BlackFin Tech weekly — November 27th, 2023

Every Monday, we publish a short digest which sums up last week’s Fintech activity

Good afternoon, fintech friends! We trust you've had a lovely weekend.

Let's dive straight into the latest insights and updates that the fintech landscape has to offer:

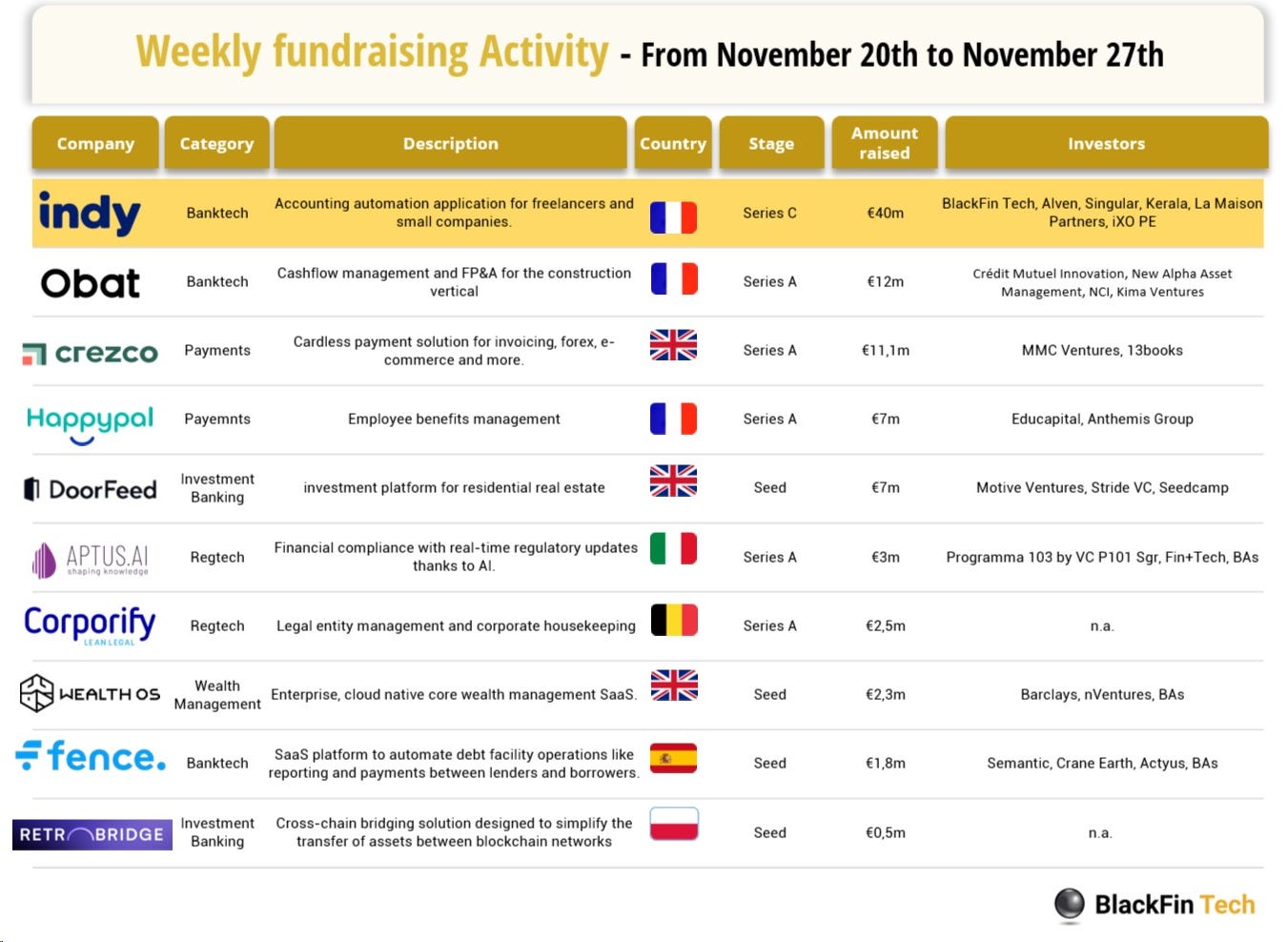

In the past week, we saw 13 deals in Europe for a total amount of €87.9m raised officially with three deals in France, three in the UK, one in Italy, one in Belgium, one in Spain, one in Poland and one in Luxembourg.

Congratulations to Obat, the French SaaS solution for professionals in the construction industry, on its €12m Series A led by Crédit Mutuel Innovation, with participation from New Alpha Asset Management, NCI, Kima Ventures, and other investors. Well done as well to Crezco, the provider of B2B invoice and bill payments, for raising a £9.6m Series A round, indicating a strong investor interest in the open banking-driven B2B payments space.

Finally, we want to congratulate our new portfolio company Indy for topping this week’s fundraising activity with a €40m Series C. We are pleased to join Alven, Singular, Kerala, La Maison and iXO on Indy’s cap table.

Let’s dive in

BlackFin Tech is proud to announce that we led Indy's €40M Series C!

