BlackFin Tech weekly — July 17th, 2023

Every Monday, we publish a short digest which sums up last week's fintech activity.

Greetings, Fintech enthusiasts!

Welcome back to our weekly newsletter, where we bring you the latest insight from the Fintech world. It's July 17th today, we hope last week has treated you well as the summer break is close! Let’s take a moment to delve into a few exciting updates:

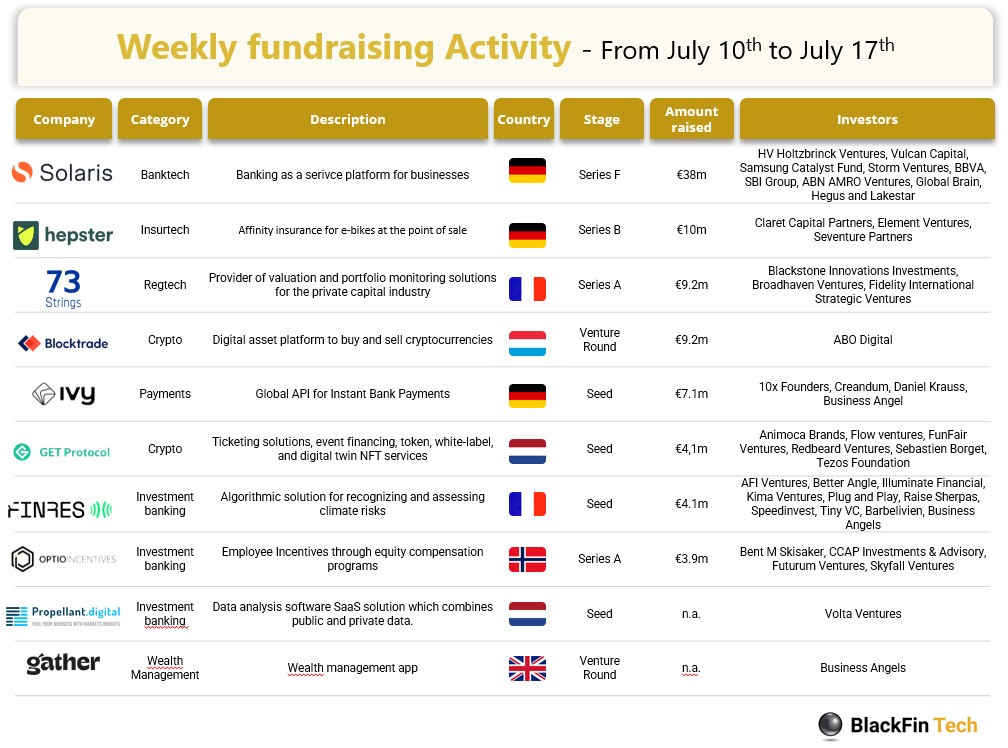

Last week we saw 10 deals in Europe for a total amount of 81.4m€ raised with 3 deals in Germany, 2 in France and in the Netherlands and 1 the United Kingdom, Luxembourg and Norway.

Congratulations to the German embedded finance platform Solaris on its €38m Series F round led by existing investors, followed by the embedded insurance Hepster, that raised €10 million in a Series A round led by Element Ventures. Finally, France-based 73 Strings, a service that helps investors like VC firms, private equity and asset managers with startup valuations and portfolio monitoring, has raised a $10m Series A round from Blackstone and FISV.

Let’s dive in

Solaris

Solaris (ex-Solarisbank) raised €38 million (at a flat $1.6B valuation) in the first close of its Series F funding round led by existing investors.

Founded in 2015, Berlin-based Solaris enables businesses, including non-financial companies and fintechs, to offer financial services to their customers, via API integrations.

The company says it will use the funding to strengthen its governance and compliance, as it looks to chart a path towards growth and profitability.

Hepster

Hepster raised €10 million in a Series B financing round from existing and new investors with Element Ventures, Seventure Partners, and Claret Capital Partners (Fund III1). The new capital includes equity and debt.

Founded in 2016, Hepster wants to become the leading embedded insurance player in Europe. It claims to have worked with over 2,500 partners, developing 500 different insurance products.

The startup, which is active in Germany, Austria, and France, says it served over 250k customers since launching.

73 strings

73 Strings secured $10m in a Series-A funding, led by Blackstone, Fidelity International and Broadhaven Ventures.

73 Strings is a data collection, monitoring and valuation platform empowering the private capital industry. The company has developed an AI-powered platform to assist alternative investment funds in streamlining their middle-office processes and enables funds to collect and structure portfolio company data, monitor these companies and estimate their fair value quickly.

The company is headquartered in Paris and has a global presence across New York, London, Paris, Toronto, and Bengaluru to support its growing customer base. 73 Strings supports clients globally across multiple strategies including Private Equity, Growth Equity, Venture Capital and Private Credit.

Congrats also to Blocktrade, Ivy, finres, Optio Incentives, Propellant.digital and Gather for their fundraisings!

And finally, here are the news that caught our eye last week:

Revolut lost $20 million to criminals exploiting a payment flaw. Revolut's flaw allowed organized crime groups to exploit discrepancies between their U.S. and European systems. They encouraged individuals to make expensive purchases that would be declined, resulting in erroneous repayments. These refunded amounts were then withdrawn from ATMs. The flaw was discovered by a partner bank in late 2021 and fixed by spring 2022. Approximately $23 million was withdrawn, and some funds were recovered through legal action against the culprits.

Apple launches Tap to Pay on iPhone in the UK, enabling businesses of all sizes to use their iPhones as payment terminals. This feature, introduced in February 2022, allows compatible iPhones to accept payments through Apple Pay and other digital wallets without additional hardware. Tap to Pay utilizes NFC technology for secure contactless payments and supports PIN entry for accessibility. It requires iPhone XS or newer models and works like a regular Apple Pay transaction. Over 700,000 additional businesses in the US and Apple Stores have also adopted Tap to Pay. The UK is the fourth region to support this feature after Australia and Taiwan.

Former Celsius CEO Alex Mashinsky and executive Roni Cohen-Pavon have been arrested on securities fraud charges. The arrests come after Celsius reached a $4.7 billion settlement with the Federal Trade Commission. Mashinsky is accused of misrepresenting Celsius's operations and faces multiple fraud charges. If convicted, both could face significant prison sentences. Earlier this year, Mashinsky was accused of orchestrating a $20 billion fraud against investors.

Have a great week & see you next week!