BlackFin Tech Weekly — March 4th, 2024

Every Monday, we publish a short digest which sums up last week’s Fintech activity

Hello fellow FinTech enthusiasts!

As we start another exciting week in the world of finance and technology, we are thrilled to share our latest insights and updates in European FinTech. From groundbreaking deals to emerging trends, we've got you covered. Join us as we explore the ever-evolving landscape of FinTech together!

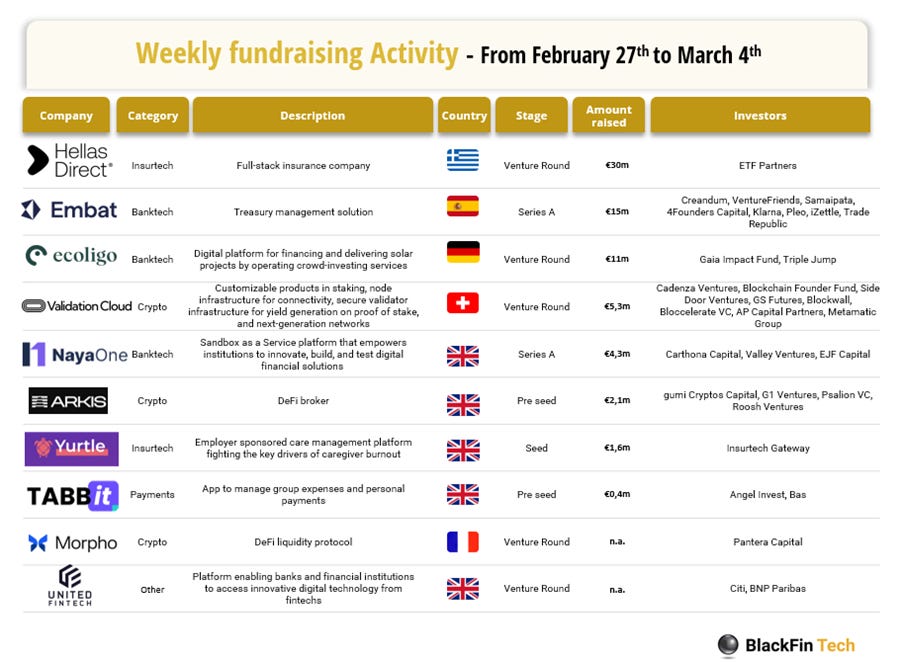

Last week we saw 10 official fintech deals in Europe for a total amount of 69,7m€ raised with 5 deals in the UK, 1 in Greece, 1 in Spain, 1 in Germany, 1 in Switzerland, and 1 in France.

Congratulations to Greek-based Hellas Direct, a full-stack insurance company, who has successfully raised €30 million in their most recent funding round led by London’s ETF Partners. Well done also to Embat, a Madrid-based fintech specializing in corporate treasury management, for having secured €15 million in a Series Around led by Trade Republic, Klarna, iZettle and Pleo, Creandum, alongside the participation of existing investors Samaipata, 4Founders, and Venture Friends. Lastly, we want to congratulate ecoligo, a Berlin-based digital platform for financing and delivering solar projects by operating crowd-investing services, for having raised €11 million. The round was led by existing investors and joined by The Energy Entrepreneurs Growth Fund and Gaia Energy Impact Fund II.

Let’s dive in

Hellas Direct, the Greek insurance tech company, secured a €30M investment aiming to strengthen its climate-focused insurance offerings. The funding round was led by London’s ETF Partners and supported by the company’s founders along with both new and existing investors. The new investment will be utilized to address the challenges posed by climate change in Central and Southern Europe. Hellas Direct, founded in 2011 by Alexis Pantazis and Emilios Markou, aims to develop insurance solutions designed to assist individuals and businesses in at-risk areas. These solutions offer coverage against seasonal threats such as wildfires and floods and also incentivize policyholders to actively contribute to climate mitigation efforts. According to the company’s data, they have more than 900K customers and €155 million in underwritten premiums.