Indy is today's most-advanced AI-powered DIY bookkeeping & accounting software dedicated to freelance and independent workers.

Joining our friends from Kerala Ventures, Alven and Singular, we're delighted to help Indy enrich its offer to build the most competitive all-in-one solution on the market.

By 2027, the French startup targets one million clients.

As Julien Creuzé points out, "Indy's software is a life changing tool for all aspiring freelancers."

Obat, a SaaS solution for professionals in the construction industry, has secured a €12 million Series A funding round.

The funding round was led by Crédit Mutuel Innovation, with participation from New Alpha Asset Management, NCI, Kima Ventures, and other investors.

This investment round marks a significant milestone for Obat, doubling the amount raised compared to its previous seed round held a year ago.

Obat, founded in 2019, aims to simplify and enhance the daily operations of construction professionals by providing a 100% online SaaS platform.

Over the past four years, Obat has become a market leader, serving approximately 15,000 entrepreneurs, artisans, and business owners in France, Belgium, and Switzerland.

The platform has evolved to offer a wide range of features, including client, supplier, and subcontractor relationship management, project tracking, financial management, margin monitoring, HR management, marketing support, an online directory of construction professionals, and accounting and legal assistance.

With this Series A funding, Obat plans to accelerate its growth and solidify its position as the go-to platform for construction artisans. The funds will be used for hiring 50 new employees over the next 12 months, expanding partnerships, enhancing its product roadmap, improving brand recognition, and streamlining platform development and collaboration.

Crezco, a FinTech specializing in B2B invoice and bill payments, has successfully raised £9.6 million in Series A funding.

The company has integrated its technology into the cloud-based accounting platform Xero, enabling on-platform invoice and bill payments.

Using open banking technology, Crezco aims to make B2B invoice and bill payments as convenient as B2C card payments, simplifying the process for small businesses.

The funding round was backed by MMC Ventures and 13books Capital, indicating a strong investor interest in the open banking-driven B2B payments space.

Crezco's technology facilitates account-to-account (A2A) payments, allowing partners to shift the point of payment from traditional banks to their platform.

This development addresses a gap in the B2B payments market, which has not received as much attention as B2C payments in eCommerce and point-of-sale.

The integration of Crezco's technology into Xero is set to provide UK small businesses with on-platform bill payment capabilities via open banking, offering a more accurate view of their cash flow.

Ralph Rogge, Founder and CEO of Crezco, highlighted the significance of A2A payments, which enable real-time payments across various channels.

Investors in Crezco recognize the growth potential of open banking in addressing SME payments in the UK and potentially internationally.

Congrats also to HappyPal, Doorfeed, Aptus AI, Corporify, Wealth OS, Fence, RetroBridge for their fundraisings!

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

NomuPay, the Irish unified payments platform, has recently expanded its geographical reach by acquiring the UK-based payment services provider Total Processing. This strategic move, noted in a recent filing with Companies House, marks a significant step for NomuPay, which emerged in 2021 following Finch Capital's acquisition of assets from the former German payment processor Wirecard. Total Processing, established in 2015 in Manchester, specializes in offering a range of payment solutions such as online payments and card readers across Europe, North America, and the MENA region. With this acquisition, NomuPay, already known for its cross-border payment services, strengthens its position significantly. The deal enables NomuPay to leverage Total Processing's technological expertise, talent pool, and established market presence in North America and the MENA region. This aligns perfectly with NomuPay's ambition, announced earlier in May, to further scale its operations. While the financial details of the acquisition remain undisclosed, the implications are clear: NomuPay now holds a majority stake (over 75%) in Total Processing. This expansion is a testament to NomuPay's ongoing commitment to enhancing its global reach and service offerings in the rapidly evolving digital payments landscape.

And finally, here are the news that caught our eye last week:

Apple is in the midst of a class-action lawsuit where it's accused of conspiring to restrict peer-to-peer payments and hinder the integration of cryptocurrency technology, resulting in higher costs for users. The lawsuit highlights Apple's use of contractual and technological restraints to control its app ecosystem, adding to its history of legal challenges related to app restrictions and competition.

Alphabet's Capital G fund is in discussions to invest in Monzo, a prominent UK digital bank with 8.5 million customers. The funding round, anticipated to value Monzo at over £4 billion, marks a significant milestone for the bank as it works toward profitability and an eventual IPO, cementing its position in the UK fintech sector.

Klarna, the Swedish fintech firm, has been granted regulatory approval by the Financial Conduct Authority (FCA) to provide credit and payments products in the UK, ensuring its continued operation in the country. While this approval excludes Klarna's "buy now, pay later" business from regulation, it marks a significant milestone for the company and comes as it reports its first quarterly operating profit in four years, setting the stage for potential future expansion and public offerings.

Binance, the prominent cryptocurrency exchange, faces a significant outflow of funds as investors withdraw nearly $1 billion following the resignation of its CEO, who pleaded guilty to money laundering charges filed by the US Department of Justice. Binance has agreed to pay $4.3 billion in fines and penalties as part of a resolution with the DoJ, signaling the broader regulatory crackdown on cryptocurrencies in the US.

Have a great week & see you soon!