BlackFin Tech Weekly — July 28st, 2025

Every Week, we publish a short digest which sums up last week’s Fintech activity

Hello FinTech Friends,

Welcome to another week of fintech insights. Let’s explore the news and trends shaping the industry!

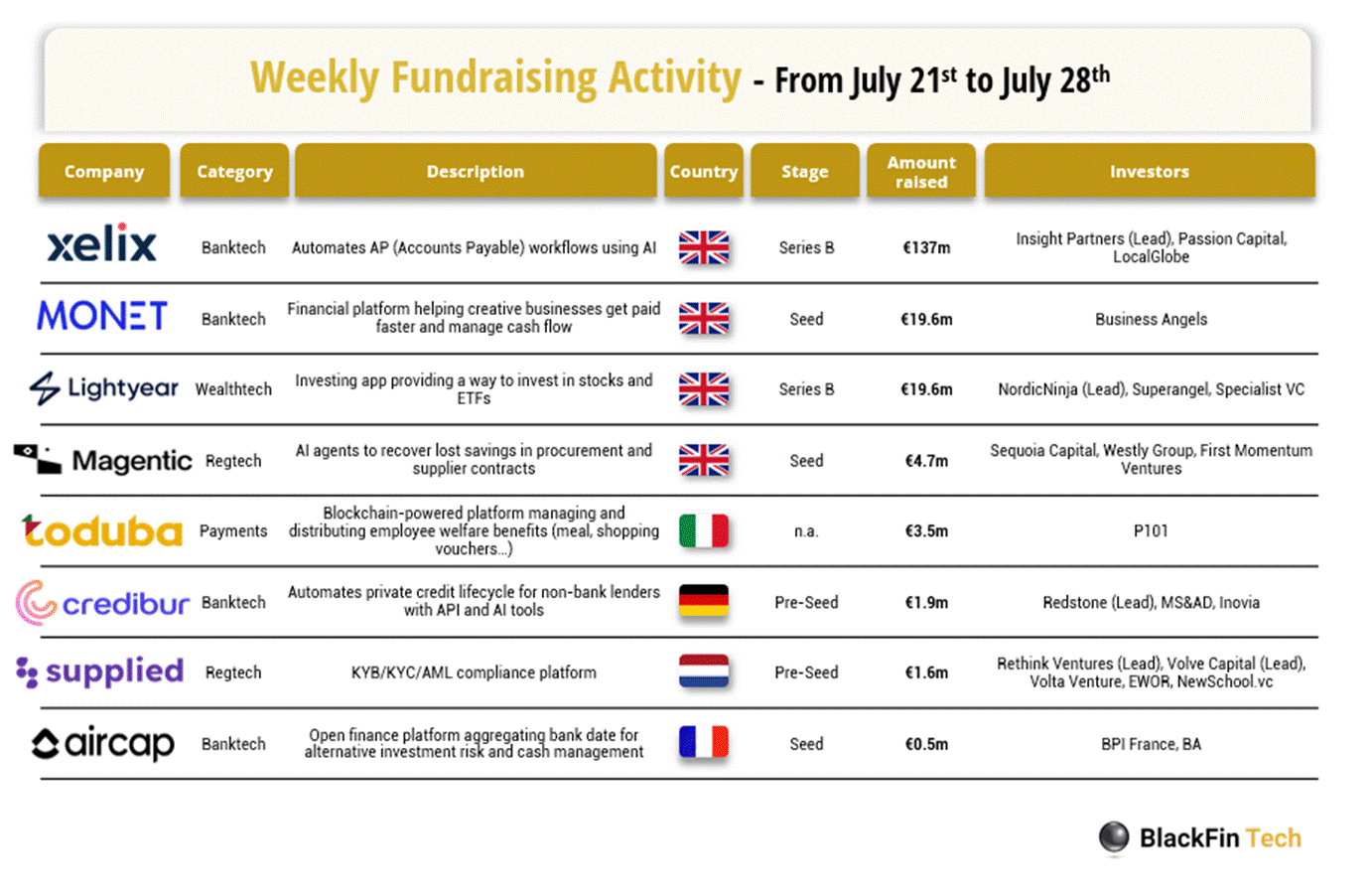

Over the last week, there were eight fintech deals in Europe, raising a total of €188 million, including four deals in the UK, and one each in France, Germany, Italy, and the Netherlands.

Congratulations to the three largest rounds announced last week:

Xelix, a London-based company automating accounts payable workflows with AI, has raised €137 million in a Series B round led by Insight Partners, with participation from Passion Capital and LocalGlobe.

Lightyear, the UK-based investing app offering access to global stocks and ETFs, secured €19.6 million in Series B funding from NordicNinja, Superangel and Specialist VC.

