BlackFin Tech Weekly — December 9th, 2024

Every Monday, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Happy Monday! Start the second week of the month with fresh fintech insights. Let’s explore the news and trends shaping the industry this season!

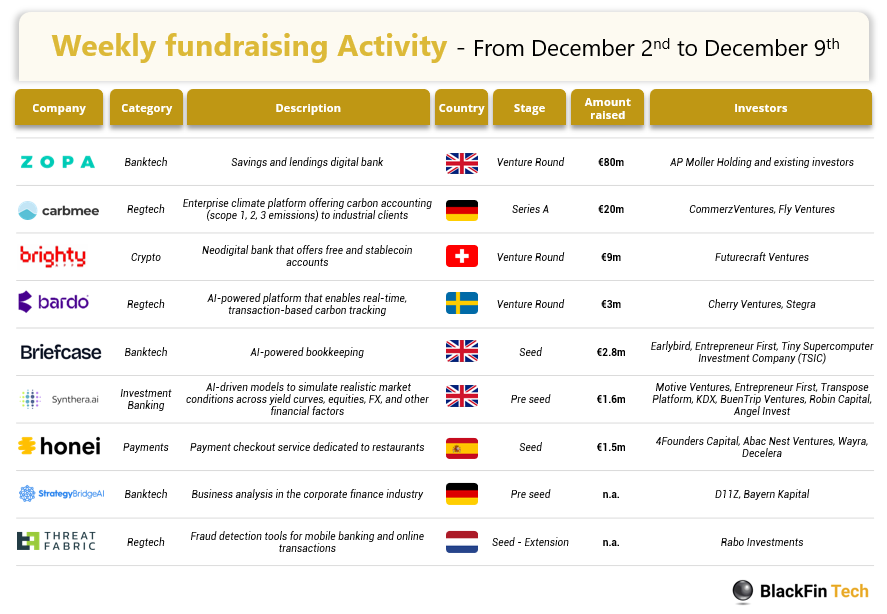

Last week, we saw 9 official fintech deals in Europe, raising a total of €119.6 million, with 3 deals in the UK, 2 deals in Germany, 1 deal in Switzerland, 1 deal in Sweden, 1 deal in the Netherlands and 1 deal in Spain.

Congratulations to Zopa, the UK-based digital bank, on raising an impressive €80 million in equity funding led by AP Moller Holding. Kudos to Carbmee, the Berlin-based AI-powered carbon management platform, on securing €20 million in a Series A round led by CommerzVentures. Finally, a round of applause for Brighty, the crypto-integrated digital banking app, on closing a €9 million funding round from Futurecraft Ventures.

Let’s dive in

UK challenger bank Zopa has secured €80 million in a funding round led by AP Moller Holding, with participation from existing investors. Since its launch in 2020, Zopa has built a diverse portfolio of offerings, including savings accounts, unsecured personal loans, credit cards, car finance, and point-of-sale (POS) lending. Zopa has amassed £5 billion in deposits, served 1.3 million customers, and lent over £13 billion. The funds will support the launch of Zopa’s flagship current account in 2025 and a new AI-driven tool to transform money management. This follows partnerships with Octopus Energy and John Lewis, as well as a strong FY 2023 performance with a £15.8 million pre-tax profit.

Berlin-based Carbmee, an AI-driven carbon management platform, has raised €20 million in Series A funding led by CommerzVentures, with participation from Fly Ventures and angel investors. Carbmee helps businesses measure, reduce, and report carbon emissions through its advanced Environmental Intelligence System (EIS™). The company, with over 60 team members and offices in Berlin, Munich, and New York, counts industry leaders like Lufthansa Technik, Maersk, and Coca-Cola among its clients. The funds will fuel product innovation, including enhancements to its granular LCA data capabilities and Carbmee Studio, a customization tool for AI-driven reports and dashboards, as Carbmee expands its global presence.

Switzerland-based Brighty, a personal finance app blending digital banking with stablecoins and decentralized finance, has raised €9 million in funding from Futurecraft Ventures. The platform offers European IBAN accounts, physical and digital VISA cards, and custodial addresses across Ethereum, Tron, Polygon, and Arbitrum. Users can easily exchange crypto for fiat currencies like EUR, USD, and GBP, send funds, and make online or offline purchases. Tailored for remote workers, especially those in Web3, Brighty enables interest-earning balances and daily rewards of up to 5% APY on stablecoin card holdings through decentralized finance. Built by alumni from Revolut and Swiss banking institutions, Brighty operates under strict compliance with EU, UK, and Swiss regulations. The funds will support Brighty’s expansion across Europe and the UK, bringing seamless crypto payments to more users.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

UK-based payments company Sokin, a provider of global payment solutions operating at a $4.5 billion annual transactional volume run-rate, has acquired Norway-based Settle Group AS, a fintech firm offering instant domestic and cross-border payment services across the EU, for an undisclosed amount. The acquisition provides Sokin with a European EMI license, enhancing its technological capabilities and market presence while supporting its Sokin Pay platform. Sokin aims to leverage the deal to strengthen its regional footprint and drive further growth, aligning with its strategy of scaling through strategic fintech acquisitions.

Dutch cloud banking vendor Mambu has acquired France-based Numeral, a paytech firm providing advanced payment solutions to banks and fintechs, including BNP Paribas, HSBC, and Barclays, for an undisclosed sum. Numeral, founded in 2021, processes over €10 billion in annual payments and offers a payments hub to streamline transactions. The acquisition allows Mambu to integrate Numeral’s technology into its core banking offerings, enhancing its payment capabilities and addressing evolving customer demands as part of its long-term expansion strategy.

And finally, we bring you four current stories from the Fintech universe:

The digital investment infrastructure provider WealthKernel has teamed up with Griffin, using their banking-as-a-service platform to offer savings accounts to Fintechs and Wealth Managers. These clients will now be able to benefit from interest-earning opportunities on short-term, liquid funds that are not committed to long-term investment strategies.

Danish challenger bank Lunar is separating its banking-as-a-service business into a standalone entity called Moonrise, an initiative aimed at establishing a dedicated entity to enhance payment solutions for both businesses and consumers. The revenues generated through this business are reportedly able to rival the revenues generated through their core activities as a bank with currently 950,000 customers across the Nordics.

Bitcoin has hit a historic milestone price of $100,000, with a record high of $103,619 on Wednesday last week. This development is driven by expectations of a crypto-friendly political landscape under the upcoming Trump administration. Since Election Day, this most well-known cryptocurrency has surged by approximately 45%, while other cryptocurrencies have experienced comparable increases.

After a two-year process, Hero has obtained its Autorité de contrôle prudentiel et de résolution (ACPR) license. Now independent of Banking-as-a-Service providers, the payments and cash flow management platform is now poised to expand across Europe. In further news, they have recently launched an all-in-one business account that features a Visa Platinum debit card, supplier invoice financing, instant payment solutions, and various short-term financing options tailored for European SMEs.

Have a great week!

Sources of the fundraising reports