BlackFin Tech weekly — November 13th 2023

Every Monday, we publish a short digest which sums up last week’s Fintech activity

Good afternoon, loyal subscribers! We trust you've had a delightful weekend.

Let's dive straight into the latest insights and updates that the fintech landscape has to offer:

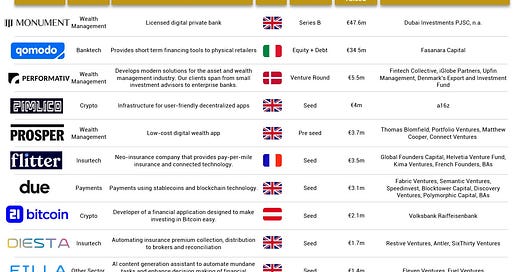

In the past week, we saw 14 deals in Europe for a total amount of €108.1m raised officially with nine deals in the UK, one deal in Italy, one in Denmark, one in France, one in Austria and one in Switzerland.

Congratulations to Monument, the London-based neo-bank, on its €47.6m Series B with existing and new investors including Dubai Investments PJSC. Well done as well to Qomodo, the provider of short term financing tools to retailers, for raising a €34.5m equity + debt round, led by Fasanara Capital.

Finally, Copenhagen-based fintech Performativ, a wealth management software solution provider, raised a €5.5m Venture round led by the Fintech Collective.

Let’s dive in

Monument, a London-based neo-bank , has successfully raised over $50 million in Series B funding.

Strategic partnership with Dubai Investments earlier in the year, in which the company acquired approximately 9% equity of the Bank. Dubai Investments intends to double its stake in the Bank, pending regulatory approval.

Monument plans to utilize these funds to expand its operations and extend its reach within the market.

Founded by Mintoo Bhandari and led by CEO Ian Rand, Monument is set to address the financial needs of approximately 4.8 million mass affluent individuals in the UK, including professionals, entrepreneurs, and property investors, with an estimated wealth of around £6 trillion in the UK and £80 trillion globally.

Monument acquired its full banking license in November 2021 and began property investment lending activities. In December 2021, the company introduced its app and initial suite of products, offering clients various communication channels such as email, video, chat, or call. The app also provides access to Monument Lifestyle, a service offering more than 35 options to help busy professionals, entrepreneurs, and their families save time and money while pursuing wealth creation.

Monument has raised over £100 million ($123 million) in equity capital and funding since its inception.

The bank's assets have exceeded £700 million, reflecting 335% year-to-date growth. The average balance per client is now over £60,000.

Italian fintech Qomodo has successfully raised €34.5 million in a pre-seed equity+debt funding round, with Fasanara Capital leading the investment.

Founded in 2023 by Gianluca Cocco and Gaetano De Maio, entrepreneurs with prior successful exits in Europe, Qomodo is introducing smart payment solutions to physical retailers, including a Buy Now Pay Later option for essential yet unexpected expenses, aimed at improving customer satisfaction and increasing business turnover.

Physical retailers often face challenges compared to online stores, including limited flexible payment options. Qomodo aims to level the playing field by providing tools like Buy Now Pay Later to physical retailers, streamlining payment management processes, allowing businesses to focus on core operations.

Qomodo is an "all-in-one" payment methods aggregator in the digital payments market, offering physical commercial operators the means to safeguard and expand their cash flow. The company's focus is on essential yet often unforeseen expenses, which typically involve higher transaction values.

During its stealth mode operation, over 500 merchants adopted Qomodo, and the company is currently in agreements to onboard thousands of physical retailers in the coming months through API-based integration. This includes independent businesses and major retail chains.

Copenhagen-based fintech Performativ has secured €5.5 million in a Seed funding round with the goal of expanding its customer base and enhancing its offerings in wealth management technologies.

The Seed round, which raised €5.5 million, was led by FinTech Collective, following a previous Pre-Seed round where Performativ received $700,000 in funding from Denmark's VF Venture, a part of the Danish Growth Fund (Vækstfonden).

Traditional banks and financial institutions, especially in Central and Eastern Europe, are struggling to keep pace with the digital-first world. A Microsoft survey revealed that one-fifth of CEE financial institutions have not yet addressed this challenge, and only about one-third have dedicated teams working on digital transformation.

Performativ, founded by Albert Geisler Fox (CEO) and Peter Barry (CTO), both with experiences at Goldman Sachs and BlackRock, offers front, middle, and back-office tools and optimizations for financial service players. Their platform aims to provide a scalable infrastructure that can streamline operations and reduce costs.

Performativ's solutions say they can reduce client onboarding time by 200% compared to industry averages and reduce operational costs by up to 70% after onboarding.

Congrats also to Pimlico, Prosper, flitter, due, 21Bitcoin, Diesta, Eilla, Nu-Credits, Ammonite, Primer and Billte for their fundraisings!

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Nexi has sold its Nordic eID business to French digital ID company IN Groupe for up to €127.5 million. Nexi is a payment services provider offering merchant acquiring, card issuing, and digital banking services across Europe. In Groupe is a provider of identity and digital services intended to help governments issue a secure legal identity, both physical and digital. The sale includes an array of trust services in Nordics and key parts of the eID infrastructure in Denmark, which serves as a personal entrance key to both the public sector and most parts of the private sector, including banks and corporates. For IN Groupe, the acquisition provides an opportunity to broaden its geographical footprint and future-proof the business for upcoming regulatory changes. The deal was valued at €90 million in upfront payments with an earn out of €37.5 million subject to performance. The acquisition is expected to be sealed by the summer of 2024, subject to regulatory approval in Denmark.

And finally, here are the news that caught our eye last week:

The EU has reached a pivotal agreement, mandating instant euro payments and granting fintech companies access to central bank payment systems, reducing reliance on third-country financial institutions. This move enhances competitiveness and economic autonomy, but banks face a daunting challenge in implementing these changes within ambitious timelines.

N26, the German online bank, is pulling out of Brazil to refocus on its European core markets, including Germany, France, Italy, and Spain, as part of its strategy to reduce losses. Despite being valued at $9 billion in 2021, N26 struggled with financial challenges and difficulties attracting investors in Brazil. This move follows previous exits from the UK and US markets and is in line with the bank's strategic shift towards its European presence.

Wefox, the German insurtech valued at $4.5 billion, has raised $55 million in fresh funding through convertible debt financing from Deutsche Bank and UniCredit. Despite not raising equity, Wefox's valuation remains stable, and this funding boosts its 2023 total to $160 million. The funds will support the company's global expansion plans and mergers and acquisitions strategy, highlighting confidence in the insurtech industry despite challenging economic conditions.

Mangopay, a platform-specific payment infrastructure provider, has teamed up with Aria, an embedded invoice financing provider, to offer enhanced payment and credit solutions for B2B marketplaces and SaaS companies. This partnership combines Mangopay's modular payments expertise with Aria's credit technology, benefiting businesses by improving payment experiences and reducing credit and payment risks. The collaboration aims to empower marketplaces with greater control over their payment strategies and access to trade credit, reflecting both companies' dedication to advancing payment innovation in B2B markets.

Have a great week & see you soon!