BlackFin Tech Weekly — February 10th, 2025

Every Monday, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome to another week of fintech insights, where we explore the news and trends shaping the industry!

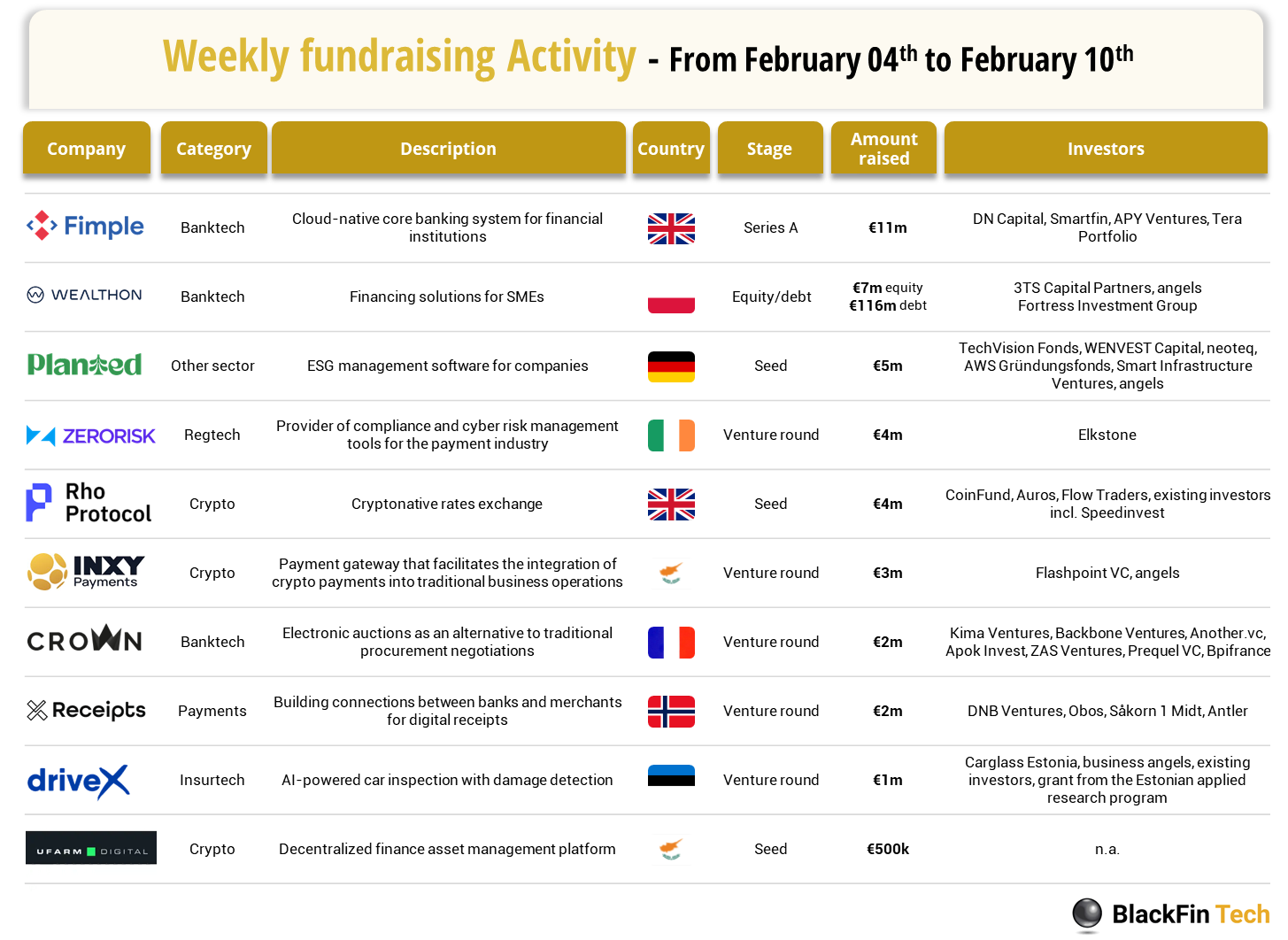

Over the last week, there were 10 fintech deals in Europe, raising a total of €39 million in equity: 2 deals in the UK and Cyprus respectively, as well as 1 deal in Poland, Ireland, Norway, Germany, France and Estonia each.

Congratulations to the top 3 fund raising companies:

Fimple, who offers cloud-native core banking system for financial institutions, has raised €11m in a Series A round led by DN Capital and Smartfin, with existing investors APY Ventures and Tera Portfolio participating.

