BlackFin Tech Weekly - October 13th, 2025

Every week, we publish a short digest which sums up last week’s Fintech activity

Hello FinTech Friends,

Welcome to another week of fintech insights. Let’s explore the news and trends shaping the industry!

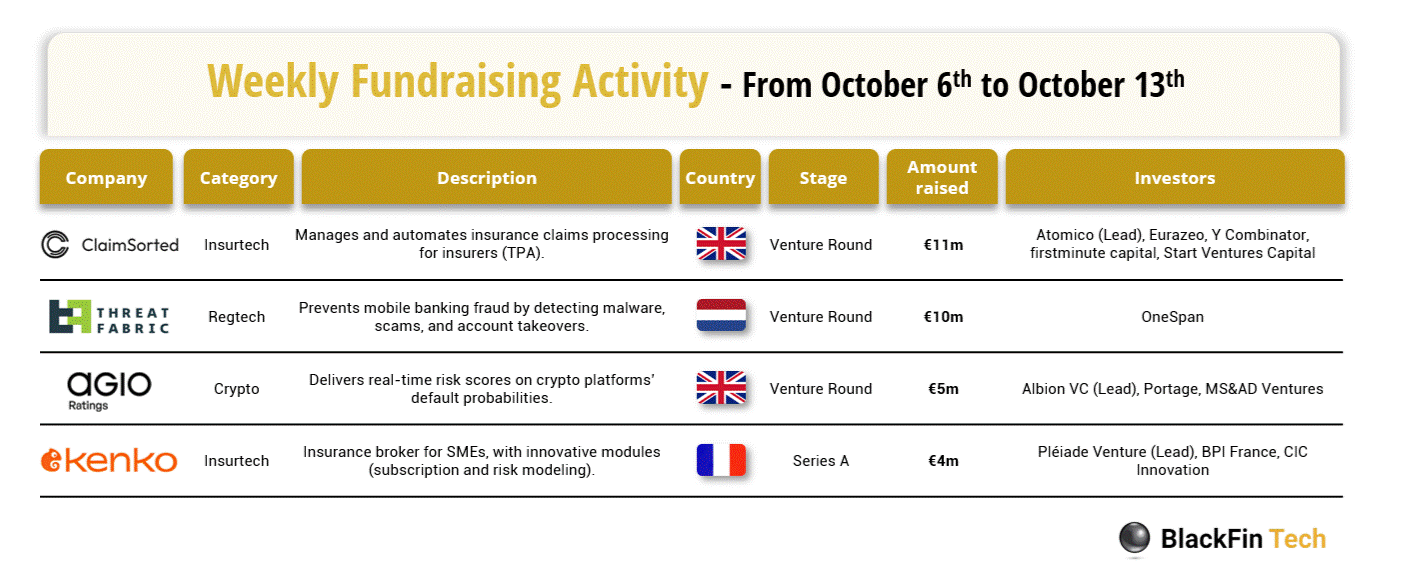

Over the last week, there were four fintech deals in Europe, raising a total of €31 million, including two transactions in the UK, one in France, one in Netherlands.

Congratulations to the three largest rounds announced last week:

ClaimSorted, a UK-based insurtech that manages and automates insurance claims processing for insurers (TPA), has raised €11.5 million in a Venture Round led by Atomico

ThreatFabric, a Netherlands-based regtech preventing mobile banking fraud by detecting malware, scams, and account takeovers, has raised €10 million in a Venture Round from OneSpan

Agio Ratings, a UK-based crypto risk intelligence platform delivering real-time risk scores on crypto platforms’ default probabilities, has raised €5 million in a Venture Round led by Albion VC

Let’s dive in!

ClaimSorted, headquartered in the United Kingdom, manages and automates insurance claims processing for insurers (TPA). The company has raised €11.5 million in a Venture Round led by Atomico, with participation from Eurazeo, Y Combinator, firstminute capital, and Start Ventures Capital. The new funds will be used to enhance its automation platform and accelerate international expansion

ThreatFabric, headquartered in the Netherlands, prevents mobile banking fraud by detecting malware, scams, and account takeovers. The company has raised €10 million in a Venture Round from OneSpan. The new funds will be used to accelerate global expansion and strengthen its fraud and scam prevention solutions

Agio Ratings, headquartered in the United Kingdom, delivers real-time risk scores on crypto platforms’ default probabilities. The company has raised €5.2 million in a Venture Round led by Albion VC, with participation from Portage Ventures and MS&AD Ventures. The funds will be used to support banks and financial institutions entering the crypto market and to expand its risk intelligence platform

In addition to this week’s fundraising activity, here is the European M&A activity for the week:

Ixopay, an Austria-based modular payment platform for merchants, has announced the acquisition of Congrify, a Germany-based payment observability and intelligence provider for merchants and payment service providers. The deal expands IXOPAY’s analytics and monitoring capabilities, enabling merchants to gain deeper insights into transaction performance and provider efficiency. Congrify’s solutions will be integrated into IXOPAY’s existing modular payment infrastructure to strengthen its data-driven offering.

