BlackFin Tech weekly — August 29th, 2023

This week, we are sharing a wrap-up of the summer's fundraising announcements.

Welcome back to another edition of our newsletter! We're glad to have you with us as we kick off once again, diving into the latest fintech updates and insights.

As always there has been slight dip in fundraising activity over the summer. However, rest assured that we've been keeping an eye on the fintech industry throughout this period, even from the beach…

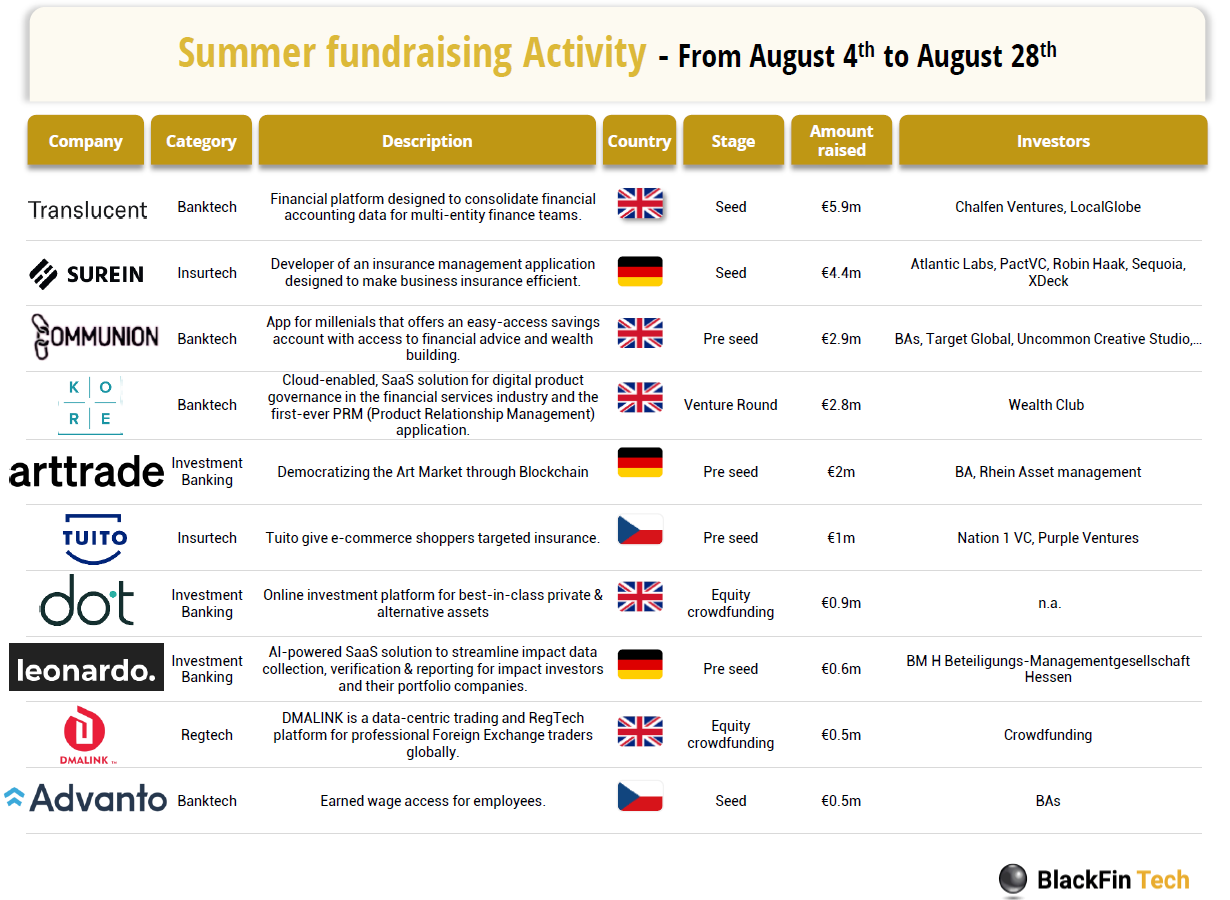

In the past three weeks, we saw 18 deals in Europe for a total amount of €21.9m raised with 10 deals in the UK, 3 in Germany, 2 in Czech republic, 1 in Switzerland, 1 in Finland and 1 in Estonia.

Congratulations Translucent and its next generation accounting software on its €5.9m Seed round co-led by Chalfen Ventures and LocalGlobe, followed by the Berlin-based insurtech SureIn which helps small businesses compare insurance coverages from a variety of insurers,that raised a €4.4m Seed led by PactVC. And finally, Communion, the London-based banktech company raised a €2.9m pre seed round from Target Global with participation from many business angels.

Let’s dive in

London-based Translucent raises €5.9 million in a seed funding round co-led by Chalfen Ventures and LocalGlobe.

Translucent's platform unifies accounting data for multi-entity and multinational businesses, offering innovative apps atop existing software like Xero and QuickBooks.

Founder and CEO Michael Wood, previously co-founder of Dext (formerly Receipt Bank), leads Translucent's mission to address financial management challenges for multi-entity businesses.

The funding follows a pre-seed round of €3.2 million and brings Translucent's total investment to €9.1 million, fueling the development of additional apps such as 'Intercompany Transactions' and 'BI & Analytics'.

Angel investors from fintech and accounting-tech leaders, along with a successful track record, endorse Translucent's potential to revolutionize financial insight for multi-entity businesses

Read more

Berlin-based insurtech SureIn raised €4.4 million in a Seed round led by Pact VC, with participation from xDeck.

SureIn serves as a broker, helping small businesses compare insurance coverage options from various insurers.

Founded in 2022, SureIn has generated over €1 million in gross written premiums and is close to reaching 1,000 customers.

