BlackFin Tech Weekly — July 1st, 2024

Every Monday, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome back to our newsletter! Last week was a busy one in terms of new deal announcements. We have seen some large Fintech deals all over Europe, but that is not the only thing! There have also been some new payments and wealth management developments. So read on, to find out more!

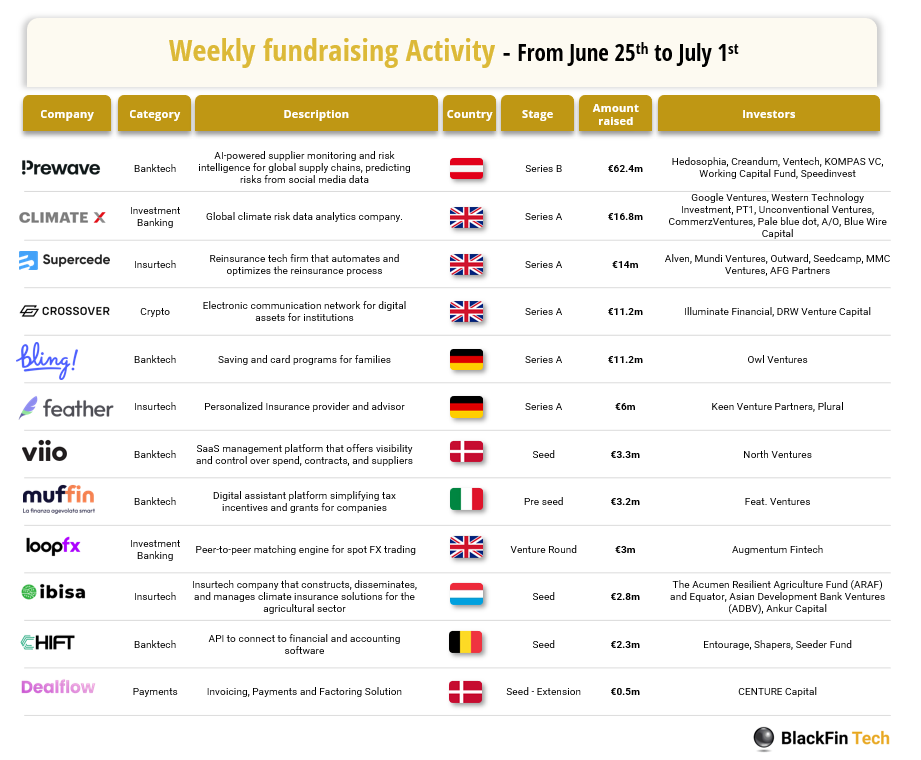

Last week we saw 12 official Fintech deals in Europe for a total amount of 136.7m€ raised with 4 deals in the UK, 2 deals in Denmark, 2 deals in Germany, 1 deal in Austria, 1 deal in Belgium, 1 deal in Italia and 1 deal in Luxembourg.

Congratulations to Prewave, an Austrian AI-enabled sustainability, risk, and compliance platform that has raised a €63 million Series B funding round led by Hedosophia, with participation from Creandum, Ventech, Kompas, Speedinvest, and the Working Capital Fund. Applause also goes out Climate X, a London-based climate risk startup, which has raised €16.8 million in a Series A funding round led by Google Ventures, with participation from PT1, Unconventional Ventures, and Western Technology Investment. Lastly, we extend our congratulations to Supercede. This London-based reinsurance tech firm has raised $15 million in a Series A funding round led by Alven, with contributions from Mundi Ventures, Outward, Seedcamp, MMC Ventures, and AFG Partners.

Let’s dive in

Prewave, an Austrian AI-enabled sustainability, risk, and compliance platform, has raised €63 million in a Series B funding round led by Hedosophia, with participation from Creandum, Ventech, Kompas, Speedinvest, and the Working Capital Fund. This investment will drive Prewave's global expansion and bolster R&D efforts to enhance its proprietary AI technology, aiming to deliver the world's only supply chain superintelligence platform, thereby advancing supply chain transparency, compliance, and resilience.

Climate X, a London-based climate risk startup, has raised $18 million in a Series A funding round led by Google Ventures, with participation from PT1, Unconventional Ventures, and Western Technology Investment. The funding will support Climate X's expansion into the US, including the establishment of a physical office, and the continued development of its climate financial risk platform, which helps businesses such as banks, mortgage lenders, and real estate firms analyze their exposure to climate change and assess the financial impact of climate events on their assets.

Supercede, a London-based reinsurance tech firm that automates and optimizes the reinsurance process, providing enhanced risk management, optimized coverage, and better pricing outcomes, has raised $15 million in a Series A funding round led by Alven, with contributions from Mundi Ventures, Outward, Seedcamp, MMC Ventures, and AFG Partners. The funds will be used to transform the reinsurance sector with next-generation technology, expand the team by attracting top-tier talent, and enhance platform development and implementation. CEO and Co-founder Jerad Leigh emphasized the platform's role in shaping the future of reinsurance.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Progyny has announced the acquisition of Apryl. Progyny is a US-based fertility, women’s health, and family-building benefits management company. It was founded in 2008, has around 600 employees, and is listed on the NASDAQ. Apryl is a fertility benefits platform that was founded in 2019 in Berlin, Germany. Apryl had previously raised over €4m in a Seed round and is offering B2B IVF, egg-freezing adoption consultation, and treatment benefits among others. With the acquisition, Progyny aims to expand its offering as well as enhance its global presence.

And finally, here are the news that caught our eye last week:

Trade Republic, a Berlin-based fintech, has launched its own custodian bank, migrating over €35 billion of client assets from HSBC subsidiary HTNG. This move gives the company greater control over post-trade operations and client account management.

The internalization effort allows Trade Republic to develop new products more quickly and capture more value from complex financial flows, including dividends and specific investment products.

Stripe will incorporate USDC on Base for faster, cheaper global money transfers and enable quicker fiat-to-crypto conversions for US customers.

Coinbase will integrate Stripe's fiat-to-crypto onramp into Coinbase Wallet, allowing instant crypto purchases with credit cards and Apple Pay, leveraging Base's secure, low-cost transaction infrastructure.

Nubank has acquired Silicon Valley-based data intelligence company Hyperplane to enhance its AI-first strategy, aiming to leverage first-party data for personalized customer experiences.

Hyperplane's platform, which allows banks to train, evaluate, and deploy self-supervised, deep-learning models for various business domains, will integrate with Nubank’s systems to deliver smarter and fairer financial products.

Klarna is selling its online checkout business to a consortium of investors for approximately €485 million to eliminate conflicts of interest with partners like Adyen and Stripe.

Launched in 2012, Klarna Checkout helps merchants offer BNPL payment options and holds a significant market share in the Nordics.

The sale allows Klarna to refocus on partnerships with payment service providers such as Stripe, aiming to simplify relationships and enhance collaboration without the conflict between PSP and checkout services.

Have a great week & see you soon!