BlackFin Tech Weekly — July 21st, 2025

Every Week, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome to another week of fintech insights. Let’s explore the news and trends shaping the industry!

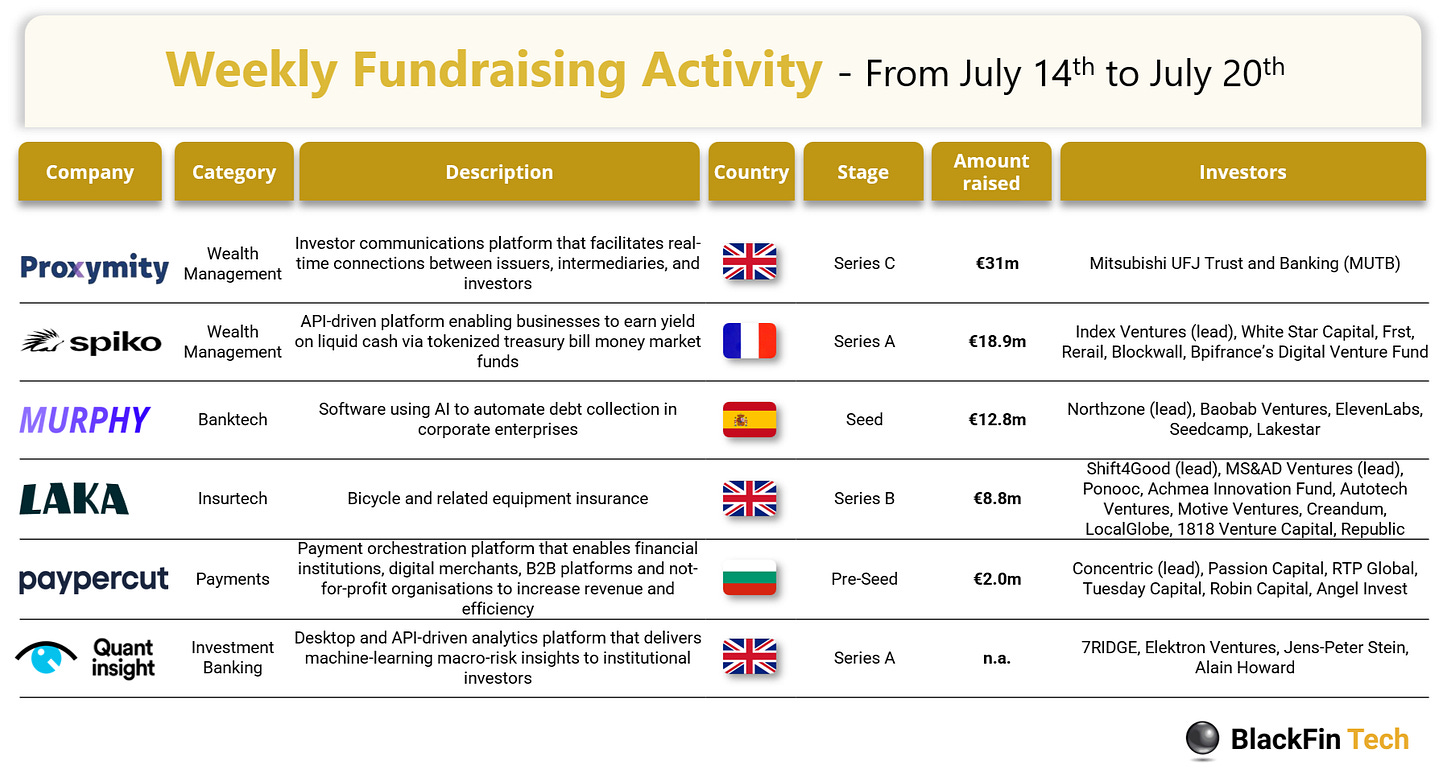

Over the last week, there were six fintech deals in Europe, raising a total of €73.5 million, three deals in the UK, and one deal each in France, Spain and Bulgaria.

Congratulations to the three largest rounds announced last week:

Proxymity, a London-based Investor communications platform that facilitates real-time connections between issuers, intermediaries, and investors, has raised €31 million in a Series C round led by Mitsubishi UFJ Trust and Banking (MUTB)

Spiko, the Paris-based B2B API-driven platform enabling businesses to earn yield on liquid cash via tokenized treasury bill money market funds, has secured €18.9 million in funding led by Index Ventures with participation from White Star Capital, Frst, Rerail, Blockwall and the Bpifrance’s Digital Venture Fund

Murphy AI, the Barcelona-based software using AI to automate debt collection in corporate enterprises, has raised €12.8 million in Seed funding led by Northzone with Participation from Baobab, ElevenLabs, Seedcamp and Lakestar.

Let’s dive in!

Proxymity, a London-based digital investor communication platform, has raised €31 million from Mitsubishi UFJ Trust and Banking. The funding follows the launch of its global voting and investor portal products, aimed at enhancing transparency and efficiency in proxy voting and shareholder communications. The capital will support further tech development and global expansion, as investor adoption continues to grow.

