BlackFin Tech Weekly — May 26th, 2025

Every Monday, we publish a short digest which sums up last week’s Fintech activity

Hello FinTech Friends,

Welcome to another week of fintech insights. Let’s explore the news and trends shaping the industry!

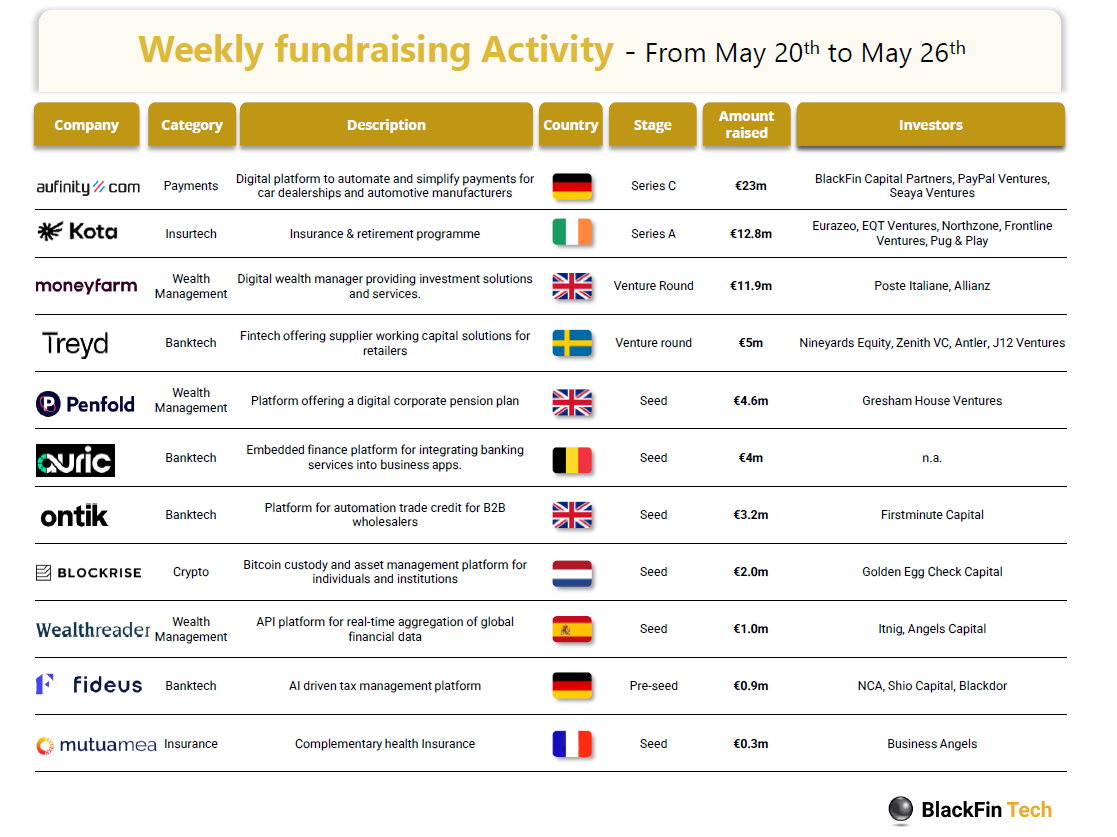

Over the last week, there were 11 fintech deals in Europe, raising a total of €68.7 million in equity, three deals in the UK, two deals in Germany and one deal each in Ireland, Sweden, Belgium, The Netherlands, Spain and France.

On the BlackFin side, we’re excited to back Aufinity Group, a digital payment management leader in the automotive sector, by leading their €23m Series C round alongside PayPal Ventures and Seaya Ventures!

Congratulations to the two other largest rounds announced last week:

Kota, an insurance and retirement benefits platform, raised a €12.8 million Series A led by Eurazeo, with participation of existing investors EQT Ventures, Northzone, Frontline Ventures, 9Yards, and Plug and Play Ventures.

Moneyfarm, a digital wealth management platform, raised €11.9 million from Poste Italiane and Allianz, with support from M&G, Cabot Square, and United Ventures.

