BlackFin Tech Weekly — January 27th, 2025

Every Monday, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome to another week of fintech insights. Let’s explore the news and trends shaping the industry!

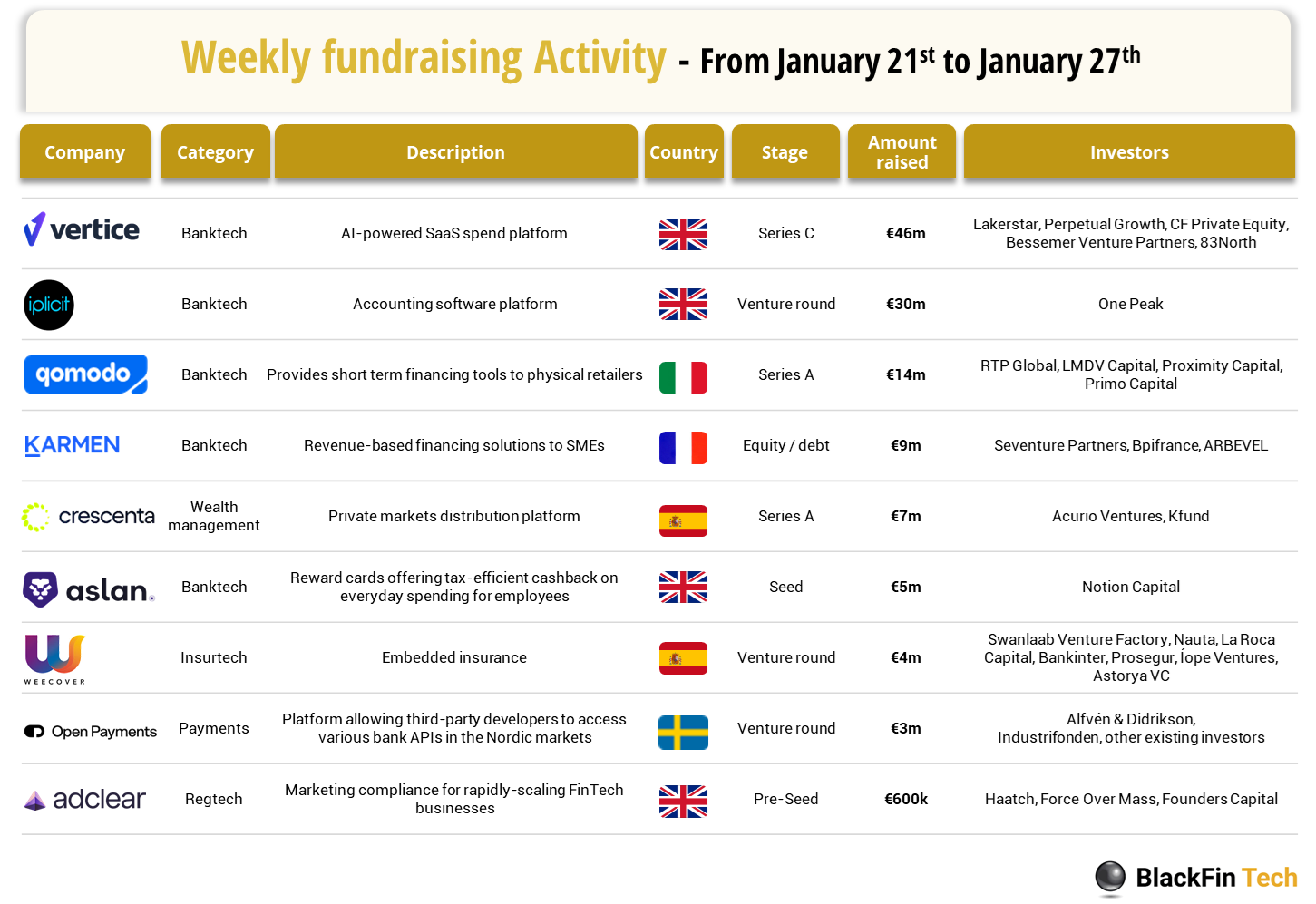

Over the last week, there were 9 fintech deals in Europe, raising a total of €118 million, with 4 deals in the UK, 2 deals in Spain, and 1 deal each in France, Italy and Sweden.

Congratulations to the top 3 fund raising companies:

Vertice, an AI-powered SaaS spend platform, on their €46m Series C round, led by Lakestar and with participation from Perpetual Growth and CF Private Equity, as well as the co-leads of their Series B round Bessemer Venture Partners and 83North.

Qomodo, which provides short term financing tools to physical retailers, on a €14m Series A round co-led by RTP Global and LMDV Capital, and with participation from Proximity Capital, Primo Capital and several angel investors.

