BlackFin Tech Weekly — March 11th, 2024

Every Monday, we publish a short digest which sums up last week’s Fintech activity

Hello, FinTech friends!

Welcome back to our weekly dive into the buzzing world of European FinTech. Today, we've got a special treat in store – among the latest deals and developments, there's one that hits particularly close to home. Keep an eye out as we explore what's been shaking up the industry.

So, let's jump into the newsletter and uncover what's been happening in the world of finance and technology. Ready to explore with us?

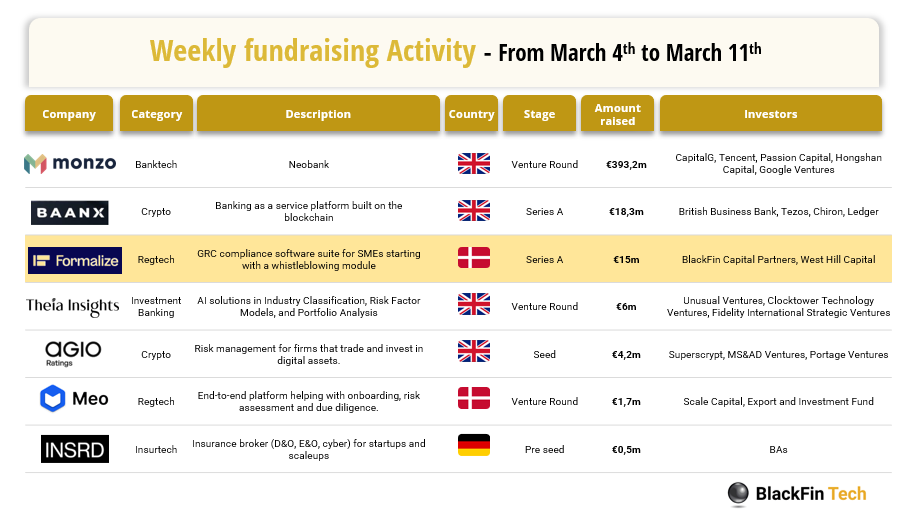

Last week we saw 7 official fintech deals in Europe for a total amount of 438,9m€ raised with 4 deals in the UK, 2 in Denmark, and 1 in Germany.

Congratulations to Monzo, the UK's largest digital bank, who has successfully raised £340 million in their most recent funding round led by CapitalG, the round also sees participation from leading global tech investors, including Google Ventures and HongShan Capital, as well as existing backers, including Passion Capital and Tencent. Well done also to Baanx, a cryptocurrency payments specialist authorized by the U.K.’s Financial Conduct Authority (FCA), for having raised $20 million in Series A funding with participation from Ledger, Tezos Foundation, Chiron, and British Business Bank. Lastly, we want to extend a special congratulations to the newest addition to our portfolio, Formalize (formerly Whistleblower Software), a Danish compliance operations platform designed to streamline workflows and automate processes, for having secured €15 million led by us!

Let’s dive in

Monzo, the UK's largest digital bank, announced that it has raised £340 million in a funding round to boost its expansion plans. The round values Monzo a post-money valuation of £4 billion. Led by CapitalG, the round also sees participation from leading global tech investors, including Google Ventures and HongShan Capital, as well as existing backers, including Passion Capital and Tencent. Monzo was founded in 2015 and now serves more than 9 million customers, making it the largest digital bank in the UK and the 7th largest UK bank by customer numbers. The company reported profitability in March 2023. In 2023, it launched Instant Access Savings and Monzo Investments alongside other features, including Cashback, Mortgage Tracker, and the industry-first Call Status fraud prevention tool.

