BlackFin Tech Weekly — November 21st

Dear Fintech folks, we hope you have had a great week. The drama surrounding FTX continues as more and more explosive details are coming…

Dear Fintech folks, we hope you have had a great week. The drama surrounding FTX continues as more and more explosive details are coming to light. Fintech fundraising increased slightly compared to last week.

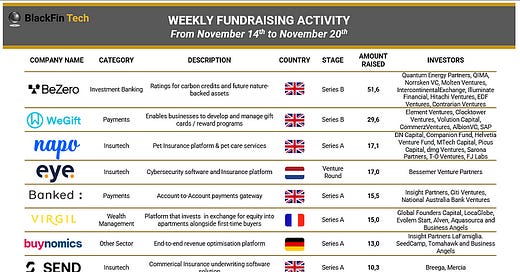

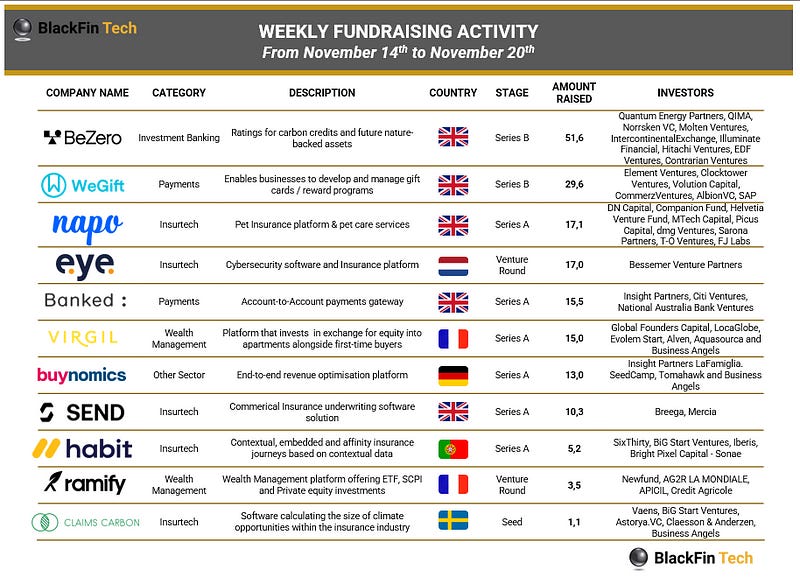

Last week €178,8m was raised across 11 deals. Congratulations to BeZero on raising a €51,6m Series B, congratulations to WeGift who raised a €29,6m Series B round and finally congratulations to Napo on raising a €17,1m Series A.

This week the United Kingdom led fundraising activity with 5 deals, followed by France with 2 deals and Germany, Sweden, Portugal and the Netherlands, each contributing 1 deal.

Sub-sector-wise, Insurtech came out on top with 5 out of 11 deals. Wealth management and Payments followed with each 2 deals, Investment Banking and Other Sectors contributed 1 deal each.

Let’s dive in:

BeZero raised €51,6m:

Climate tech startup BeZero has raised a €51,6 million Series B. US-based fund Quantum Energy Partners led the round with follow-on investments from Molten Ventures, Norrsken VC, Illuminate Financial, Qima and Contrarian Ventures. They also secured strategic investment from EDF Group’s venture capital arm EDF Pulse Ventures, Hitachi Ventures and Intercontinental Exchange.

BeZero provides more coverage than any other carbon ratings agency backed by a team of world leading climate scientists, earth observation specialists, data scientists and financial analysts.

The funds will be used to drive innovation in environmental markets through the development of ratings, risk and analytics tools.

WeGift raised €29,6m:

WeGift today announced the closing of a €29,6 million Series B round. New investors included Element Ventures, which led the round, along with Clocktower Ventures and Volution Capital. Existing investors including CommerzVentures, AlbionVC and SAP also participated.

WeGift’s offers companies the capability to launch reward, gift and payout programs seamlessly thanks to its API-first solution. Use cases include incentive marketing, gift cards, employee payouts, and other retail brand services.

These funds will be used to expand its digital currency network, support growth in new geographies — with a focus on North America — make key hires, and add new features and functionality to its already-robust solution.

Napo raised €17,1m:

Napo has raised €17,1 million in a Series A funding in a round led by DN Capital and backed by Companion Fund, MTech Capital and Picus Capital.

Napo offers health insurance for pet owners. Its platform offers policy quotes in minutes. It also offers access to 24/7 online vet consultations, as well as offering dental coverage, money to help find missing pets and third-party liability cover.

Congrats also to Eye.Security, Banked, Virgil, Buynomics, Send Technology, Habit, Ramify and Claims Carbon on their respective fundraises.

And here is the news from the last week that caught our eye.

In 2022, it’s B2B fintech that investors find ‘sexy’: Fintech (B2B) in Europe has attracted $14.1bn investment so far in 2022 across 819 funding rounds — more than four times the $3.2bn raised across 230 B2C rounds. But European fintech funding has fallen 25% overall compared to last year — with the number of consumer fintech rounds at its lowest since 2015.

The investigation against FTX continues: Several investigations have been launched against FTX and its former top management in an attempt to shed light on the shadowy areas of the group’s more than 130 entities. According to the newly appointed CEO, FTX “did not keep appropriate books and records or security controls” for its digital assets, used unsecured shared email accounts to access private keys, and to this day cannot provide a list of those working for the company.

Employees are leaving Twitter after Musk’s “hardcore” ultimatum: Twitter decided to abruptly shut its offices after many employees reacted negatively to Musk’s ultimatum of either staying for a new “hardcore” work environment or leaving with three months’ severance. — So many employees decided to take severance that it created a cloud of confusion over which people should still have access to company property