BlackFin Tech Weekly — June 15th, 2025

Every Week, we publish a short digest which sums up last week’s Fintech activity

Welcome to another week of fintech insights. Let’s explore the news and trends shaping the industry!

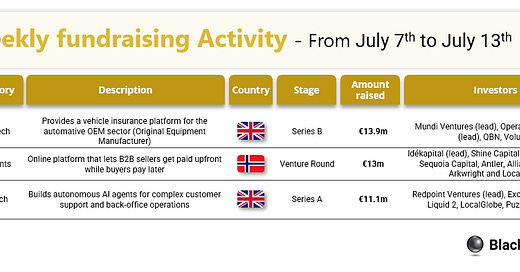

Over the last week, there were 3 fintech deals in Europe, raising a total of €38 million, two deals in the UK, and one in Norway:

Wrisk, London-based insurtech specializing in embedded automotive

insurance, has raised €13.9 million in a Series B round co-led by Mundi Ventures and Opera Tech Ventures.Two, the Oslo-based B2B payments platform, has secured €13 million in funding. The round was led by Idékapital and Shine Capital, with participation from

Investinor, Antler, Sequoia Capital, Alliance Ventures, Arkwright, and LocalGlobe.Gradient Labs, the London-based AI agentic startup for regulated industries, has raised €11.1 million in Series A funding led by Redpoint Ventures, with participation from LocalGlobe, Puzzle Ventures, Liquid 2 Ventures, and Exceptional Capital.

Let’s dive in!

Wrisk, the London-based insurtech, has raised €13.9 million in a Series B round co-led by Mundi Ventures and Opera Tech Ventures. Founded in 2016, Wrisk provides embedded insurance solutions to automotive brands. The company recorded triple-digit revenue growth in 2024, writing over 100,000 policies, and will use the new capital to accelerate European expansion, enhance data and intelligence capabilities, and scale partner programs across the continent.

Two, the Oslo-based B2B payments platform, has secured €13 million in funding led by Idékapital and Shine Capital, with participation from

Investinor, Antler, Sequoia Capital, Alliance Ventures, Arkwright, and

LocalGlobe. Founded in 2021, Two offers instant upfront payments for sellers, flexible net terms for buyers, and AI-powered fraud prevention. Its infrastructure, including proprietary risk engines Frida and Delphi, is used by over 200 merchants across the Nordics and Europe, with recent partnerships including ABN AMRO, and Santander. The new funding will support US and Western European expansion, further product development, and global partnerships.

Gradient Labs, the London-based AI agentic startup founded by former Monzo employees, has raised €11.1 million in Series A funding led by Redpoint Ventures, with participation from LocalGlobe, Puzzle Ventures, Liquid 2 Ventures, and Exceptional Capital. Founded in 2023, Gradient Labs is building autonomous AI agents to automate customer operations for regulated industries, especially fintech and financial services. Their current clients include Yonder, Plum, and Zego. The new capital will fuel US expansion and further team growth.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

US-based Clarity AI, an AI platform specialized in environmental and sustainability data, has acquired Germany-based ecolytiq, a climate engagement fintech known for its carbon footprint tracking APIs for banks. This deal combines Clarity AI’s institutional ESG analytics with ecolytiq’s consumer-facing carbon insights, helping banks and payment providers embed sustainability tools directly into customer apps.

US-based Alpaca, an API-first brokerage that lets developers build trading apps with free real-time market data, has acquired UK-based WealthKernel, a white-label infrastructure provider for investment and wealth management services. This acquisition gives Alpaca an FCA-regulated presence in the UK and Europe, enabling it to offer compliant securities trading, tax wrappers like ISAs, and digital investing solutions to partners expanding in the region.

And finally, we bring you 4 news stories that caught our eye last week:

Monzo, the UK-based digital challenger bank, has been fined £21 million by the Financial Conduct Authority (FCA) for inadequate anti-financial crime systems and controls between October 2018 and August 2020. The FCA found that Monzo allowed customers to open accounts using “implausible” addresses, including Buckingham Palace, 10 Downing Street, and even Monzo’s own headquarters. The bank’s rapid growth—from 600,000 customers in 2018 to 5.8 million in 2022—outpaced its fraud prevention capabilities, resulting in repeated breaches of regulatory requirements, including onboarding more than 34,000 high-risk customers after restrictions were imposed. Monzo agreed to settle, receiving a 30% discount on the original £30 million penalty, and has since implemented significant enhancements to its systems.

Revolut, the London-based neobank, is in advanced talks to raise $1 billion in a new funding round that could value the company at $65 billion—a dramatic increase from its $45 billion valuation last year. The round is expected to be led by Greenoaks Capital. The raise will include both primary and secondary capital. Revolut reported $4 billion in revenue and $1 billion in net profit last year, and recently secured a UK banking license, positioning itself for further expansion and lending growth. The valuation jump underscores renewed investor confidence amid global fintech volatility.

MassMutual Ventures (MMV) has expanded its partnership with Crane Venture Partners, appointing Crane to manage MMV’s $450 million Europe and Asia-Pacific funds, covering 40 portfolio companies. Crane Venture Partners will oversee all existing and new investments in these regions, leveraging its deep network and expertise to support early-stage founders.

MassMutual Ventures will continue to manage its North American and Israeli portfolios and invest through its US and Climate Tech Fund teams. The collaboration marks a new phase in their seven-year relationship, aiming to strengthen support for innovative startups across Europe and APAC.

Wise, the UK-based international payments company, has been fined $4.2 million by regulators from California, Massachusetts, Minnesota, Nebraska, New York, and Texas for deficiencies in anti-money laundering (AML) and Bank Secrecy Act compliance between July 2022 and September 2023. The multistate examination found Wise failed to meet certain identity verification and suspicious activity reporting requirements, potentially exposing its services to misuse for money laundering or terrorism financing. As part of the settlement, Wise must hire an independent third party to verify corrective actions and submit quarterly compliance reports for two years. The company has committed to strengthening its AML controls and working closely with regulators to ensure ongoing compliance.

Have a great start into the week!

Sources of the fundraising reports