BlackFin Tech Weekly — October 14th, 2024

Every Monday, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome back to our newsletter! We’ve got exciting updates and insights from the world of fintech lined up for you. Let’s jump right into the latest trends and news!

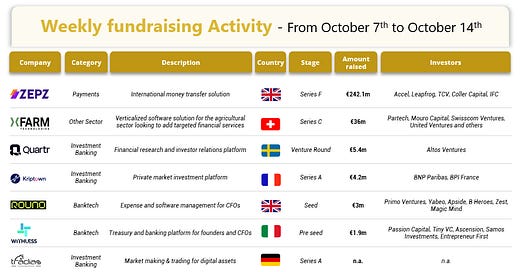

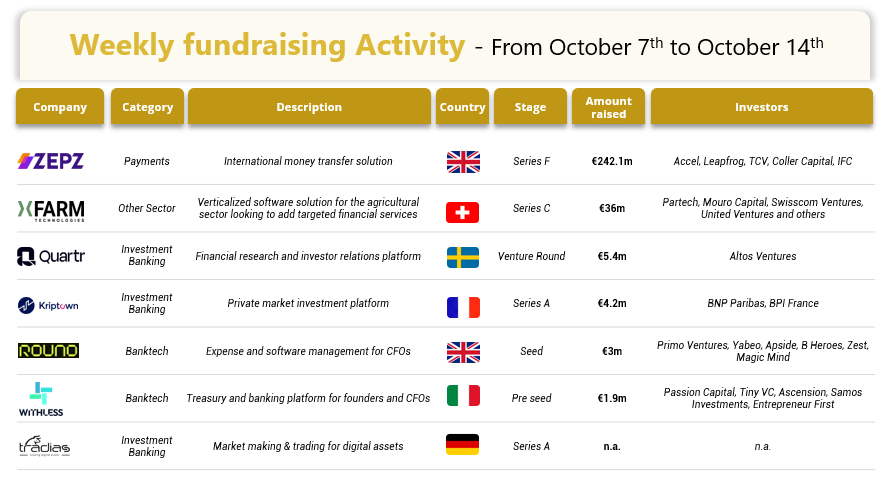

Last week, we saw 7 official fintech deals in Europe, raising a total of €291.6 million, with 2 deals in the UK, 1 deal in Germany, 1 deal in France, 1 deal in Switzerland, 1 deal in Italy and 1 deal in Sweden.

A big congratulations to Zepz, the UK-based remittance fintech, for successfully closing its €241.4 million Series F round led by Accel. Another round of applause goes to xFarm, the Swiss farm management app, for raising €36 million in Series C funding, led by Partech. Lastly, hats off to the Swedish research and IR platform Quartr, for securing €5.4 million in funding from Altos Ventures.

Let’s dive in

London-based fintech Zepz, has raised €241.4 million in a funding round led by Accel, with participation from Leapfrog, TCV, Coller Capital and the International Financial Corporation (IFC), part of the World Bank Group. This latest round follows a €267.2 million Series E round in 2021, shortly after Zepz acquired Sendwave and rebranded. Zepz was created in 2010 to provide a low-cost alternative for cross-border money transfers, addressing the high fees of traditional services. The platform now operates in 150 countries, allowing users to securely send money via bank deposits, cash collection, mobile airtime top-ups, and mobile money. Despite reaching a €4.6 billion valuation in 2021 and achieving profitability in 2022, Zepz has paused its IPO plans. Zepz plans to use the new funding to grow beyond its core African markets and introduce new products, like the Zepz Wallet.

Read more

Xfarm Technologies, a Switzerland-based leader in agri-food digitalisation, has secured €36 million in a Series C funding round, led by Partech's Impact Growth Fund and joined by Mouro Capital, Swisscom Ventures, United Ventures and all previous institutional investors. The company's innovative platform offers advanced digital tools for farm management, supporting over 450,000 farms across more than 100 supply chains worldwide. With this new funding, xFarm plans to expand into LatAm, India, Turkey, and the U.S., while also launching a Fintech and Insurtech division to provide farmers with enhanced financial and insurance solutions, focusing on risk and credit management to further boost efficiency and sustainability.

Stockholm-based Quartr, a leading software and data provider revolutionizing public market research for finance and investor relations (IR) professionals, has closed a €5.4 million investment from Altos Ventures. Since its launch in 2020, Quartr has quickly become a top global distributor of IR materials, offering a free mobile app, desktop research platform, and an API that provides seamless access to critical company information. Its flagship product, Quartr Pro, is widely used by hedge funds, asset managers, equity research teams, and Fortune 500 companies, transforming how professionals conduct qualitative research by streamlining access to earnings calls, presentations, and reports.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Pockit has acquired Monese for £15 million in a move to strengthen its position in providing financial services to underserved consumers across the UK and Europe. The deal will expand Pockit's product offerings by leveraging Monese's regulatory infrastructure and licenses, while the combined entity will serve 3 million customers and generate around £30 million in annual revenue. Led by Pockit’s CEO Virraj Jatania, the acquisition aims to enhance financial inclusion with new products and services, with Monese's CEO Norris Koppel assisting in the transition.

And finally, here are the news that caught our eye last week:

British online bank Monzo has announced an employee share sale. StepStone Group and Singapore state fund GIC, who are both existing investors of Monzo, will be buying the shares at a total valuation of the company at £4.5bn.

Last Tuesday, API investment infrastructure provider Upvest announced they are now authorized and regulated in the UK. This means their offering is now available to UK-based Fintechs, banks and wealth managers. Just the week prior, it was announced that competitor WealthKernel had obtained an authorization as a Securities Broker from the Spanish National Securities Market Commission.

In a newly announced cooperation, Revolut Business now enables UK merchants to accept American Express via Revolut Gateway, Payment Links and Tap to Pay on iPhone. Revolut Business customers are thus now able to offer seven different payment options at checkout.

In a push towards profitability, banking-as-a-service Fintech Solaris is letting go of one third of their ~700 employees. The layoff will disproportionately affect the British subsidiary Contis, which Solaris had acquired at the end of 2021. At Solaris itself, roughly 15% of employee will be cut.

Read more (German version only)

Have a great week!

Sources of the fundraising reports