Spiko, a fintech based in Paris, reinventing cash management through tokenized money market funds, has raised €18.5 million in a Series A round led by Index Ventures, with participation from Bpifrance, Frst, and prominent tech figures. In just one year, Spiko manages over €300 million for nearly 1,000 companies without a sales team, offering an API-first platform that delivers daily returns with full liquidity. The funds will support Spiko’s European expansion, aiming to democratize low-risk yield access through transparent, cost-efficient, token-based infrastructure.

Murphy, a Barcelona-based AI-native platform transforming debt servicing, has raised €12.8 million in pre-Seed and Seed funding led by Northzone, with backing from Seedcamp, Lakestar, and others. Founded in 2024, Murphy replaces traditional call centers with multilingual autonomous agents, enabling faster, more efficient debt recovery with 40% higher success rates and 75%-time savings. Already managing hundreds of millions in debt, Murphy plans to use the funding to scale its product and expand across Europe and the U.S., addressing a $300+ billion global market ripe for AI disruption.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

London-based Wagestream, a financial wellbeing app providing salary advances to employees, has acquired the local company Zippen, a digital pension platform that helps employers set up and manage workplace pension plans. This acquisition strengthens Wagestream’s position as a comprehensive workplace finance platform, enabling it to tackle long-term savings challenges like the UK’s £31.1 billion in unclaimed pension assets.

Berlin-based Atlas Metrics, an ESG data platform that automates internal data collection and generates audit-ready sustainability reports has acquired Zurich-based Pelt 8, a SaaS platform that enables companies to collect ESG data directly from suppliers for regulatory reporting. This acquisition accelerates Atlas's expansion in Switzerland and enables Pelt 8 clients to benefit from Atlas's advanced features, including AI-driven double materiality analysis and multi-standard audit-ready reporting.

And finally, we bring you 4 news stories that caught our eye last week:

Anthropic has introduced a vertical version of Claude Enterprise tailored to financial institutions, designed to automate analyst workflows and unify access to both internal and external data sources. This solution integrates Model Context Protocol (MCP) connectors with internal platforms like Snowflake, while also offering seamless access to external reference data from providers such as S&P Global, FactSet, Morningstar, and PitchBook—bringing historically siloed datasets into a single AI-powered workspace for faster, more comprehensive analysis. Targeted use cases span financial modeling, due diligence, market research, competitive benchmarking, portfolio analysis, and the creation of investment memos and pitch decks. Claude Opus 4 demonstrated strong capabilities in real-world financial tasks, passing 5 out of 7 levels of the Financial Modeling World Cup competition and achieving 83% accuracy on complex Excel tasks.

Starling Bank, a UK-based digital bank, is exploring a potential IPO in New York as part of its broader expansion into the United States. While no final decision has been made, the company believes a US listing could result in a higher valuation compared to London. Chief Financial Officer Declan Ferguson said in an interview with the Financial Times that building a strong US presence, including generating local revenue and establishing brand recognition, is a critical step before moving forward with any public offering. Valued at £2.5 billion in 2022, Starling is reportedly seeking to acquire a US-based bank to support its entry into the American market. A New York IPO would follow a broader trend as rival fintechs like Revolut and Wise also look to shift away from the London Stock Exchange in favor of US markets. Ferguson noted that Starling is taking a measured approach, focusing on long-term strategic growth rather than rushing into a listing.

Lloyds Banking Group is in advanced talks to acquire Curve, a UK-based digital wallet provider, for a reported price of up to £120 million. The deal, expected to be finalized by the end of September, would mark a significant step in Lloyds' push into digital payments infrastructure amid regulatory scrutiny of dominant players like Apple and Google. Founded in 2016 by Shachar Bialick, Curve has raised over £200 million in equity and was valued at £133 million in its Series C round last year. The company has scaled back its US expansion and cut staff but continues to position itself as a rival to Apple Pay by offering a unified digital wallet experience. Lloyds sees Curve as a strategic and financially rational acquisition, aiming to counter the high fees charged by Apple and expand its fintech portfolio. Curve is chaired by tech investor Lord Fink and advised by investment bank Stifel in the ongoing discussions. Both companies declined to comment on the potential deal.

The US House of Representatives has passed the GENIUS Act, the first major federal legislation to regulate stablecoins, in a bipartisan 308–122 vote. The bill, now awaiting President Trump’s signature, provides a clear framework for dollar-pegged digital tokens and opens the door for US banks to issue their own. Alongside it, lawmakers advanced the CLARITY Act—clarifying when crypto assets are securities—and approved a separate measure blocking the Federal Reserve from launching a retail CBDC. The move has been welcomed by major banks including JPMorgan, Citi, and Bank of America, all of which have signaled plans to launch stablecoins. The legislation follows a $260 million lobbying campaign by pro-crypto groups and highlights the Trump administration’s more supportive stance on digital assets. With companies like Uber developing token-based payment systems, banks see stablecoins to stay competitive and modernize their offerings.

Have a great start into the week!

Sources of the fundraising reports