Tax Systems, a UK-based software developer for tax compliance, has announced the acquisition of Loctax, a UK-based platform for managing tax obligations and data in a single system built for in-house tax teams. The transaction enhances Tax Systems’ regtech portfolio by combining compliance automation with centralized tax data management, helping enterprises improve governance, collaboration, and audit readiness. Loctax will continue operating under its brand with ongoing product integration planned.

And finally, we bring you four news stories that caught our eye last week:

Lawsuit risk is outpacing available AI insurance. OpenAI and Anthropic face multibillion claims while brokers say carriers lack capacity for correlated losses. OpenAI hired Aon and has reportedly covered nearly 300 million dollars, though some say lower, far short of potential exposure. Active cases include New York Times copyright claims and a wrongful death suit tied to ChatGPT. Anthropic agreed to a 1.5 billion author settlement over alleged use of pirated books. With traditional policies insufficient, labs are exploring self insurance and captives funded by investors. OpenAI has weighed a ring-fenced vehicle, yet a large claim could drain a thin captive. The episode exposes a protection gap for young AI firms even as OpenAI has raised nearly 60 billion and Anthropic above 30 billion. Insurers fear damaging verdicts and correlated model failures, delaying full coverage products and pushing risk back onto founders and backers for now.

Monzo is weighing a renewed try for a US banking licence, four years after shelving an application that met resistance. The UK fintech had retreated in 2021 amid valuation pressure and questions on anti money laundering controls, then refocused on its home market where revenue rose by 48% to 1.2 billion pounds and pretax profit reached 60.5 million in the year to March. People familiar say regulatory conditions have eased, with agencies updating rules that once hindered licences and partnerships for nontraditional lenders. If Monzo proceeds, it would join peers expanding in America. Checkout.com gained a limited purpose Georgia charter to process settlements, Nubank has begun a national charter bid, and Revolut and Starling have explored buying existing banks. Monzo still serves US customers through partner banks and declined to comment on the potential filing.

London got a small but symbolic reopening of the IPO window as three UK names tested demand. Beauty Tech Group’s shares rose on debut, Princes Group announced plans to float, and specialist lender Shawbrook launched an offering that could value it at nearly 2 billion pounds. Activity follows a barren year in which the exchange fell out of the top twenty by capital raised and UK IPO proceeds were below 200 million through the third quarter. Bankers and lawyers say a pipeline is forming for next year as global investors show fresh interest in UK deals. Recent steps include a secondary London listing by Fermi, and prospective floats such as Visma and Navoi being discussed. Policy support is building, with the chancellor considering stamp duty exemptions for newly listed shares. If Shawbrook and Princes price well, it could signal a turn for mid cap listings and restart London’s equity market.

OpenAI introduced in-platform app communication, letting ChatGPT users connect directly to services such as Spotify, Zillow, Figma, Expedia, and Booking, allowing tasks to be completed with one sign-on. The reveal at the annual developer event followed a secondary share sale that made OpenAI the most valuable start up. In the event, a burst of new products were covered, including the Sora social video app, as well as infrastructure deals with Nvidia and AMD. Stocks of mentioned partners jumped. The company framed the push as a route to faster developer adoption and a step toward ChatGPT acting like an operating system for software. OpenAI also launched AgentKit for building agents and said weekly users of ChatGPT exceed 800 million. Management sees revenue of 13 billion dollars this year, up from 4 billion last year, but remains unprofitable given its chip and data centre spend. The aim is growth first and profitability later.

Have a great start into the week!

Sources of the fundraising reports

*The information presented in this publication comes from publicly available sources. While the management company uses strict data selection criteria and focuses on the reliability of its sources, it cannot be held responsible for any inaccuracies, omissions, or errors in the data provided. This publication is for informational purposes only and does not constitute an investment recommendation