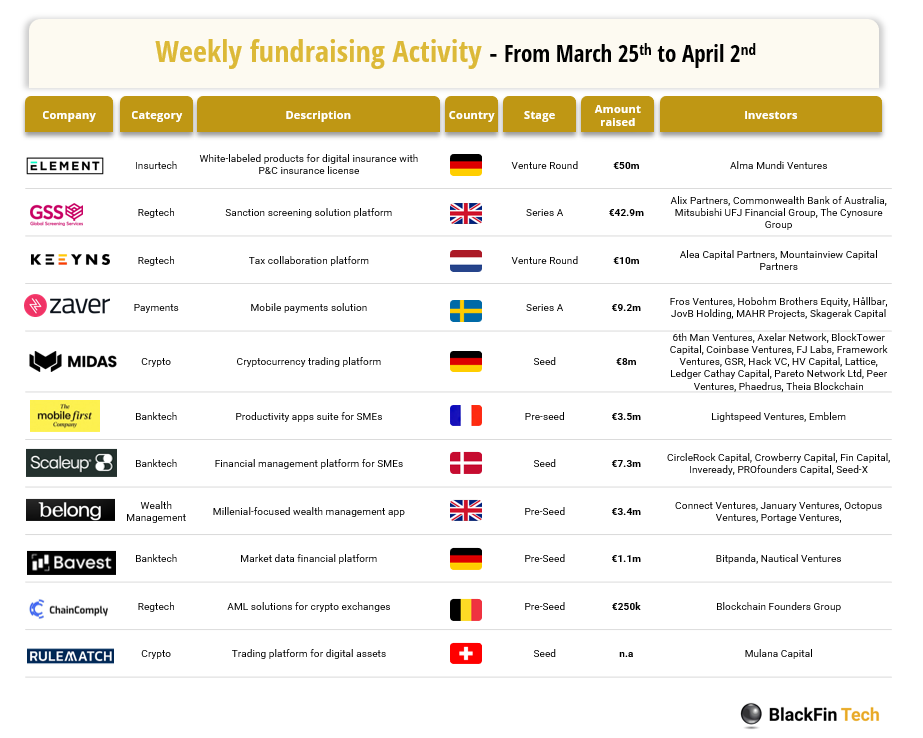

Last week we saw 12 official fintech deals all over Europe for a total amount of 136m€ raised with 3 deals in Germany, 2 in the UK, 2 in France, 1 in the Netherlands, 1 in Sweden, 1 in Denmark, 1 in Belgium and 1 in Switzerland.

Congratulations to ELEMENT, the digital insurer, who has successfully raised €50 million in a Venture round led by the PFDAB. Well done also to Global Screening Services, a London-based company that provides a sanction screening solution platform for financial institutions, for having raised a $47 million Series B round. The new round was led by the Commonwealth Bank of Australia, with participation from AlixPartners and Cynosure Group. Lastly, we want to extend our congratulations to Keeyns, a Dutch fintech company that operates a tax collaboration platform, who raised €10 million in a Venture Round. The round was led by Alea Capital Partners, a private equity investor from Portugal, and Mountainview Capital Partners, a Dutch investment firm.

Let’s dive in

ELEMENT, the digital insurer based in Frankfurt, has successfully concluded its latest funding round. The startup secured an additional 50 million euros in funding. The round was led by the Pension Fund of the Dental Association of Berlin and Mundi Ventures, who were already investors in the startup. During negotiations with investors, ELEMENT reportedly had to make concessions. It is important to note that the initial funding target was revolving around 100 million euros. Until the last funding round in July 2022, the Berlin-based company had raised 88 million euros. While ELEMENT intends to maintain this approach, it plans to streamline its operations significantly. The reason behind this decision is the difficulty in covering the costs associated with BaFin's regulatory requirements. This challenge is also shared by other Insurtechs licensed as insurers by the BaFin, as they often do not grow as quickly as the founders had initially hoped.

Global Screening Services (GSS), a London-based sanction screening solution platform, has successfully closed its Series A2 funding round, raising over $47 million, led by investors such as AlixPartners, Cynosure Group, and Commonwealth Bank of Australia (CBA). The company raised a similar amount of funding last year from big-name backers including Japan’s Mitsubishi UFJ Financial Group (MUFG). GSS offers a cloud-native platform aimed at revolutionizing regulatory compliance within the financial sector, providing innovative solutions to navigate the complexities of the sanctions landscape. With this new capital infusion, GSS plans to transition from the development to the operational phase, deploying its platform to inaugural clients. Additionally, the company will focus on advancing technology development to set new industry standards and enhancing transaction screening efficiency through innovative frameworks and technologies. This strategic allocation of funds underscores GSS's commitment to reshaping regulatory compliance on a global scale.

Read more

Keeyns, a Dutch fintech that developed a tax collaboration platform, has raised €10m in a Venture Round. The round counted two investors, who were both leading the deal. The first is Mountainview Capital Partners, a Dutch VC firm, while the other is Alea Capital Partners, a Portuguese PE firm that also partly does VC deals. It is unclear if the two firms took a minority or majority stake. Keeyns was founded in 2017 to facilitate the life of finance departments with their tax collaboration platform. Keeyns uses its tax data warehouse to give employees and external stakeholders a platform to collaborate on transfer pricing, wage tax, and VAT. With the additional cash, Keeyns is looking to invest more into its tax engine as well as expand its tax tech stack in other areas. Additionally, Keeyns is also planning to enter new markets, namely Portugal and the US.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Paynetics announced the acquisition of Novus. Paynetics is a regulated e-money institution from Bulgaria, that provides a range of different payment services. Many of those services are offered through white-label and embedded solutions. Novus is the UK’s first impact neobank, founded in 2020. By using the Novus card for making transactions, a part of the transaction fee is given to a cause of the user’s choice. Furthermore, users can offset their carbon emissions through certified carbon removal projects on the app. Paynetics seeks to bolster its efforts of strengthening its offerings which are ESG focused with the acquisition of Novus.

Read more

And finally, here are the news that caught our eye last week:

As Visa and Mastercard agreed to lower interchange fees which could save merchants billions of dollars to merchants, there are concerns about how this reduction will affect issuing banks.

Fintech companies are discussed as potential players in providing alternative payment methods that could help both merchants and banks navigate these changes. For example, "Pay by Bank" is mentioned as a payment method built on global open banking payment rails, which could reduce fees and provide near-instant settlement, benefiting both merchants and banks.

Visa+ is a service that allows users to send and receive money across different P2P digital payment apps. PayPal and Venmo’s partnerships highlight the expansion of Visa+'s reach, enabling cross-platform money movement.

In addition to enhancing P2P payment experiences, Visa+ is becoming a preferred platform for B2C payouts, with partners like DailyPay facilitating direct deposits to Visa+ linked accounts.

As Revolut did earlier this week, Western Union has launched an eSIM mobile data service in partnership with eSIM Go's Powered by Breeze solution. The service, called "Western Union eSIM, Powered by Breeze," is now available to Western Union digital wallet customers, offering global coverage in over 150 countries with various data bundles.

This eSIM service aims to provide Western Union customers with convenient connectivity options for traveling abroad.

According to a KPMG report, Irish fintechs only attracted $60.83 million in funding in 2023, down from over $1 billion in the previous year. This decline is reflected in the reduced number of deals, with only 11 transactions compared to 22 in the previous year.

Despite these challenges, there is optimism about the resilience of Ireland's fintech sector and the potential for recovery once market conditions stabilize. Opportunities are still seen within areas like regtech, payments, insurtech, and wealthtech.

Have a great week & see you soon!