BlackFin Tech Weekly — March 24th, 2025

Every Monday, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome to another week of fintech insights. Let’s explore the news and trends shaping the industry!

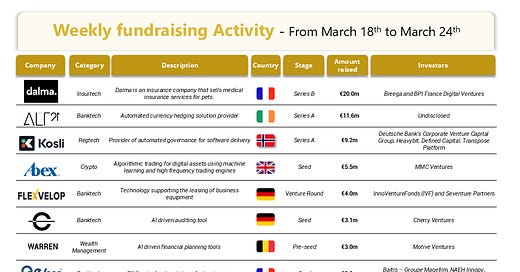

Over the last week, there were 11 fintech deals in Europe, raising a total of €62 million: 3 deals in Germany, 2 deals in the UK and France and 1 deal each in Ireland, Norway, Belgium and Spain.

Congratulations to the top 3 fundraising companies:

Dalma, a French insurtech focusing on pet insurance, raised €20M in Series B funding from Bpifrance Digital Venture and Breega.

ALT21, an Irish fintech specializing in foreign exchange (FX) transactions has raised a €11.6m Series A. The round was led by a network of super angel investors.

Kosli, a fintech automating software delivery governance, risk, and compliance (GRC) in DevOps, has raised a €9.2m Series A, led by Deutsche Bank’s Corporate Venture Capital group and Heavybit, with additional participation from Defined Capital, Transpose Platform, and individual investors.

Let’s dive in

Dalma, a French insurtech specializing in pet insurance, has raised €20M in Series B funding, led by Bpifrance Digital Venture and Breega. The funding will accelerate Dalma's expansion in France and Germany, where it has seen significant growth, while also advancing its innovative distribution and technology-driven insurance model. With a focus on personalized, data-driven solutions, Dalma aims to revolutionize the pet insurance market by better meeting the needs of pet owners and enhancing the overall customer experience.

ALT21, a Dublin-based fintech firm specializing in foreign exchange transactions, hedging, and payments, has raised €11.6 million in an oversubscribed Series A funding round. The investment, secured from a network of super angel investors with extensive global scaling experience, brings ALT21's total funding to €44 million. The funds will be used to accelerate global expansion, enhance the go-to-market strategy, and introduce new products beyond FX. ALT21 utilizes high-frequency trading technology to automate FX processes, reducing operating costs and offering customers more transparent and efficient services.

Kosli raised €9.2 million in Series A funding, led by Deutsche Bank’s Corporate Venture Capital group and Heavybit, with additional participation from investors including Defined Capital, Transpose Platform, and a group of individual investors. The funds will be used to enhance Kosli's software delivery governance solutions, particularly for large financial institutions, helping them address governance, risk, and compliance (GRC) challenges. This investment will support the launch of Kosli Enterprise, a new offering aimed at automating governance in fast-paced DevOps and CI/CD environments, ultimately improving efficiency and reducing risk in software delivery for financial services.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Munich Re has announced the $2.6 billion acquisition of NEXT Insurance, a US-based digital small business insurer, integrating it into its primary insurance arm ERGO. The deal enhances Munich Re’s position in the US market, where over 30 million small businesses remain largely underinsured. Founded in 2016, NEXT serves 600,000 customers with tech-driven solutions like General Liability and Workers’ Compensation. The acquisition strengthens ERGO’s digital capabilities and supports its international growth strategy. Munich Re, an early investor in NEXT, expects the deal to drive sustainable earnings and accelerate innovation in the underserved US SME insurance market.

MyUnisoft, a French cloud-based software provider for the accounting profession, has announced a strategic partnership with leading tech investor Hg. As part of the deal, Hg acquires the stake held by Drakarys, while over 100 accounting firms reinvest alongside Hg to support the next phase of growth. The funding will accelerate product and technology development, in close collaboration with the firm’s accounting partners. The transaction also includes a €1 million commitment to MyUnisoft Solidaire, supporting education and microcredit initiatives. This partnership strengthens MyUnisoft’s mission to digitally transform the accounting sector while preserving strong industry-led governance

And finally, we bring you 4 news stories that caught our eye last week:

Tether, the world's largest stablecoin issuer, has bought over $33 billion in U.S. Treasury bonds, making it the seventh-largest holder of American government debt. This surpasses the holdings of countries like Canada, Mexico, and Taiwan, positioning Tether as a significant player in the U.S. financial system. The investment aligns with potential stablecoin regulations, including the proposed GENIUS Act, which would require stablecoin issuers to hold reserves in U.S. government bonds. President Trump's recent comments suggest stablecoins could enhance the dollar's global strength. Tether's widespread use, particularly in developing economies, supports this by providing global access to digital dollar alternatives. However, the company's historical resistance to external audits remains a potential obstacle to regulatory acceptance. Tether's Treasury bond investment marks a pivotal moment for digital currencies, potentially shaping the regulatory landscape and reinforcing the dollar's prominence in the global financial system.

Alphabet has agreed to acquire cybersecurity startup Wiz for $32 billion, marking its largest deal to date. The acquisition is set to provide substantial returns for early investors, with some seed investors potentially seeing returns as high as 200 times their initial investment. Notably, Cyberstarts, an early-stage investment firm, stands to gain approximately $1.3 billion from its initial $6.4 million investment made in 2020. Wiz, founded by veterans of Microsoft’s cloud security group, rapidly gained prominence for its cloud security platform that identifies vulnerabilities across an organization's cloud infrastructure.

Klarna's IPO prospects have been further boosted by a major partnership with Walmart, where it will exclusively provide buy now, pay later (BNPL) services through OnePay, replacing rival Affirm. Klarna owns a majority stake in OnePay, a fintech startup also backed by Ribbit Capital. This deal is expected to significantly expand Klarna's U.S. footprint, with the potential to boost Klarna's total GMV by 28% if it captures just 5% of Walmart's U.S. volume. Affirm's stock took a hit, dropping 8% upon the announcement of Klarna's Walmart partnership. While Affirm is more focused on the U.S. market, Klarna's global reach and aggressive expansion into the U.S. has created a competitive rivalry between the two companies.

European fintech Vivid is rapidly expanding its SME financial platform across Europe, onboarding 30,000 businesses in less than a year and aiming to reach 50,000 by Q2 2025. The company is launching in Spain, Luxembourg, Italy, the Netherlands, and France. Vivid has introduced a Crypto Earn Account for SMEs, allowing businesses to stake selected cryptocurrencies and earn rewards. This innovative offering combines traditional financial services with crypto investment opportunities for small and medium-sized enterprises. Vivid's Crypto Earn Account provides a user-friendly way for SMEs to explore the potential of crypto investments while managing their day-to-day finances on a single platform.

Have a great start into the week!

Sources of the fundraising reports