BlackFin Tech Weekly — May 6th, 2025

Every week, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome to another week of fintech insights. Let’s explore the news and trends shaping the industry!

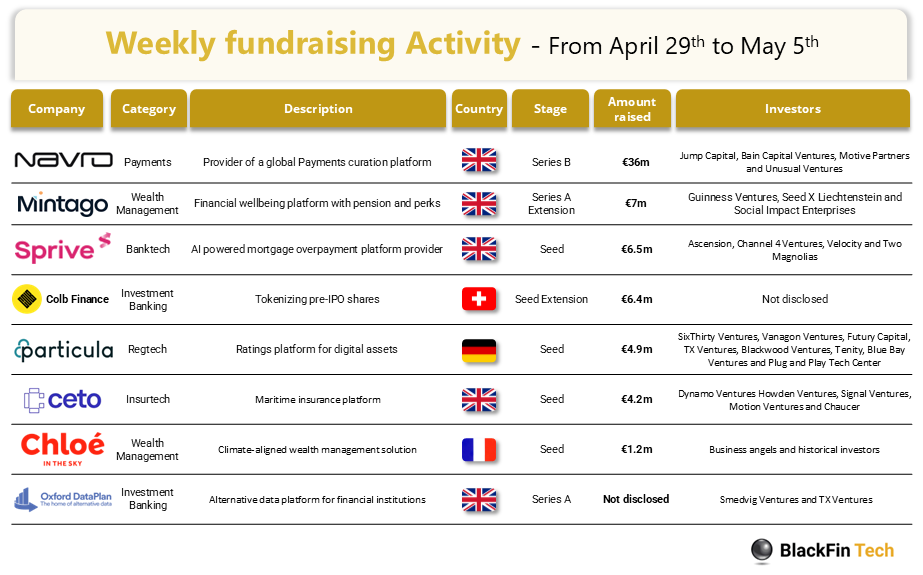

Over the last week, there were 8 fintech deals in Europe, raising a total of €68.2 million in equity, five deals in the UK and one deal in each of Switzerland, Germany and France.

Congratulations to the top 3 fund-raising companies:

Navro, a cross-border payments fintech simplifying international transactions for businesses, has raised a €36m Series B led by Jump Capital, with participation from Bain Capital Ventures, Motive Partners, and Unusual Ventures.

Mintago, a financial wellbeing platform supporting employers and employees with salary sacrifice, pension management, and financial advice, has secured a €7m Series A extension co-led by Guinness Ventures and Seed X Liechtenstein.

Sprive, an AI-powered mortgage overpayment platform helping UK homeowners pay off their mortgages faster, has closed a €6.5m Seed round led by Ascension, with backing from Channel 4 Ventures, Velocity Capital, and Two Magnolias.

Let’s dive in

Navro

Navro has raised €36m in Series B funding to accelerate its global expansion and connect more local payout and collection services worldwide. The round was led by Jump Capital, with support from Bain Capital Ventures, Motive Partners, and Unusual Ventures. Founded in 2022, Navro enables businesses to access quality payment and banking infrastructure globally through a single contract and API, reducing the cost and complexity of cross-border transactions. The platform supports real-time payments in over 200 countries and 140 currencies, serving sectors like payroll, pensions, and workforce management. With this new capital, Navro plans to expand licensing, integrate more digital wallets and real-time payment options, and extend operations into the US, Dubai, Hong Kong, and India.

Mintago

Mintago has secured a €7m Series A round extension co-led by Guinness Ventures and Seed X Liechtenstein, with Social Impact Enterprises and existing investors also participating. This follows Mintago’s initial €4.2m Series A funding announced in September 2023. Mintago provides an all-in-one financial wellbeing platform for employers and employees, offering salary sacrifice schemes, pension management, independent financial advice, and retail discounts. The company, founded by Chieu Cao and Daniel Conti, counts Lucky Saint, Avis, and Northumbrian Police among its clients. The new funding will be used to develop AI-driven products and expand Mintago’s suite of financial wellbeing solutions, helping organisations become more people-centric while saving on National Insurance Contributions and supporting employee financial health.