Let’s dive in

Headquartered in London, Vertice has raised a €46m Series C round, led by Lakestar and with participation from Perpetual Growth and CF Private Equity, as well as the co-leads of their Series B round Bessemer Venture Partners and 83North. Vertice, founded in 2015, provides an AI-powered SaaS spend optimization platform, helping businesses streamline their procurement operations, with a focus on software and cloud expenditures. The company serves hundreds of customers across Europe, the US, and Asia Pacific, including notable clients such as ASML, Euronext, Grant Thornton, and Santander. Vertice plans to leverage its recent funding to expand globally by opening new regional offices and significantly scaling its engineering team in 2025, with the strategic goal of advancing its product's automated capabilities and integrations to help enterprise procurement and finance teams optimize spending and operational efficiency.

iplicit has just raised €30m from One Peak today in a first external institutional funding round. Founded in 2019, they are a leading cloud-based accounting software platform specifically designed for the UK mid-market, offering a robust and intuitive financial management solution. The company serves over 2,000 mid-market organizations across the UK and Ireland, with more than 38,000 daily users, and helps businesses future-proof their financial operations through its cloud accounting software. The investment aims to enable the company to sustain its annual revenue growth, and enhance its product development.

Qomodo, which provides short term financing tools to physical retailers, has raised a €14m Series A round co-led by RTP Global and LMDV Capital, and with participation from Proximity Capital, Primo Capital and several angel investors. Founded in 2023, Qomodo is an Italian company that provides digital payment solutions, including Buy Now Pay Later (BNPL) and smart Point of Sale (POS) systems, to physical retailers, focusing on essential expenses and simplifying payment processes. As of January 2025, Qomodo serves over 2,500 merchants across Italy, including beauty centers, dental practices, veterinary clinics, and auto repair shops. The company will utilize its funding to expand its product ecosystem for physical merchants, implementing advanced AI technologies to scale operations across Italy, and attracting new tech talent to accelerate service and technology development.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Neonomics, a Norwegian open banking platform connecting banks, businesses, and consumers, has acquired Ordo, a UK-based open banking payments provider. The financial terms of the transaction have not yet been disclosed but transaction has been approved by both the UK FCA and the Norwegian FSA.

The acquisition aims to accelerate Neonomics’s expansion into the UK market by leveraging Ordo’s expertise in secure and efficient payment solutions. The rationale behind the acquisition is to combine Ordo’s innovative payment and invoicing capabilities with Neonomics’s advanced API platform, enabling enhanced financial transparency and efficiency for consumers and businesses. Ordo, headquartered in the UK, will bring its services to complement Neonomics’s existing offerings. This move strengthens Neonomics’s position in the open banking ecosystem.

Cadence, a leading provider of electronic design automation and semiconductor IP solutions, has acquired Secure-IC, a leader in embedded security IP. The financial terms of the transaction were not disclosed. The acquisition aims to enhance Cadence’s secure system design and verification offerings by integrating Secure-IC’s expertise and technology. Secure-IC, headquartered in Rennes, France, has completed 500+ projects worldwide delivering comprehensive solutions to partners and customers across industries. This move accelerates innovation, and strengthens Cadence’s position in the secure embedded IP market.

And finally, we bring you 4 news stories that caught our eye last week:

Monzo, last valued at $5bn, is considering an IPO but faces internal disagreement over where to list, with CEO TS Anil supporting a US listing while the board favors London. The debate over the listing location highlights concerns about the UK market’s liquidity and the potential valuation. The company is in talks with bankers to be IPO-ready by the end of 2025, though a 2026 launch is more likely.

Stripe has laid off 300 employees, about 3.5% of its workforce, primarily in product, engineering, and operations. Simultaneously, they plan to grow its headcount by 17% (10,000 new employees) by the end of the year. A memo obtained by Business Insider states that the move was necessary to ensure the company had the right people in the right roles and locations to effectively execute its plans.

Checkout.com ended 2024 profitably with 45% year-on-year net revenue growth in its core business, which serves commerce and fintech sectors and now processes over $1 billion annually for each of its top 40 merchants. CEO Guillaume Pousaz announced 2025 goals, including 30% net revenue growth, full-year profitability, and a 15% increase in employee headcount. The company aims to enhance customer solutions and expand access to preferred regions and payment methods.

Visa has made a strategic investment in Nigerian fintech unicorn Moniepoint, following the company's $110 million Series C funding round that tripled its valuation to over $1 billion three months ago. The partnership aims to leverage Moniepoint’s expertise in providing banking and payment services to African SMEs and Visa’s global resources to deepen financial inclusion and drive digital transformation across the continent. This marks Visa’s continued commitment to Africa’s fintech ecosystem, as it now holds stakes in three Nigerian fintech unicorns: Interswitch, Flutterwave, and Moniepoint.

Have a great start into the week!

Sources of the fundraising reports