BlackFin Tech Weekly — March 3rd, 2025

Every week, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome to another week of fintech insights. Let’s explore the news and trends shaping the industry!

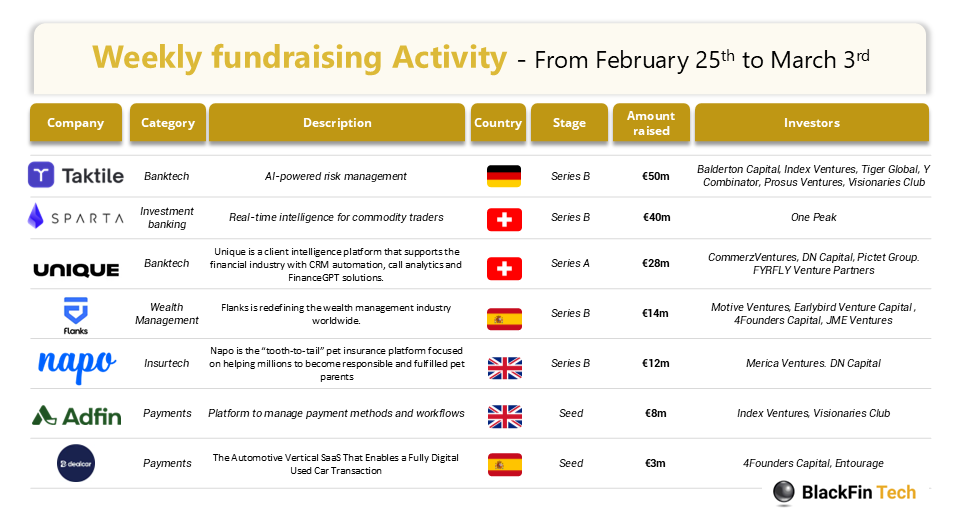

Over the last week, there were 7 fintech deals in Europe, raising a total of €155 million, 2 deals each in Switzerland, Spain and the UK, as well as one deal in Germany.

Congratulations to the top 3 fundraising companies:

Taktile, an AI powered risk management tool, has raised €50m in Series B led by Balderton Capital, with participation from Index Ventures, Tiger Global, Y Combinator, Prosus Ventures and Visionaries Club.

Sparta, a Swiss startup, which provides real-time intelligence for commodity traders, has raised €40m million in Series B funding led by One Peak, with continued backing from Singular and FirstMark.

Unique AI, a software platform that supports the financial industry with various AI-based uses cases, such as KYC automation, call analytics and FinanceGPT solutions, has raised €28 million in Series A funding led by CommerzVentures, with participation from DN Capital, Pictet Group and FYRFLY Venture Partners.

Let’s dive in

Taktile, a company revolutionizing decision automation in financial services, has raised €50 million in a Series B funding round led by Balderton Capital. Other investors include Index Ventures, Tiger Global, Y Combinator, Prosus Ventures and Visionaries Club. Taktile’s platform helps financial institutions optimize risk management and supports AI-driven decision-making. The new capital will help the company enhance its tools for better risk decisioning, which is crucial in areas like credit underwriting and fraud prevention.

Sparta, a leader in real-time intelligence for commodity trading, has raised €40 million in a Series B funding round led by One Peak, with support from Singular and FirstMark. The company plans to use this funding to expand beyond oil and gas, evolving from a data provider into a full AI-powered trading platform. Founded by former traders, Sparta is addressing inefficiencies in the industry by replacing outdated data methods with real-time, collaborative AI tools for traders. The company aims to transform commodity trading by offering predictive insights, price forecasting, and a seamless operating system for decision-making. This expansion will help Sparta compete with financial data giants like Bloomberg.