Sprive

Sprive, a London-based fintech, has raised a €6.5m Seed round led by Ascension, with participation from Channel 4 Ventures, Velocity Capital, and Two Magnolias. Launched in 2021 by CEO Jinesh Vohra, Sprive uses AI and automation to help homeowners pay off mortgages faster, offering cashback rewards on everyday shopping and market scanning for better mortgage deals. The platform supports over 14 major UK lenders and claims to save users an average of £10,000 over the mortgage lifetime. The fresh capital will fuel Sprive’s operational expansion and further development of its AI mortgage assistant, aiming to reduce household debt and help more homeowners achieve financial freedom.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Earnix, an Israel-based provider of AI-driven pricing and product optimization software for insurers and banks, has acquired Zelros, a French startup specializing in generative AI for the insurance sector. Zelros helps insurers personalize customer journeys by recommending products and assisting agents in real time. Through this acquisition, Earnix adds advanced generative AI capabilities to its existing predictive analytics suite, enhancing its value proposition to insurance clients. The deal also strengthens Earnix’s presence in Europe, with Zelros’ Paris team becoming a strategic development hub. Together, the companies aim to deliver more personalized, data-driven decision-making across the insurance value chain.

Sapiens, an Israel-based provider of software solutions for the insurance industry, has acquired AdvantageGo, a UK-based commercial and specialty insurance software provider. AdvantageGo offers an advanced underwriting workbench and exposure management tools used by global insurers. With this acquisition, Sapiens strengthens its presence in the London specialty insurance market and broadens its P&C product suite. AdvantageGo’s solutions will be integrated into Sapiens’ platform and also offered standalone, enhancing support for complex underwriting workflows. The deal is expected to drive long-term growth and profitability while expanding Sapiens' global footprint.

And finally, we bring you 4 news stories that caught our eye last week:

Revolut has reportedly turned down a proposed secondary share sale that would have valued the company at $65 billion a 45% increase over its last sale in late 2024. Founded in 2015, Revolut has grown from a travel-focused app to the UK’s most valuable fintech, expanding into business banking, savings, trading, and even mobile contracts. CEO Nikolay Storonsky recently increased his stake in Revolut to 25%, with no signs of slowing down as Revolut eyes new products like points-based credit cards. The company declined to comment on the rejected deal.

Fintech unicorns Qonto and Mollie have announced a partnership to address Europe’s £275 billion late payment crisis. The collaboration will combine Qonto’s business banking platform with Mollie’s payment solutions, aiming to simplify fragmented financial infrastructure for SMEs. By integrating banking and payments into a single platform, the partnership seeks to accelerate cash flow for businesses and reduce the impact of late payments across the continent.

Danish fintech investment fund Upfin, established by EIFO, Velliv, and Finansforbundet, is joining the international FinTech Collective as its new management base. The move is intended to strengthen Denmark and the Nordics’ fintech ecosystem by expanding access to global networks, expertise, and capital. Upfin, Denmark’s first dedicated fintech venture fund, will continue its partnership with Copenhagen Fintech, while FinTech Collective’s European leadership will ensure close ties to the local ecosystem. The collaboration is expected to create new opportunities for Danish and Nordic fintech startups and investors.

The UK government has unveiled new crypto regulations that will bring cryptocurrency exchanges, trading platforms, and related services under the country’s existing financial regulatory framework. The rules aim to boost transparency, consumer protection, and operational standards for crypto businesses, closely mirroring the US approach of treating most digital assets as securities. The legislation, building on 2023 proposals, is expected to be finalized by year-end and includes specific provisions for stablecoins. Only UK-based issuers will fall under the new rules, which are designed to support responsible innovation while curbing misconduct.

Have a great start into the week!

Sources of the fundraising reports