BlackFin Tech Weekly — March 10th, 2025

Every Monday, we publish a short digest which sums up last week’s Fintech activity

Hello FinTech Friends,

Welcome to another week of fintech insights. Let’s explore the news and trends shaping the industry!

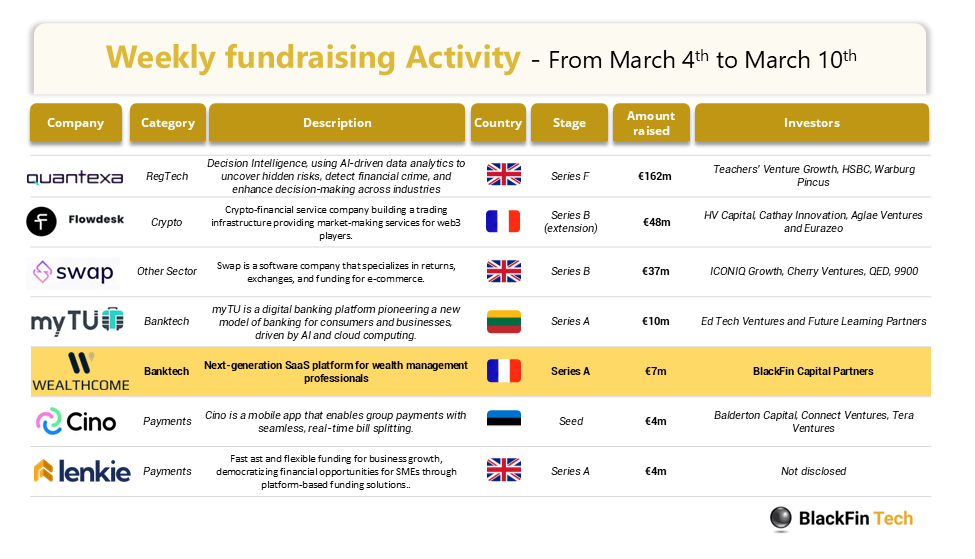

Over the last week, there were 7 fintech deals in Europe, raising a total of €272 million: 3 deals in the UK, 2 deals in France and 1 deal each in Lithuania and Estonia.

Congratulations to Wealthcome, a BlackFin portfolio company, and the top 2 fund raising companies:

Wealthcome, a French software provider for independent financial advisors (IFAs), family offices and financial institutions has raised €7 million in a funding round led by BlackFin Capital Partners.

Quantexa, a decision intelligence platform that helps private and public companies uncover hidden risks and identify new opportunities, has raised €162 million in Series F, led by Teachers’ Venture Growth (TVG), alongside participation from previous investor British Patient Capital.

Flowdesk, a crypto-trading financial service, has raised an additional €48 million in a Series B extension, led by HV Capital, with participation from Eurazeo, Cathay Innovation, and ISAI.

Let’s dive in

Wealthcome, a French software provider for independent financial advisors (IFAs), family offices and financial institutions has raised €7 million in a funding round led by BlackFin Capital Partners. The investment will be used to improve its platform and expand its team, enabling Wealthcome to better serve its growing client base and expand the scope of its wealth management solutions. The company aims to improve operational efficiency, making the management of wealth easier, more accessible, and more efficient for clients. Furthermore, expansion into the European market is a key objective of this funding round.

Quantexa, a global leader in Decision Intelligence solutions for the private and public sectors has completed a €162 million Series F round, led by Teachers’ Venture Growth (TVG), alongside participation from previous investor British Patient Capital. The funding will bolster Quantexa’s innovation efforts to elevate experiences for existing clients, expand its presence in North America and will allow the firm to pursue M&A opportunities. This investment comes shortly after Quantexa has achieved $100m in ARR, alongside reporting a 40% license revenue growth for 2024.

