BlackFin Tech Weekly - October 21th, 2025

Every Week, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome to another week of fintech insights. Let’s explore the news and trends shaping the industry!

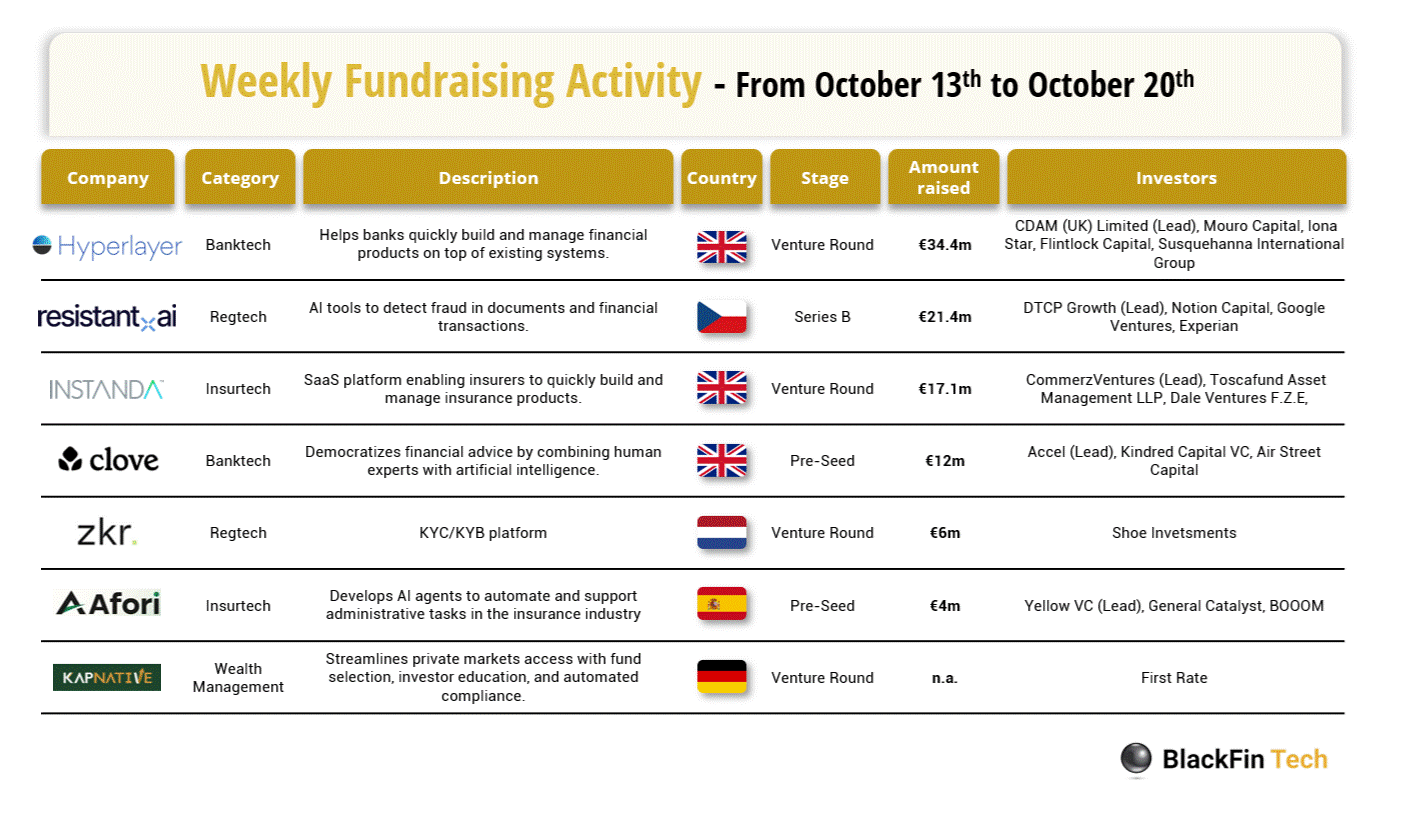

Over the last week, there were seven fintech deals in Europe, raising a total of €95 million, including three in the UK, one in Germany, one in Spain, one in the Czech Republic and one in the Netherlands.

Congratulations to the three largest rounds announced last week:

Hyperlayer, a UK-based banktech helping banks build and manage financial products on top of existing systems, has raised €34.4 million in a Venture Round led by CDAM (UK) Limited.

Resistant AI, a Czech regtech developing AI tools to detect fraud in documents and financial transactions, has raised €21.4 million in a Series B round led by DTCP Growth.

Instanda, a UK-based insurtech SaaS platform for insurers to quickly build and manage insurance products, has raised €17.1 million in a venture round led by CommerzVentures.

Let’s dive in!

Hyperlayer, headquartered in the UK, helps banks quickly build and manage financial products on top of existing systems. The company has raised €34.4 million in a Venture Round led by CDAM (UK) Limited, with participation from Mouro Capital, Iona Star, Flintlock Capital, and Susquehanna International Group.

Resistant AI, based in the Czech Republic, develops AI-powered tools to detect fraud in documents and financial transactions. The startup has secured €21.4 million in a Series B round led by DTCP Growth, with participation from Notion Capital, Google Ventures, and Experian. The funds will help scale its fraud prevention technology and expand internationally.

