BlackFin Tech Weekly — May 21st, 2024

(Almost) Every Monday, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome back to our newsletter! Hope you had a great long weekend if you had one! We are back with a range of interesting Fintech deals and news from all over Europe for you. Especially, in the earlier stages there were many funding rounds last week.

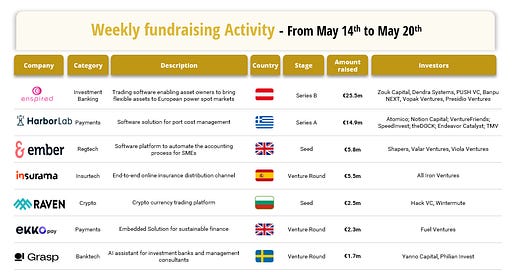

Last week we saw 8 official fintech deals in Europe for a total amount of €58.1m raised with 3 deals in the UK, and 1 in Austria, Greece, Spain, Sweden, and France. A true European mix!

Congratulations to the Austrian trading software Enspired, which has secured a €25.5m Series B funding round. Zouk Capital led the round alongside PUSH VC, Banpu NEXT, Vopak Ventures, Presidio Ventures, Emerald Technology Ventures, Helen Ventures, 360 Capital, and EnBW New Ventures. Applause also goes out to Harbor Lab, the Greece-based solution for port cost management, which has successfully secured €14.9 million in an impressive Series A funding round from Atomico, with follow-on investments by existing investors Notion Capital, Venture Friends, SpeedInvest, and the Dock. Lastly, we congratulate Ember, the UK-based platform automating tax and accounting processes for securing €5.8 million in a seed round, led by Valar Ventures, and Viola Fintech alongside Shapers.

Let’s dive in

Enspired, the pioneer for the simultaneous commercial optimization of batteries and other power assets across the wholesale, control reserve, and ancillary service markets, secured a €25.5m Series B funding. Zouk Capital led the round with participation from PUSH VC, Banpu NEXT, Vopak Ventures, Presidio Ventures, Emerald Technology Ventures, Helen Ventures, 360 Capital, and EnBW New Ventures. The company intends to use the funds to expand operations and its business reach globally.

Harbor Lab, a Greek startup revolutionizing port cost management for shipping companies, has successfully raised $16 million. This latest Series A funding round was led by European venture capital firm Atomico, with participation from existing investors Notion Capital, Venture Friends, SpeedInvest and The Dock, alongside new investors Endeavor Catalyst and maritime venture company TMV. Atomico Partner Ben Blume will join the board as a result of the transaction. The new funding will be used to support growth in Harbor Lab’s Athens-based team – currently 70 people – and investment in new technologies including artificial intelligence to further improve its offerings.

Ember, a London-based provider of a centralized platform for limited companies and sole traders to streamline their access to banking services, tax insights, and accounting needs, has secured £5 million in its seed funding round. The round was led by Valar Ventures, Viola Fintech and Shapers. Ember has partnered with HSBC to offer digital tax services to hundreds of thousands of SME customers, integrating invoicing, transaction categorization, and cashflow tracking into HSBC's banking platform. With the new funding, Ember plans to expand its operations and extend its platform to other major UK banks.

Last week there were no notable M&A transactions in the European Fintech scene.

And finally, here are the news that caught our eye last week:

Lydia is investing €100 million to relaunch its banking services under the new brand, Sumeria, offering remunerated current accounts with a 2% return (4% for the first three months). Aiming to reach 5 million customers in three years, Lydia plans to hire around 400 new employees. By applying for a banking license from the ACPR and ECB, Lydia signals its ambition to become a true bank and simplify savings for clients in a competitive market.

Raisin, the German online savings platform, recorded its first net profit of nearly one million euros in 2023, after a significant loss in 2022. Revenues almost doubled to 158 million euros, with assets increasing 74% to 57 billion euros. Operating across the EU, UK, and US, Raisin now partners with 257 banks and serves over half a million users. Despite the profit, the company plans to reinvest in marketing and growth, aiming for a 35% revenue increase this year.

Insurance unicorn Wefox has warned shareholders of potential insolvency due to financial losses and regulatory charges. CEO Mark Hartigan indicated the company could become insolvent by August, citing cash flow issues and regulatory capital needs. Wefox is cutting jobs and closing offices in Italy, Germany, Poland, and Switzerland. Valued at £3.6 billion less than two years ago, the company has fallen into crisis despite securing £55 million in funding in 2023. The company aims to save costs and sustain its business model by closing international offices.

Visa has unveiled a suite of new digital-first products and services to meet the needs of businesses, merchants, consumers, and financial institutions.

Key offerings include Visa Flexible Credentials, which allow a single card to switch between payment methods, and mobile features like Tap to Confirm, Tap to Add Card, and Tap to P2P. Visa also introduced Pay By Bank, an account-to-account payment system using Tink's technology, featuring fraud detection capabilities.

Have a great week & see you soon!