BlackFin Tech Weekly — December 2nd, 2024

Every Monday, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Happy December! Kick off the first week of the month with the latest fintech insights. Let’s dive into the news and trends driving the industry forward this season!

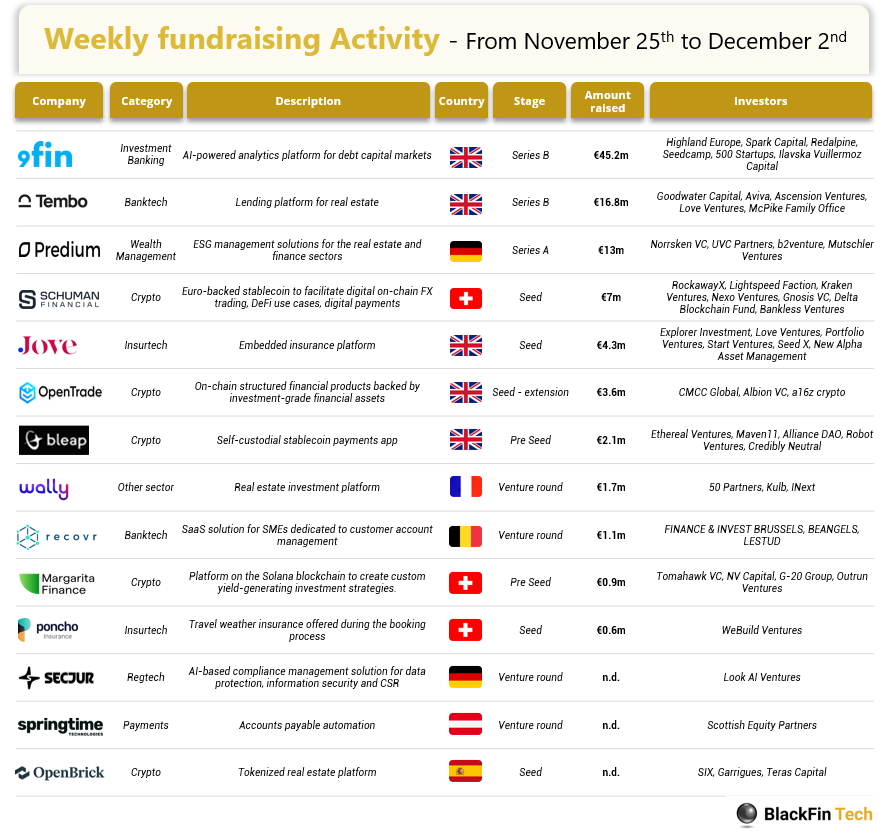

Last week, we saw 14 official fintech deals in Europe, raising a total of €96.3 million, with 5 deals in the UK, 3 deals in Switzerland, 2 deals in Germany, 1 deal in France, 1 deal in Austria, 1 deal in Belgium and 1 deal in Spain.

A huge congratulations to 9fin, the London-based AI-driven debt analytics platform, for securing €47.4 million in a Series B funding round led by Highland Europe. Applause also goes to Tembo, a London-based savings and mortgage innovator, for raising €16.1 million in its Series B round, led by Goodwater Capital. Finally, a round of kudos to Predium, the Munich-based ESG platform revolutionizing real estate management, for closing a €13 million Series A round with Norrsken VC leading the charge.

Let’s dive in

London-based 9fin, an AI-driven analytics platform for debt capital markets, has raised €45.2 million in a Series B funding round led by Highland Europe, with participation from existing investors Spark Capital, Redalpine, Seedcamp, 500 Startups, and Ilavska Vuillermoz Capital. The funding will drive further advancements in 9fin’s AI-powered platform, expand its analytics capabilities, and accelerate its US expansion. 9fin simplifies debt market workflows by providing cutting-edge data and insights through tools for credit assessment, deal predictions, ESG analysis, and more. Since its Series A+ in 2022, 9fin has achieved 400% ARR growth and doubled its customer base to nearly 200 global credit market leaders. With over $17T in combined AUM managed by its clients, 9fin is poised to become the top global provider of debt market analytics.