Flowdesk, a crypto-financial service company building a trading infrastructure providing market-making services for web3 players, has raised an additional €48 million in a Series B extension, led by HV Capital, with participation from Eurazeo, Cathay Innovation, and ISAI. The raise, completed with debt financing from funds managed by Blackrock, will be used for several projects including, improving the company’s proprietary trading infrastructure and broadening its offerings for the digital asset market. Additionally, the company aims to open an office in the United Arab Emirates, marking its 4th global office.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Morningstar, a leading provider of independent investment insights, has announced its acquisition of DealX, a data provider specializing in standardized Commercial Mortgage-Backed Securities (CMBS) and Collateralized Loan Obligations (CLOs). This strategic move aims to strengthen Morningstar’s structured finance analytics and expand its capabilities in securitization, commercial real estate lending, and private credit markets. By integrating DealX’s data solutions, Morningstar plans to enhance transparency, efficiency, and decision-making for institutional investors and asset managers. The acquisition builds on an existing partnership between the two firms, which began with the launch of CRE Analytics in 2023. With DealX’s expertise in clean, standardized loan and bond data, Morningstar Credit is set to provide more robust insights into CMBS trends, leveraged loan markets, and regulatory compliance, reinforcing its position as a leader in structured finance analytics

·German identity verification startup IDnow has been acquired by New York-based private equity firm Corsair Capital in an all-cash deal worth $295m (€273m). This acquisition, marking the largest German fintech exit in recent years, is seen as a positive development for Germany's M&A market, which has slowed since 2021. Corsair, which first acquired a 43% minority stake in IDnow in 2019, will now take control of 96% of the company, with a potential 20% earnout based on future performance. Founded in 2014, IDnow has grown through strategic acquisitions, including Trust Management AG and ARIADNEXT, which helped the company expand into the French market. The startup, which has 900 customers worldwide, generated €79m in revenue in the previous year and remains profitable on an EBITDA basis.

And finally, we bring you 4 news stories that caught our eye last week:

Swedish fintech giant Klarna is reportedly preparing to file for a $1 billion initial public offering (IPO) on the New York Stock Exchange as early as this week. The buy now, pay later (BNPL) provider is targeting a valuation of over $15 billion, with plans to price the IPO in early April 2025. The company serves over 85 million customers and partners with more than 500,000 retailers globally. The planned IPO is part of a resurgent market for new listings, with U.S. IPO volumes reaching $8.8 billion since the start of 2025, the highest since the same period in 2022. Klarna's public offering could signal renewed investor confidence in the fintech and BNPL sectors after recent market challenges.

Germany's financial watchdog, BaFin, has levied a €23.05 million fine on Deutsche Bank AG for multiple compliance failures. The penalties, announced on March 4, 2025, address violations in organizational requirements for currency derivatives sales in Spain, Postbank's failure to record telephone investment advice after COVID-19 exemptions expired, and delays in processing account switching requests. Deutsche Bank confirmed the fines are covered by existing provisions and won't affect 2025 financials. The bank has cooperated with BaFin and reportedly improved processes in the affected areas.

The UK's Payment Systems Regulator (PSR) plans action against Visa and Mastercard after a March 6, 2025, report found a lack of competition in the card payment market, impacting UK businesses. Visa and Mastercard, controlling 95% of UK card payments, have raised scheme and processing fees by over 25% since 2017, adding £170 million annually to business costs. The PSR is considering remedies like fee caps and enhanced financial reporting. Meanwhile, Revolut and Visa have filed legal challenges against the PSR’s decision to cap interchange fees on cross-border online payments, claiming the regulator exceeded its authority.

London-based crypto payments platform BVNK has launched an embedded wallet to bridge traditional finance and blockchain technology. It enables businesses to manage both fiat currencies (USD, EUR, GBP) and stablecoins on a single platform while accessing payment schemes like SWIFT, SEPA, and ACH. BVNK integrates with traditional banking (SWIFT, ACH, SEPA) and blockchain networks (Ethereum, Bitcoin, Solana), streamlining cross-border transactions, treasury management, and cost-effective settlements.

Have a great start into the week!

Sources of the fundraising reports