BlackFin Tech Weekly — June 16th, 2025

Every week we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome to another week of fintech insights. Let’s explore the news and trends shaping the industry!

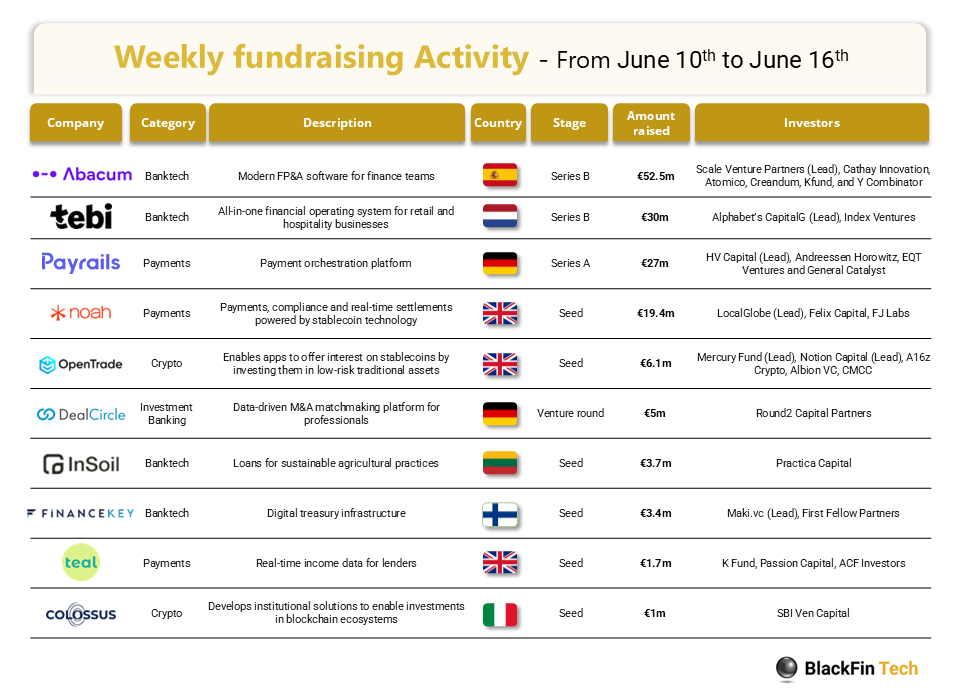

Over the last week, there were 10 fintech deals in Europe, raising a total of €150 million: three deals in the UK, two in Germany, and one deal each in Spain, Finland, Italy, Lithuania and The Netherlands.

Congratulations to the three largest rounds announced last week:

Abacum, a Barcelona-based financial planning and analysis (FP&A) platform, has raised €52.5 million in Series B funding led by Scale Venture Partners, with participation from Cathay Innovation, and existing investors Creandum, Y Combinator, K Fund and Atomico.

Amsterdam-based Tebi raises €30 million in a Series B round led by CapitalG, the growth fund backed by Alphabet.

Payrails, a Berlin-based global payment software company, has raised €27 million in Series A funding led by HV Capital’s Growth Fund

Let’s dive in

Abacum, a Barcelona-based business planning software provider, has raised over €52.5 million in a Series B round led by Scale Venture Partners, with participation participation from Cathay Innovation, and existing investors Creandum, Y Combinator, K Fund and Atomico. Founded in 2020, Abacum offers a collaborative financial planning and analysis platform that automates reporting, forecasting, and scenario planning for mid-market and high-growth companies. The company’s solution integrates with a range of business tools, enabling finance teams to make faster, data-driven decisions. The new funding will be used to accelerate product development and expand Abacum's global presence, reinforcing its mission to modernize finance operations for businesses worldwide.

Tebi, an Amsterdam-based hospitality technology platform, has secured €30 million in funding led by CapitalG, with participation from existing investor Index Ventures. Founded in 2022, Tebi provides a unified platform for hospitality businesses, streamlining operations such as payments, reservations, and guest management through a single interface. Currently active across Europe, Tebi aims to use the fresh capital to scale its platform, enhance product features, and expand into new European markets, supporting the digital transformation of the hospitality sector.

Payrails, a Berlin-based payment orchestration and performance platform for global enterprises, has raised €27 million in Series A funding led by HV Capital’s Growth Fund with participation from existing investors EQT Ventures, General Catalyst and Andreessen Horowitz.

Founded in 2021, Payrails offers a modular payment operating system that lets large enterprises orchestrate payment routing, tokenization, payouts, reconciliation, analytics, and in-person payments through a unified platform. The new investment will support further product innovation and international expansion, strengthening Payrails' position as a leader in payment performance solutions for enterprises.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Robinhood, a US-based trading platform, has completed its $200 million acquisition of Bitstamp, a global cryptocurrency exchange founded in 2011. With the acquisition complete, Robinhood gains over 50 active licenses across multiple jurisdictions and expands into institutional crypto services including staking, lending, and white-label infrastructure. The deal strengthens Robinhood’s international footprint and marks its entry into the institutional segment of the crypto market.

And finally, we bring you the news stories that caught our eye last week:

Chime, the San Francisco-based digital bank, raised $864 million by selling 32 million shares at $27 each in its Nasdaq IPO. Shares jumped 59% on debut, valuing Chime at a fully diluted $18.4 billion. Founded in 2012, Chime offers fee-free accounts targeting consumers earning under $100,000, generating revenue mainly from debit card interchange fees. The IPO, priced below its $25 billion private valuation in 2021, is seen as a key moment for fintech, signaling renewed investor interest in the sector.

Shopify, Coinbase, and Stripe have announced a partnership to accelerate stablecoin adoption for online payments using the USDC protocol. The collaboration enables merchants on Shopify to accept USDC payments via Coinbase Commerce and Stripe, offering instant, low-cost transactions on blockchain rails. This move aims to reduce settlement times and payment friction for global e-commerce, leveraging USDC's regulatory compliance and stability. Analysts see this as a milestone in mainstreaming stablecoin payments, potentially setting a new standard for digital commerce.

JPMorgan has launched the Fintech Forward Programme, a 12-week accelerator designed for early-stage UK fintech startups with live products and annual revenues under £1 million. Run in partnership with EY, the programme offers mentorship from JPMorgan executives, specialist workshops, and a two-day offsite at the bank’s Glasgow tech center. Participants gain exposure to investors, commercial partners, and a sponsored trip to the Slush event in Helsinki. The initiative aims to empower founders addressing real-world financial challenges, especially those from underserved backgrounds, and is part of JPMorgan's broader mission to improve the payments ecosystem and support innovation in financial services.

Have a great start into the week!

Sources of the fundraising reports