Baanx, a cryptocurrency payments specialist authorized by the U.K.’s Financial Conduct Authority (FCA), has raised a $20 million Series A funding round. Baanx was founded in 2018 by Garth Howat, a serial entrepreneur with experience in fintech and e-commerce. The company’s vision is to democratize access to crypto payments and banking, by enabling anyone to create their own branded digital wallets, cards and accounts. Baanx also provides a range of crypto services, such as lending, borrowing, staking, swapping and earning interest. The investment round, which included Ledger, Tezos Foundation, Chiron and British Business Bank, brings the crypto payment enabler’s total funding to over $30 million. Baanx recently signed a three-year partnership with Mastercard for the U.K. and Europe. Large legacy payments companies such as Mastercard and Visa have been exploring topics like payments on Ethereum, stablecoins and the Web3 world of non-custodial wallets – areas where Baanx provides seamless connectivity. The funding will help the firm introduce its services in the U.S. and Latin America later this year. The company currently has over 150.000 users.

Denmark-based Formalize (formerly Whistleblower Software), a compliance operations platform designed to streamline compliance workflows and automate processes for various frameworks and regulations, secures €15M in a Series A round of funding. The round was led by us, BlackFin. The proceeds will help the company to establish itself as Europe’s premier compliance software provider. The company is now gearing up to expand beyond whistleblowing software with the launch of a new compliance platform designed to “gather, structure, and automate” all the compliance work that companies are increasingly expected to engage in as part of GDPR data protection laws in Europe. Formalize, currently with 90 employees in Aarhus, Copenhagen, and Madrid, is expanding to Milan this year and aims to nearly double its workforce.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Qonto has announced the acquisition of Regate. Qonto is a French neobank for SMEs, which has been founded in 2016. Qonto has more than 450,000 businesses on its platform and has raised over €600m so far. Regate is a French accounting automation startup which has been founded in 2020. Regate counts 10,000 SMEs and 500 accounting firms as its customers and was able to grow its revenues by 300% in 2023. Regate marks Qonto’s second acquisition after acquiring the German SME neobank, Penta, in 2022. With the acquisition of Regate, Qonto aims to build out its accounting services and come one step closer to building an all-in-one finance solution for SMEs.

Read more

Indexa Capital Group has announced the acquisition of Caravel. Indexa Capital is an automated investment manager and insurance provider from Spain. Indexa Capital has over 75,000 clients in Europe and manages €2.2bn in assets. Caravel is a French insurance broker specializing in retirement savings and with a recent expansion into life insurance. Caravel was founded in 2020 and has 1,900 clients in France. It is the first acquisition for Indexa Capital Group and with the acquisition of Caravel, Indexia Capital Group is looking to strengthen its presence in the French market and expand its offering.

Read more

And finally, here are the news that caught our eye last week:

PayPal's Complete Payments package offers small businesses and sellers in 22 markets worldwide, including Canada, the UK, and across Europe access to an extensive array of payment instruments, including PayPal, buy now pay later options, Apple Pay, Google Payv, credit and debit cards, and various alternative payment methods worldwide. This wide range of options aims to cater to diverse consumer preferences and enhance the convenience of transactions

Deutsche Börse Group has launched the Deutsche Börse Digital Exchange (DBDX), a regulated spot platform for institutional clients to trade crypto assets. This platform offers a fully regulated and secure ecosystem for trading, settlement, and custody of crypto assets, catering specifically to institutional-grade standards. This new DBDX platform has been made possible by the German exchange's partnership with Swiss-based Crypto Finance and their cryptocurrency trading and custody offering.

JPMorgan Chase & Co. has announced its membership in France's leading payments network, Cartes Bancaires (CB), marking the first U.S. bank to join. This partnership allows JPMorgan to offer its merchant customers, including major U.S. firms, the ability to process payments domestically in France through the CB network, providing a cost-effective alternative to Visa and Mastercard services.

Capstack Technologies, a Miami-based startup, is developing the first online bank-to-bank marketplace aimed at helping financial institutions mitigate asset risk. The platform, backed by recent funding from Citi Ventures, seeks to create a national marketplace for buying and selling loans and deposits, providing small and regional banks with access to national resources and aiding in diversifying their loan portfolios.

Have a great week & see you soon!