BlackFin Tech Weekly — July 22nd, 2024

Every Monday, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome back to our newsletter! As we move closer to August, the activity in the Fintech space is slowing down a little. However, there are still a handful of deals and news that you shouldn’t miss out on, so read on to learn more about the latest developments in the European Fintech scene.

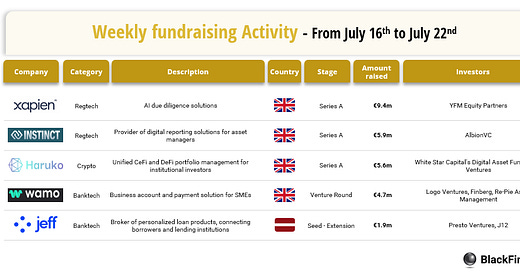

Last week we saw 5 official Fintech deals in Europe for a total amount of €27.4m raised with 4 deals in the UK and 1 deal in Latvia.

Congratulations to Xapien, a UK-based AI due diligence provider, for securing a €9.4 million Series A round led by YFM Equity Partners. Applause also goes to Instinct Digital, which provides digital reporting solutions for asset managers, for their €5.9 million Series A round led by AlbionVC. Finally, we extend our congratulations to Haruko, a British digital asset investment management platform, which has successfully raised €5.6 million in Series A funding led by White Star Capital’s Digital Asset Fund and MMC Ventures.

Let’s dive in

UK-based AI due diligence platform Xapien has raised £8m in a Series A round led by YFM Equity Partners. Xapien’s platform uses AI and natural language processing to deliver rapid research by analyzing millions of sources, saving businesses countless hours on due diligence. Supported by Dow Jones Risk and Compliance, Xapien launched the Integrity Check compliance tool. The company also partnered with a major law firm to develop the world’s first large language model AI tool for AML compliance in the legal industry, aiming to reduce onboarding times and enhance risk management. The new funding will accelerate the development of Xapien’s next-generation entity resolution engine, including integrations with top data suppliers, new enterprise features, and a continuous monitoring solution for perpetual KYC compliance. The company also plans to expand into new sectors such as financial services and large corporate partnerships, while also increasing its presence in the US market.

Irish Instinct Digital, a software designed to streamline and automate funds and investor reporting, has raised £5M in Series A funding led by AlbionVC. Their cloud-based platform aggregates reporting assets from internal and external sources, unifies reporting operations, and digitizes communications across 37 languages and 40 countries. The new funding will help Instinct Digital onboard and support new clients, enhance partner integrations, and expand into new geographies, including the US.

The British digital asset investment management platform Haruko raised $6 million in Series A funding led by White Star Capital’s Digital Asset Fund and MMC Ventures, bringing its total funding to $16 million. Haruko's platform serves asset managers, hedge funds, and family offices, offering centralized and decentralized digital asset management, blockchain portfolio management, risk control tools, and data insights via API. It also features a proprietary crypto multi-chain wallet compatible with various digital asset storage providers. Haruko has scaled quickly across North America and Europe, serving over 50 investment management institutions, with offices in London and Singapore. This new funding will support its expansion into Southeast Asia and further global consolidation, driven by strong market traction and interest in its portfolio and risk management solutions.

There has been another week with no major new announcements in terms of M&A activity. We will hopefully be back with news on that space next week.

And finally, here are the news that caught our eye last week:

Sequoia Capital is offering to buy shares in Stripe at a $70 billion valuation, targeting limited partners in its 2009-2012 funds with shares priced at $27.51 each. This move provides up to $861 million in liquidity, amidst Stripe's fluctuating valuation, which recently settled at $65 billion in February, down from $95 billion in 2021.

N26 will let French clients buy stocks via its app, competing with Boursorama, Fortuneo, and Revolut. It offers 500 stocks and ETFs, aiming to attract new clients with a simple, educational approach. With €0.90 trading fees, no custody fees, and investments starting at €1, N26 plans to grow its European market presence and achieve profitability by late 2024.

London-based fintech Divido, backed by HSBC and ING, has entered insolvency and appointed administrators as of July 5, 2024. The company offered a white-label consumer lending solution and had raised $45 million in funding but faced escalating losses.

Klarna is preparing for a potential US IPO in the first half of next year, with Goldman Sachs, JP Morgan Chase, and Morgan Stanley competing to advise. The company's valuation dropped from $46 billion in 2021 to $6.7 billion in 2022, but recent financials show narrowed losses, with the US as its largest revenue market.

Have a great week & see you soon!

Sources of the fundraising reports