BlackFin Tech Weekly — February 26th, 2024

Every Monday, we publish a short digest which sums up last week’s Fintech activity

Hello FinTech Enthusiasts,

Happy Monday! We hope you're all refreshed from the weekend. As we kick off another week, it's time to delve into the latest from the European fintech scene. From groundbreaking deals to emerging trends, we've got you covered. Let's dive in and explore what's shaping the future of finance together!

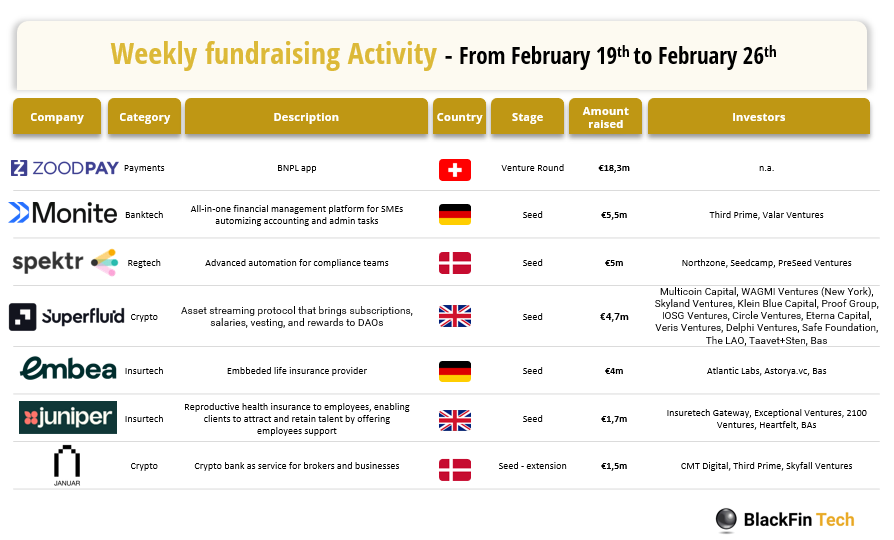

Last week we saw 7 official fintech deals in Europe for a total amount of 40,7m€ raised with 2 deals in the UK, 2 in Germany, 2 in Denmark, and 1 in Switzerland.

Congratulations to Switzerland-based ZOOD Pay, a lending platform that provides innovative financial solutions, that has successfully raised $20m million in their most recent funding round. Well done also to Monite, a German API-first fintech company providing finance automation for B2B platforms, for having secured $6m in a Seed round led by Valar Ventures and Third Prime, with support from existing investors. Lastly, we want to congratulate spektr, a Denmark-based provider of a platform that automates and streamlines compliance tasks for businesses, for having raised €5m in Seed funding. The round was led by Northzone, Seedcamp, and PreSeed Ventures.

Let’s dive in

ZOOD Secures $20 Million in Funding to accelerate development in Uzbekistan. ZOOD is a leading Swiss-based digital lending platform that provides innovative financial solutions. ZOOD operates in Uzbekistan, Pakistan, and Lebanon, serving over 10 million users globally through its diversified FinTech ecosystem. ZOODPay (lending), ZOODMall (marketplace), and ZOODShip (logistics, operated by Fargo.uz) are part of ZOOD's ecosystem with a commitment to revolutionizing lending services and e-commerce in emerging markets. The secured funds will amplify ZOOD's innovative financial solutions in Uzbekistan, supported by a local team of 400 people and serving more than 6 million users. This marks a significant stride forward, building on the success achieved since ZOOD's establishment in Uzbekistan in 2019. Going forward, ZOOD expects an additional $30 million in debt funding before mid-2024 to grow its lending portfolio in Uzbekistan reinforcing its commitment to driving financial innovation and digital solutions.

Monite, a Berlin, Germany-based API-first fintech company providing finance automation for B2B platforms, added $6M to its Seed funding. The round was led by Valar Ventures and Third Prime, with support from existing investors. The company intends to use the funds to consolidate its position as a European embedded finance leader and to expand its footprint in the US. Monite lets B2B platforms, such as banks, neobanks, payment providers, and verticalized SaaS, embed financial workflows like invoicing, payables automation, expense management, and accounting for their clients. Due to its APIs and SDKs, B2B platforms can now offer finance management to their clients in 4-5 weeks instead of building an internal solution for 2 years and over $1-2M in development costs. The company serves over 28 platform clients across the EU, US, and other regions. Monite is backed by Valar Ventures, Third Prime, P72, founders of Klarna, Mollie, and Nium, and execs from Plaid and PayPal.

spektr, a Copenhagen, Denmark-based provider of a platform that automates and streamlines compliance tasks for businesses, raised €5m in seed funding. The round was led by Northzone, Seedcamp, and PreSeed Ventures. The company intends to use the funds to introduce advanced automation to compliance teams worldwide. Co-founded by CEO Mikkel Skarnager, CTO Ciprian Florescu, CRO Jan-Erik Wagner, and CPO Jeremy Joly, spektr is officially exiting stealth mode to launch a no-code solution that automates risk processes, sets up monitoring, resolves alerts instantly, and integrates easily with vendors. By automating 90% of risk and monitoring tasks, the company boosts operational efficiency and drives higher conversion rates for a business. Users gain access to advanced analytics and reporting features to make informed decisions and optimize compliance strategies for commercial success.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

LEA Partners has announced the acquisition of Easybill. LEA Partners is a multi-stage private equity and venture capital firm which is located in Karlsruhe, Germany. LEA Partners was founded in 2002 and invests in B2B Tech companies and aims to reach active market leadership with the businesses it invests in. Easybill is a SaaS business that provides electronic invoicing services to sole entrepreneurs and SMEs and was founded in 2007. Easybill is profitable and has been steadily growing over the last 10 years with now 18,000 customers. The founders of Easybill are stepping back from the active business after the deal and a new CEO was put in place, who aims to accelerate growth and innovation.

Read more

And finally, here are the news that caught our eye last week:

The $35.3 billion acquisition of Discover Financial by Capital One marks a significant strategic move in the US banking sector. By consolidating two major credit card lenders, the merger aims to enhance competition in the industry while potentially reducing consumer options. Capital One's acquisition of Discover's card network, the fourth largest in the US, is expected to bolster its competitiveness. This move would position the combined entity above JPMorgan Chase, the largest issuer in terms of credit card loans last year.

In a bid to simplify its payment offerings, Google has announced the sunset of Google Pay in the United States, favoring the consolidation of its services under Google Wallet. This strategic move aims to streamline the user experience and reduce confusion. While P2P payments will be discontinued, users are encouraged to transition to the Google Wallet app, where they can conveniently manage all their credit and debit cards.

Green Dot Corporation, a leading digital bank and fintech provider, has joined forces with Dayforce, Inc. in a strategic alliance set to redefine on-demand pay solutions. As the exclusive U.S. banking provider for Dayforce Wallet, Green Dot will leverage its innovative Banking-as-a-Service (BaaS) platform to deliver cutting-edge embedded finance solutions.

In a statement dubbed "The Naked Emperor's New Clothes," ECB officials have voiced strong opposition to the defiance surrounding the Bitcoin ETF. Several notable quotes from the article shed light on their stance. The officials emphasize that Bitcoin's price level does not reflect its sustainability, lacking economic fundamental data or fair value for serious forecasts. Instead, they attribute price fluctuations to speculative bubbles driven by lobbying efforts. They stress the importance of authorities being vigilant in protecting society from money laundering, cybercrimes, financial losses, and environmental damage associated with Bitcoin.

Have a great week & see you soon!