Unique AI, a Zurich-based startup focused on agentic AI for the financial services industry, has raised USD €28 million in a Series A round led by CommerzVentures and DN Capital. The funding will accelerate the company's development and support its expansion, particularly into the U.S. Since its launch in 2021, Unique has grown its platform to help financial firms improve efficiency in areas like research, compliance, and KYC. Its AI solutions are already used by major clients like Pictet and LGT Private Banking, driving significant time savings for financial professionals. Unique plans to continue innovating and expanding its global footprint.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Marqeta, a global modern card issuing platform, has announced its acquisition of TransactPay, a BIN Sponsorship provider licensed as an E-Money Institution (EMI) in the UK and European Economic Area. This strategic move aims to strengthen Marqeta's card program management capabilities across the UK and Europe. By integrating TransactPay's services, Marqeta plans to enhance its platform, optimizing digital payment solutions for customers in these regions. This acquisition will allow Marqeta's clients to manage card programs more efficiently without the need to engage multiple partners, thereby simplifying operations and accelerating market entry. TransactPay, established in 2012, operates in 25 countries, supports 16 currencies, and holds principal memberships with Mastercard and Visa. Its expertise in BIN Sponsorship and digital wallet services is expected to bolster Marqeta's offerings, enabling clients to navigate local regulatory environments effectively and scale their card programs throughout the UK and Europe.

Behavox, a leader in AI-powered compliance and risk management solutions, has announced the acquisition of Mosaic Smart Data, a provider of advanced transaction analytics for financial institutions. The transaction marks Behavox’s strategic expansion into front-office analytics, strengthening its ability to deliver actionable insights for Fixed Income, Currencies, and Commodities (FICC) markets. Mosaic Smart Data has transformed financial data analysis by aggregating and normalizing transaction data, applying AI-driven insights to enhance liquidity discovery and decision-making. This acquisition aims to enrich Behavox’s platform by integrating Mosaic’s proprietary technology, offering a unified solution that enhances trade surveillance, regulatory compliance, and risk monitoring. The Mosaic Smart Data brand will be incorporated into Behavox’s AI ecosystem, with its solutions set to be fully integrated into the company’s next-generation compliance and analytics offerings

And finally, we bring you 4 news stories that caught our eye last week:

Capim, a Brazilian startup specializing in buy now, pay later (BNPL) options for dental services, has secured $26.7 million in Series A funding. The São Paulo-based company, founded in July 2021 by co-CEOs Marcelo Lutz and Roberto Biselli, positions itself as a vertical SaaS provider for the dental sector. The company's operating system is designed to assist dentists in digitizing and managing their clinics while boosting revenue. Capim's platform offers a unique combination of clinic management tools and financing options, aiming to make dental care more accessible to Brazilian consumers while supporting dental practices in their operations and growth

Amazon and TradeBridge have partnered to launch a new term financing option for Amazon sellers in the UK. This collaboration offers eligible businesses up to £5 million in funding. The initiative aims to support seller growth by providing a straightforward and accessible financing solution. The partnership addresses the capital needs of Amazon sellers, enabling them to invest in inventory, marketing, or operational improvements to scale their businesses effectively. The financing solution is designed to be flexible, with repayment terms tailored to suit individual business needs. This approach helps sellers overcome common financial hurdles and focus on expanding their operations more efficiently.

Since its launch in 2018 as a ride-hailing service in Togo, Gozem has steadily expanded across French-speaking West Africa, integrating a wide range of services as it sought to become a super app. The company now offers ride-hailing, commerce, vehicle financing, and digital banking across Togo, Benin, Gabon, and Cameroon. Now, in a bid to scale its ecosystem, Gozem has raised $30 million in a Series B funding round — $15 million in equity and $15 million in debt — led by Al Mada Ventures. The company will use the funds to bolster its vehicle financing service and foray into new markets.

UK fintech investment declined to £7.97bn in 2024, down from £10.95bn the previous year, according to KPMG's Pulse of Fintech report. Despite this downturn, the UK remains Europe's fintech leader, attracting more investment than France, Germany, China, India, Brazil, and Canada combined. The largest UK deal was a £215M venture funding round by money transfer provider Zepz. While 2024 proved challenging for the EMEA region, with total investment falling to £16.3bn from £21.5bn in 2023, there are signs of a potential recovery. KPMG's UK fintech lead, Hannah Dobson, noted indications of a "slow recovery in deals" due to reduced interest rates and the prospect of increased political stability.

Have a great start into the week!

Sources of the fundraising reports