Wealthon, who provides banking and financing solutions to SMEs, has raised €7m in equity from 3TS Capital Partners and angels, and €116m in debt from Fortress Investment Group.

Planted, an ESG software platform for companies, has raised €5m in Seed from TechVision Fonds, WENVEST Capital, neoteq ventures, AWS Gründungsfonds, Smart Infrastructure Ventures and several angel investors.

Let’s dive in

Fimple, who offers cloud-native core banking system for financial institutions, has raised €11m in a Series A round led by DN Capital and Smartfin, with existing investors APY Ventures and Tera Portfolio participating. Fimple provides financial services to banks and financial institutions, offering solutions for remittance, foreign exchange, loans, and deposits. Founded in 2022, the Turkey-founded fintech secured 10 core banking customers and formed partnerships with over 180 global fintech firms by June 2024. This investment is supposed to fast-track Fimple’s product development and support their international expansion into the MENA and CIS regions.

Wealthon, who provides banking and financing solutions to SMEs, has raised €7m in equity from 3TS Capital Partners and angels, and €116m in debt from Fortress Investment Group. Wealthon is a Polish company, founded in 2018, and provides SMEs with tailored financial products and services, including POSCASH, a financing solution based on terminal payments, and Wealthon WALLET, a mobile wallet designed for business financial management. The equity financing will be dedicated towards product development and extending their sales network. The debt raised will enable the company to scale up financing for SMEs.

Planted, an ESG software platform, has raised €5m in Seed from TechVision Fonds, WENVEST Capital, neoteq ventures, AWS Gründungsfonds, Smart Infrastructure Ventures and several angel investors. Founded in 2021, Planted is a sustainability platform that helps businesses manage their ESG strategies by offering tools for CO₂ tracking, reduction, and reporting, as well as tree planting and biodiversity initiatives in Germany. The company collaborates with over 350 businesses across 12 industries, with notable customers including, Lufthansa, DHL and AXA. The funding will be used to advance Planted’s ESG software.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Worldpay, a global payment processing giant, has announced the acquisition of Ravelin, a UK-based fraud prevention platform specializing in fraud prevention and payment security for online businesses. The financial terms of the transaction were not disclosed. Ravelin, a portfolio company of BlackFin Tech I Fund, has built a strong reputation for its advanced machine-learning technology that helps businesses prevent fraud while optimizing transaction approvals. This acquisition aims to strengthen Worldpay’s fraud prevention capabilities by integrating Ravelin’s cutting-edge solutions, enhancing security for merchants, and improving authorization rates. The acquisition of Ravelin will complement and enhance Worldpay’s portfolio of value-added solutions, enabling merchants of all sizes to grow faster and protect their businesses as fraud activity accelerates globally.

And finally, we bring you 4 news stories that caught our eye last week:

BlackRock is expanding its crypto offerings beyond North America by preparing to launch a Bitcoin-linked exchange-traded product (ETP) in Europe, likely domiciled in Switzerland. This move follows the success of its US$58 billion US Bitcoin ETF, the largest of twelve Bitcoin-tied funds launched last year amid growing institutional demand. Despite Europe's competitive cryptocurrency ETP market, BlackRock sees strong investor interest, especially as regulatory frameworks evolve.

ACI Worldwide has partnered with Banfico, a fintech specializing in regulatory technology, worldwide account verification, and Open Banking solutions. This collaboration will help financial institutions such as banks and payment service providers (PSPs) comply with regulatory requirements, including the European Verification of Payee (VOP) mandate going into effect by October 2025 and the Confirmation of Payee (CoP) service.

Cryptocurrency platform Gemini is exploring an IPO and is in talks with potential advisors, with a possible listing as early as this year. The company recently faced regulatory challenges, including a $5 million penalty from the Commodity Futures Trading Commission and the return of $1.1 billion to customers affected by its failed partnership with Genesis.

Investor Kinnevik has cut the valuation of its 14% stake in expense management unicorn Pleo by 26% year-on-year, implying a company valuation drop from $2.1bn to $1.6bn in Q4 2024. Despite this, Pleo reportedly grew two to three times faster than SaaS benchmarks with strong gross margins, though margin improvements will stall in 2025 as it invests in product and market expansion for a “larger and stronger business in 2026 and beyond”.

Have a great start into the week!

Sources of the fundraising reports