Instanda, headquartered in the UK, offers a SaaS platform enabling insurers to rapidly build, configure, and manage insurance products. The company raised €17.1 million in a Venture Round led by CommerzVentures, alongside Toscafund Asset Management LLP and Dale Ventures F.Z.E. The capital will support further product innovation and international growth.

In addition to this week’s fundraising activity, here is the European M&A activity for the week:

S&P Global, a US-based provider of financial data, benchmarks, and analytics solutions, has agreed to acquire With Intelligence, a UK-based provider of private markets and alternative investment data and intelligence, from Motive Partners for $1.8 billion. The transaction expands S&P Global’s presence in private markets intelligence, enhancing its capabilities across alternative assets and investor insights. With Intelligence will continue to operate under its brand, with its existing leadership team remaining in place.

Deel, a US-based platform powering global payroll, hiring, compliance, and HR services, has announced the acquisition of Omnipresent, a UK-based provider of global employment, payroll, and compliance solutions as an Employer of Record (EOR) platform, for $15 million. The acquisition reinforces Deel’s leadership in the HR tech sector, expanding its global reach and strengthening its product offering in international workforce management. Omnipresent will continue to operate under its brand, with its existing leadership team remaining in place.

CUBE, a UK-based Regtech firm providing AI-powered compliance and risk automation solutions, has announced the acquisition of Kodex AI, a Germany-based AI compliance platform managing regulatory workflows and alerts for financial institutions. The transaction creates an industry-first unified platform for compliance, risk, and agentic AI, enhancing CUBE’s capabilities in intelligent regulatory management. Kodex AI will continue to operate under its brand, with its existing leadership team remaining in place.

And finally, we bring you four news stories that caught our eye last week:

Swiss German chancellor Friedrich Merz urged the creation of a single European stock exchange and signalled Berlin’s readiness to accept centralised market supervision, reversing years of hesitation. He told the Bundestag that successful German companies should not have to list in New York and called for deeper capital markets that finance growth faster. His government has aligned with France to revive the capital markets union, including exploring a single supervisor that would move powers from BaFin to Esma, a shift long resisted by Germany and still opposed by Luxembourg and Cyprus. The plan echoes recommendations from Mario Draghi and Enrico Letta to lift productivity and competitiveness, and to complete the single market for goods, capital, labour and services. Merz, a former adviser to BlackRock and board member at Deutsche Börse, presented the push as part of a growth agenda ahead of next week’s EU summit.

S&P Global agreed to acquire With Intelligence for 1.8 billion dollars from investors led by Motive Partners, with closing targeted in 2025 or early 2026 subject to approvals. The London based data firm, founded in 1998, supplies alternative investment data and analytics to pension funds, managers and advisers by collecting proprietary information from limited partners and general partners through surveys and filings. It serves about 3,000 clients via a digital platform that offers real-time benchmarking and workflow tools and is forecast to generate around 130 million dollars of revenue this year. Motive Partners bought a majority stake from Intermediate Capital Group for 400 million pounds in 2023, with ICG retaining a minority. S&P Global plans to integrate the company’s fund data with its databases on private companies and transactions to expand coverage of private markets and support performance analytics initiatives with Cambridge Associates and Mercer.

OpenAI agreed to buy ten gigawatts of computer chips from Broadcom, a colossal order that could cost between 350 and 500 billion dollars on top of roughly one trillion dollars of recent chip and data center commitments. The deal includes custom inference chips codesigned with Broadcom for running OpenAI models, marking the company’s first move into its own AI silicon. Combined with earlier orders of ten gigawatts from Nvidia and six gigawatts from AMD, plus a data center partnership with Oracle estimated at 300 billion dollars over five years, OpenAI’s total access to computing capacity would exceed 26 gigawatts, roughly the output of 26 nuclear reactors. The spree deepens ties with major suppliers even as funding needs exceed current revenues. Unlike its Nvidia and AMD agreements, OpenAI did not secure incentives from Broadcom, which expects lower chip prices as competition rises.

London’s High Court dismissed a $440m claim brought by UBS against SoftBank over losses tied to the 2021 collapse of Greensill Capital, handing SoftBank a high-profile victory. Lord Justice Miles ruled that no relief should be granted and found SoftBank did not orchestrate the transactions behind the dispute, which centred on money the group provided to Greensill that was said to be earmarked to cover Credit Suisse client losses. The case delivered the first public testimony from Lex Greensill and produced disclosures on Credit Suisse risk management failings from Swiss regulator Finma. UBS, which inherited Credit Suisse litigation after the 2023 rescue, said the Credit Suisse fund would review options while SoftBank claimed full vindication. The judge criticised a message from Greensill to a senior Credit Suisse executive as opportunistic and misleading.

Have a great start into the week!

Sources of the fundraising reports

*The information presented in this publication comes from publicly available sources. While the management company uses strict data selection criteria and focuses on the reliability of its sources, it cannot be held responsible for any inaccuracies, omissions, or errors in the data provided. This publication is for informational purposes only and does not constitute an investment recommendation.