Let’s dive in

Aufinity Group, based in Cologne, has secured €23 million in Series C funding to accelerate its European expansion and strengthen its partnerships with automotive OEMs. The round was led by BlackFin Capital Partners, with continued backing from existing investors PayPal Ventures and Seaya Ventures. Aufinity Group operates the Aufinity (international) and bezahl.de (Germany) platforms, providing car dealers and OEMs with digital, white-label payment management solutions that streamline processes from vehicle sales to after-sales. The company is already a market leader in Germany, serving over 1,400 dealerships, and recently expanded into Spain and Italy with new offices in Madrid and Rome. Read more

Kota, a Dublin-based benefits platform, raised a €12.8 million Series A led by Eurazeo, with continued support from EQT Ventures, Northzone,

Frontline Ventures, 9Yards, and Plug and Play Ventures. Founded by CEO Luke Mackey, Kota streamlines insurance and retirement benefits for companies and employees, integrating directly with insurance carriers and HR/payroll systems. Now licensed across the EEA and UK, Kota powers benefits for platforms like Remote and Helios. The new funding will support expansion and further product development. Read more

Moneyfarm, a digital wealth management platform, raised €11.9 million from Allianz and Poste Italiane to expand products, strengthen its advisor network, and boost tech innovation. Moneyfarm manages over €6 billion across Italy and the UK, with key investors including M&G, Cabot Square, and United Ventures. Read more

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Apex Group, the global financial services provider, has acquired a majority stake in Tokeny, a Luxembourg-based tokenization platform for real-world assets. Tokeny enables financial institutions to issue and manage digital securities using blockchain infrastructure. The deal gives Apex access to leading tokenization technology, reinforcing its push into digital assets and enhancing services for institutional clients. Tokeny will continue operating under its own brand, while benefiting from Apex’s global reach and client base. Financial terms were not disclosed. Read more

Swiss wealthtech Etops has acquired Finanzportal24, a German financial planning software provider, for an undisclosed sum. Founded in 2002, Finanzportal24 offers software tailored for financial advisors and brokers, featuring modules for financial and biometric risk analysis, liquidity management, and retirement planning. The company currently serves approximately 4,500 clients. Etops, specializing in wealth and asset management technology, states that this acquisition aligns with its "buy-and-build strategy" following its own acquisition by private equity firm Pollen Street Capital last year. Finanzportal24 will continue to operate independently with teams based in Burbach and Marburg. Read more

And finally, we bring you 4 news stories that caught our eye last week:

Revolut will invest over €1.1 billion in France over the next three years, establishing a new Western Europe headquarters in Paris and applying for a French banking license with the ACPR. The move is part of Revolut's ambition to become Europe’s largest banking group, with Paris overseeing operations in France, Spain, Italy, Portugal, Ireland, and Germany. Revolut

already serves over five million French customers and employs 300 people in the country, aiming to add 200 more jobs. The company will maintain Lithuania as a key EU hub, while London remains its global HQ. The expansion coincides with the Choose France summit, where Revolut joined other firms announcing major investments in the French economy. Read moreQuantumLight, the venture capital firm founded by Revolut CEO Nik Storonsky, has closed a $250 million fund backed by billionaire tech founders, VCs, and institutions. Led by Storonsky and CEO Ilya Kondrashov, QuantumLight invests globally at Series B and C, using a proprietary AI model to recommend all deals—removing most human judgment from the process. The firm’s new hiring playbook, based on Revolut's growth strategy, emphasizes structured, bias-resistant recruiting and high-performance team management. QuantumLight plans to return to fundraising in 2026, with 70% of its portfolio currently US-based and a focus on AI, Web3, fintech, SaaS, and marketplaces.Read more

Several of the largest US banks—including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo—are in early talks to launch a joint stablecoin project. The initiative also involves entities such as Early Warning Services, operator of Zelle, and The Clearing House, which manages real-time payments infrastructure. The proposed stablecoin would be pegged to the US dollar and designed for use by both member and non-member banks, potentially creating a broad ecosystem for digital payments and settlements. Some regional and community banks are reportedly considering their own consortium as well. Read more

Brex and Zip have partnered to launch “Brex for Zip,” embedding Brex virtual cards into Zip’s procurement platform. The integration streamlines purchasing, enforces spend controls, and provides real-time visibility for enterprises. With Brex for Zip, businesses can pay vendors instantly at any stage, automate reconciliation, and manage payments in over 30 currencies. Early adopters like Anthropic, Coinbase, and eToro are already leveraging the unified solution to simplify global procurement and payments. Read more

Have a great start into the week!

Sources of the fundraising reports