BlackFin Tech Weekly - January 19th, 2026

Every Week, we publish a short digest which sums up last week’s Fintech activity

Hello FinTech Friends,

Welcome to another week of fintech insights. Let’s explore the news and trends shaping the industry!

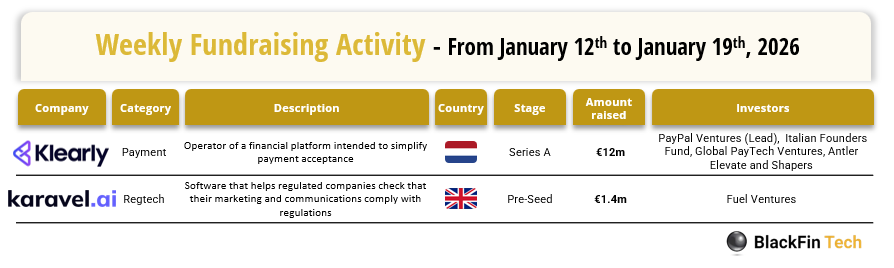

Over the last week, there were two fintech deals in Europe, raising a total of €13.4 million, including one transaction in Netherlands and one in the UK.

Congratulations to the two rounds announced last week:

Klearly, a Netherlands-based payment platform for restaurants that integrates with existing POS systems to enable fast and reliable in-store payments, has raised €12m in a Series A round led by PayPal Ventures.

Karavel.ai, a UK-based RegTech company providing software that helps regulated businesses ensure their marketing and communications comply with regulations, has raised €1.4m in a Pre-Seed round led by Fuel Ventures.

Let’s dive in!

Klearly: based in the Netherlands, provides a payment platform for restaurants that integrates with existing POS systems to make in-store payments faster and more reliable during peak hours. The company has raised €12m in a Series A round led by PayPal Ventures, with participation from Italian Founders Fund, Global PayTech Ventures, Antler Elevate, and Shapers. The funds will be used to scale the product and expand deployments across the hospitality sector.

Karavel.ai: based in the UK, provides compliance software that helps regulated companies review marketing and communications materials to ensure they meet regulatory requirements. The company has raised €1.4m in a Pre-Seed round led by Fuel Ventures. The funds will be used to develop the product and accelerate go-to-market with regulated financial services and other regulated industries.

And finally, we bring you four news stories that caught our eye last week:

Visa has partnered with BVNK, a stablecoin infrastructure provider, to power stablecoin payments across its Visa Direct network, which manages approximately $1.7 trillion in transactions. The integration enables select business customers to pre-fund payouts using stablecoins instead of fiat currency, with recipients able to receive digital dollars directly into their wallets. The partnership builds on Visa Ventures‘ investment in BVNK in May 2025 and will initially focus on high-demand markets for digital asset payments before broader global expansion. BVNK processes over $30 billion in stablecoin payments annually across more than 130 countries.

Alpaca, a US-headquartered brokerage infrastructure API provider, has raised $150 million in Series D funding led by Drive Capital, valuing the company at $1.15 billion and achieving unicorn status. The round included participation from Citadel Securities, BNP Paribas, Opera Tech Ventures, MUFG, Kraken, and DRW Venture Capital, alongside a $40 million credit line to strengthen its balance sheet. Alpaca powers nine million brokerage accounts across 300+ organisations in 40+ countries and claims to support 94% of all tokenised US equities and ETFs, with revenue more than doubling year-over-year. The company plans to use proceeds to expand into new jurisdictions and bridge traditional finance with on-chain ecosystems.

Klarna has launched instant peer-to-peer payments in 13 European countries, enabling users to send money to friends and family directly within the app for bill-splitting and gifting. The launch follows rapid growth in Klarna’s banking products, with deposits nearly doubling to $14 billion and Klarna Card reaching four million sign-ups within four months of launch. P2P payments currently run on traditional banking rails, though Klarna is exploring stablecoin-based options to enhance speed and efficiency, building on its recent KlarnaUSD stablecoin announcement. At launch, transfers work between Klarna users, with plans to expand to non-Klarna customers and cross-border payments.

The UK High Court has ruled that the Payment Systems Regulator (PSR) is within its rights to impose a price cap on cross-border interchange fees, rejecting a judicial review filed by Visa, Mastercard and Revolut. Cross-border interchange fees for online UK-EEA transactions rose more than fivefold since Brexit, with consumer debit fees increasing from 0.2% to 1.15% and credit card fees from 0.3% to 1.5%. The PSR estimates these increases have cost UK businesses £150-200 million annually. European fintechs argued the cap would make them “lose money on each transaction” due to higher operating costs, but the court confirmed the regulator’s powers to ensure card payment costs are fair for UK businesses and consumers.

Have a great start into the week!

*The information presented in this publication comes from publicly available sources. While the management company uses strict data selection criteria and focuses on the reliability of its sources, it cannot be held responsible for any inaccuracies, omissions, or errors in the data provided. This publication is for informational purposes only and does not constitute an investment recommendation.