MONET, a financial platform helping creative businesses in the UK get paid faster and manage cash flow, closed a €19.6 million Seed round with support from Business Angels.

Xelix, a London-based fintech automating accounts payable (AP) workflows with AI, has raised €137 million in a Series B round led by Insight Partners, alongside Passion Capital and LocalGlobe. The platform helps large finance teams detect fraud, prevent duplicate payments, and streamline invoice processing. This new funding will support global expansion and further development of its enterprise-grade AP automation suite.

Lightyear, a UK-based investing app, has secured €19.6 million in Series B funding led by NordicNinja, with backing from Superangel and Specialist VC. Lightyear offers retail investors access to global stocks and ETFs with low fees and a transparent pricing model. The platform has expanded across Europe and plans to accelerate product development and user growth following this raise.

MONET, a London-based financial platform targeting the creative industry, has raised €19.6 million in Seed funding from Business Angels. MONET enables freelancers and creators to get paid faster through invoice advances and integrated cash flow tools. With this capital, the team will scale the platform across the UK and further develop embedded financial services tailored to underserved creative professionals.

In addition to this week’s fundraising activity, here is the European M&A activity for the week:

Corpay, a US-based global B2B payments platform, has announced the $1.9 billion acquisition of Alpha Group, a UK-based provider of FX, treasury, and fund finance services for corporates and investment managers. The deal, currently pending, expands Corpay’s footprint in international finance operations and adds sophisticated treasury capabilities to its mid-to-large enterprise offering.

Regnology, a German Regtech platform specializing in regulatory, ESG, and supervisory reporting, has acquired the Finance, Risk & Regulatory Reporting (FRR) business unit of Wolters Kluwer, based in the Netherlands. The transaction (pending) strengthens Regnology’s position as a leading European player in financial regulation software and enhances its coverage of tax, transaction, and ESG reporting across jurisdictions.

And finally, we bring you four news stories that caught our eye last week:

The Bank of New York Mellon (BNY) is collaborating with Goldman Sachs to tokenize money market funds (MMFs), using blockchain as the record of ownership. BNY, the world’s largest provider of administrative services to money managers, will offer the tokenized funds to its investment-firm and corporate clients over its LiquidityDirect cash-management platform. Goldman will in turn record and track the ownership of the tokens on its private blockchain, with BNY keeping the funds’ books. Tokenized money market funds have been a hit with crypto traders, who have been in search of higher-yielding places to store their cash, as stablecoins don’t pass on interest income to their holders. This surge in demand comes as U.S. money-market fund assets reached approximately $7.1 trillion by mid-July, up from $6.9 trillion earlier in the year.

Nasdaq Verafin has unveiled its new Agentic AI Workforce, a suite of digital workers designed to significantly enhance anti-money laundering (AML) compliance by automating labor-intensive processes. These AI-driven tools, building on the success of the company’s GenAI Entity Research Copilot, will help banks improve efficiency and refocus human resources on higher-value tasks like investigating serious financial crimes. The Agents will initially address two of the most time-consuming areas: Sanctions Screening and Enhanced Due Diligence (EDD) reviews. The Digital Sanctions Analyst will filter out false positives and escalate real threats, potentially reducing alert workloads by over 80%. Meanwhile, the Digital EDD Analyst will automate low-risk reviews, offering major cost and time savings for banks burdened by slow, manual processes.

The UK’s Competition and Markets Authority (CMA) has announced plans to impose new pro-competition measures on Apple and Google by proposing to designate them with ‘strategic market status’ (SMS) over their mobile ecosystems. The move aims to address their dominance in the UK’s app economy and encourage a more dynamic and competitive digital market. The CMA’s proposals come amid growing concern that Apple and Google exert excessive control over the UK’s mobile landscape, which accounts for 90–100% of devices nationwide. Their influence stretches across app store policies, payment systems, interoperability with connected devices, and the development of AI services. The proposed interventions could trim fees of up to 30 per cent that Apple and Google charge for digital transactions through their mobile app stores, as well as prevent them from designing their systems to favour their own apps and services.

Wise, listed in London since 2021, is facing opposition to its plan to shift its primary listing to the US. Shareholder advisory groups Glass Lewis and PIRC, along with co-founder Taavet Hinrikus, have criticized the proposal, particularly the 10-year extension of the dual-class share structure that grants enhanced voting rights to class B shareholders. Glass Lewis expressed concerns about unequal voting rights, while PIRC urged shareholders to vote against the move, citing control issues. Hinrikus argued that bundling the listing switch with the share structure extension lacks transparency and fairness, urging separate votes. Despite criticism, Wise’s CEO Kristo Käärmann and the board support the plan, backed by investors like Andreessen Horowitz. The proposal requires approval from a majority of both class A and B shareholders and a 75% supermajority by value.

Have a great start into the week!

Sources of the fundraising reports