Embat, a Madrid-based fintech specializing in corporate treasury management, has secured $16 million in a Series A funding round that will drive continued international expansion plans. The Series A is led by historic backers of Trade Republic, Klarna, iZettle, and Pleo, Creandum, alongside the participation of existing investors Samaipata, 4Founders, and Venture Friends. Adding further credence to Embat’s offer, angel investors in the company’s latest funding round include former Commerzbank CEO Martin Blessing. With a range of services on tap including banking connectivity, treasury processes, payment automation, and automated accounting and reconciliation, Embat claims that it can save financial teams up to 75 percent of time dedicated to these tasks, while concurrently providing global visibility of cash and facilitating automatic monitoring of treasury forecasts. Throughout 2023 the startup reports the handling of more than 3 million bank transactions, representing over $20 billion in value, serving over 150 clients including Playtomic, Cabify, Wallapop, and Fever. In so much, Embat says it’s seen a turnover multiplier of 4x last year alone. Late last year Embat announced a partnership that sees the startup now leveraging the power of Google Cloud’s Vertex AI platform, a move that’s proving to help financial teams further reduce errors in accounting and save up to 10 hours per week.

Berlin-based ecoligo, a company that claims to be leading the clean energy transition around the world, announced that it has raised €11M in an oversubscribed funding round. Existing investors led the round, joined by two new investors: The Energy Entrepreneurs Growth Fund (Fund by Triple Jump), supporting companies in the energy access ecosystem in Sub-Saharan Africa; and Gaia Energy Impact Fund II, a French VC fund focusing on impact companies in markets along the energy value chain. ecoligo intends to use the funds to strengthen its market presence in the solar project sector and introduce new financial products in the German market. The company also plans to extend its financial product range to chosen European countries. Having implemented 130 solar systems globally, valued at €40M, ecoligo’s projects, operating in emerging countries, are anticipated to prevent over 1.7 million tons of CO2 emissions throughout their expected lifespan. The company operates in 11 countries, including Kenya, Vietnam, and Chile. ecoligo collaborates with committed and environmentally conscious private investors to implement solar installations on company buildings, contributing to the global energy transition. By providing solar energy to commercial and industrial enterprises in growing economies, ecoligo addresses the climate crisis, saving over one million tonnes of CO2 through fully financed Solar-as-a-Service projects.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

FIS Global has announced the acquisition of Torstone Technology. FIS Global is an American multinational corporation that offers a wide range of banking, payments, trading, and wealth management solutions. It serves clients around the world in different industries, ranging from financial institutions to retailers and energy providers. Torstone Technology is a London-based SaaS business that provides post-trade securities and derivative processing technology to its clients. FIS already completed the acquisition of SunGard in 2015 in a move to build up its capital markets technology offering, and Torstone Technology is now the next building block to widen its offering in this space.

Read more

And finally, here are the news that caught our eye last week:

American Express (Amex) has launched a new monthly installment payment offering called Plan It, allowing UK cardmembers to pay off purchases or a portion of their balance in equal monthly installments. Plan It allows cardholders to select specific transactions or amounts from their recent statements and divide them into installments of three, six, or twelve months

Klarna's financial performance in 2023 showed healthy growth and reduced losses, with a gross profit of $1.1 billion and a 22% increase in revenue to about $2.2 billion. Net losses decreased significantly to $245 million from $1 billion the previous year. Despite a valuation drop in 2022, Klarna's recent performance and the success of its rival Affirm suggest a potential $20 billion valuation at IPO

Financial technology companies Fiserv and Amadeus IT Group are reportedly in a bidding war to acquire Shift4 Payments, a payments processor with a market value of nearly $7 billion. Both companies are preparing to submit final offers in the coming weeks as Shift4 runs a sale process. The potential deal is significant in the financial services sector and represents ongoing consolidation in the industry.

Worldline, a French payments group, announced a forecast of slowing revenue growth for the current year, with sales growth expected to be "at least 3%". Worldline reported an €817 million loss for 2023, attributed in part to a €1.15 billion impairment charge resulting from the revaluation of certain acquisitions on its books. Despite this, the company aims to enhance profitability through cost-cutting measures, including plans to eliminate approximately 1,400 jobs by 2025 to reduce annual costs by €200 million.

Have a great week & see you soon!

All sources: here