London-based savings and mortgage platform Tembo has raised €16.8 million in a Series B funding round led by Goodwater Capital, with support from Aviva, Ascension Ventures, Love Ventures, and McPike Family Office. This brings Tembo’s total funding to €18.1 million. Since its launch in 2020, Tembo has helped over 4,000 first-time buyers purchase homes and 35,000 customers save for deposits through its Lifetime ISA. Offering access to over 100 lenders and innovative family mortgage schemes, Tembo’s platform simplifies affordability and decision-making for prospective buyers. The new funds will expand Tembo’s savings app and introduce new mortgage products to support more customers.

Munich-based Predium, a platform providing ESG management solutions for the real estate and finance sectors, has raised €13 million in a Series A funding round. The investment was led by Norrsken VC, supported by existing backers UVC Partners, b2venture, and Mutschler Ventures. Predium leverages AI, satellite imagery, and 3D modeling to deliver actionable insights on ESG metrics, financial indicators, and renovation strategies. Its platform addresses growing regulatory and market demands for sustainable and financially sound real estate decisions, helping clients like Deutsche Investment Group and Colliers optimize property investments and operations. The funds will enhance Predium’s software capabilities and support expansion into new markets, aligning with the EU's 2050 climate-neutral building goals.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Deel, a global payroll and HR platform, has acquired UK-based fintech company Atlantic Money to bolster its payments infrastructure in Europe and enhance global money transfer solutions. While financial terms remain undisclosed, the acquisition aims to integrate Atlantic Money’s expertise into Deel’s comprehensive platform, improving secure and efficient payment options for businesses operating internationally. Existing services, including accounts, transfers, and security, will remain unchanged for Atlantic Money customers. Together, the companies will develop technologies to optimize financial processes for global workforce management, ensuring compliance with regulatory standards while advancing the international financial ecosystem.

And finally, we bring you four current Fintech stories:

The German Fintech unicorn Solaris is urgently seeking €100m in funding by the start of December. The need for funds is linked to accounting issues, specifically related to the write-off of its UK Electronic Money Institution business, and delays in sales, particularly concerning their flagship ADAC contract. Should the funding fail, Solaris is preparing to find a buyer. Interested parties are reportedly Japanese investor SBI, Deutsche Bank and BNP Paribas.

Reaching an impressive milestone, SumUp has processed over 1 billion transactions this year and now serves more than 1 million merchants across 36 markets. Over the past decade, the offering has grown considerably, shifting from a primary focus on payments to a robust, multi-faceted solution that encompasses payment processing, business accounts and cards, as well as advanced business software. SumUp has been EBITDA-positive since the last quarter of 2022, with consistently improving margins. While the company continues to grow organically as well as through M&A, they are reportedly in no hurry to go public.

The aftermath of BaaS Fintech Synapse's downfall earlier this year persists, as multiple partner banks, incl. American Bank, AMG National Trust, Lineage Bank and Evolve Bancorp, now confront legal action over alleged customer fund mismanagement. Synapse's bankruptcy has caused widespread financial disruption, leaving approximately 100,000 consumers unable to access their funds due to catastrophic ledger failures, with an estimated $65-95 million in unaccounted funds and multiple fintech partners left scrambling to recover customer deposits.

Under a license from Autorité de contrôle prudentiel et de résolution (ACPR), French payments infrastructure unicorn Spendesk has been able to launch a financial services division. This will give Spendesk end-to-end control over its payment services infrastructure and enable them to deliver their payment solutions across the European Union. Overall, the Fintech offers finance teams in midmarket companies a SaaS-based spend management solution that ensures complete visibility and control over all expenditures. Each transaction can be linked to specific individuals, projects, and budgets.

Have a great week!

Sources of the fundraising reports