Traditional brokers and Managing General Agents (MGAs) lack user-centricity, and SureIn aims to address this gap.

The funds will be used to develop the SureIn platform further, automate product processes, and expand insurance offerings to healthcare, pension, professional services, and startups.

London-based fintech startup Communion Save Ltd secured £2.5 million in pre-seed funding, valuing the company at £11.5 million pre-money

The funding round was led by Target Global, with participation from angel investors Max Rofagha, Greg Marsh, and Erin Lantz.

Communion offers a savings app designed for millennials, providing an easy-access savings account with 3.66% Annual Equivalent Rate (AER). Users can increase their interest rate by up to 2% by inviting friends to the app, reaching a maximum of 5.66%.

CEO Daniel Hegarty left his role at digital mortgage broker Habito to found Communion, inspired by his own relationship with money.

Communion is currently focused on attracting users and deposits through referrals.

Read more

Congrats also to Kore Labs, Arttrade, Tuito, dot investing, Leonardo. Impact, DMALINK and Advanto for their fundraisings!

In addition to this week’s fundraising activity, we also observed the following M&A deal in Europe:

FullCircl, the Customer Lifecycle Intelligence platform, has acquired W2 Global Data Solutions, a digital compliance provider. This enhances FullCircl's compliance suite, aiming to lead in smart customer onboarding for regulated businesses. W2's expertise in identity verification, such as global KYC, AML and anti-fraud services complements FullCircl's growth strategy, expanding its applications and APIs. Combined the entity covers 160 countries, broadening market appeal and venturing into sectors like personal finance, gaming, and crypto.

Germany's digital lending platform, auxmoney, has acquired a majority stake in Dutch consumer credit marketplace Lender & Spender. This move expands auxmoney's international reach and product range, building on a previous partnership. Lender & Spender will maintain its brand and Amsterdam base. Transaction details remain undisclosed pending local authorities' approval.

Vanquis Banking Group has acquired money-saving app Snoop, founded by Jayne-Anne Gadhia. Snoop uses Open Banking to find savings opportunities. Having raised £15 million in Series A funding and £10 million in crowdfunding, the app has been installed over 1.2 million times. The acquisition grants Snoop access to Vanquis Bank's 1.7 million customers for growth.

Fintech player Rapyd has acquired PayU's Global Payments Organisation for $610 million. Rapyd, originally a mobile payments firm, now empowers global brands like Ikea and Uber with diverse payment options across 100+ countries. The acquisition strengthens Rapyd's presence in Central and Eastern Europe and Latin America while enabling PayU to focus on Indian opportunities.

Italian paytech Nexi has acquired a 30% stake in German payments processor Computop. The deal expands Computop's services in point-of-sale and e-commerce across Nexi's covered regions. Computop's Paygate platform offers integrated payments for e-commerce and in-store, supporting over 350 payment methods. This move strengthens Nexi's position in the DACH region, particularly Germany, and enhances its e-commerce capabilities.

Turkish fintech Param has acquired Czech BNPL provider Twisto from Zip Co, aiming to expand across Europe. The initial focus will be on the UK, Germany, Netherlands, Czech Republic, and Poland. Param plans to introduce its innovative solutions using Twisto's existing European licenses.

In the past weeks, we have also observed an M&A activity in the US that is worth mentioning briefly:

Upgrade, a San Francisco-based fintech company, has acquired Uplift, a Menlo Park-based provider of Buy Now Pay Later (BNPL) solutions for travelers, for $100 million. Uplift offers BNPL products for travel expenses and serves 3.3 million customers in partnership with major airlines and hotel chains. Upgrade, known for affordable credit and mobile banking, has delivered over $24 billion in credit since 2017.

And finally, here are the news that caught our eye last week:

Revolut Ceases Crypto Services for US Customers. Revolut has confirmed its decision to halt cryptocurrency services for its US customers starting from September 2nd. Access to buying crypto through the bank will be completely disabled by October 3rd. This announcement reflects the growing tension between US regulators and the cryptocurrency sector, following recent actions by the Securities and Exchange Commission (SEC) against major players like Coinbase and Binance.

Iceberg Data Lab Chosen by Banque de France, ERAFP, and Generali Group for ESG Data Solution. Banque de France, Generali Group, and ERAFP have partnered with Iceberg Data Lab to utilize its dataset to assess the environmental impact of their investment portfolios. This dataset, integrated into IDL’s impact calculation platform, will empower these institutions to make more sustainable investments, enhance risk management strategies, and create environmental impact reports. Banque de France aims to address biodiversity impact, ERAFP will analyze the climate change and biodiversity exposure of its asset portfolios, and Generali Group plans to leverage the dataset to advance its ecological investment strategy.

TerraPay Obtains EMI License in Italy, Sets Sights on European Expansion TerraPay, a global payments infrastructure company headquartered in the UK, has been granted an Electronic Money Institution (EMI) authorization from the Bank of Italy. This approval gives TerraPay the green light to expand its operations in Italy and subsequently throughout the European Union. This announcement follows TerraPay's successful Series B funding round, during which it secured $100 million in debt and equity funding to enhance its regulatory and compliance infrastructure and pursue new licenses globally.

Adyen's Stock Plummets After Disappointing Results. Amsterdam's fintech powerhouse, Adyen, saw its stock drop by over 38% due to disappointing financial results in the first half of the year. The company faced slowing US growth and increased competition, impacting profitability. Although revenue grew by 21% to 739.1 million euros in H1 2023, it missed analyst expectations, resulting in the biggest daily stock loss since its 2018 listing on the Amsterdam exchange. Despite the setback, Adyen, valued at 35.4 billion euros, remains resilient with an expansion-focused approach, distinguishing itself through aggressive hiring rather than layoffs.

Have a great week & see you soon!