BlackFin Tech Weekly — September 16th, 2024

Every Monday, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome back to our newsletter! It’s been an eventful week in fintech, and we’re excited to bring you the latest deals and news from the past 7 days. Read on to catch up on all the recent developments!

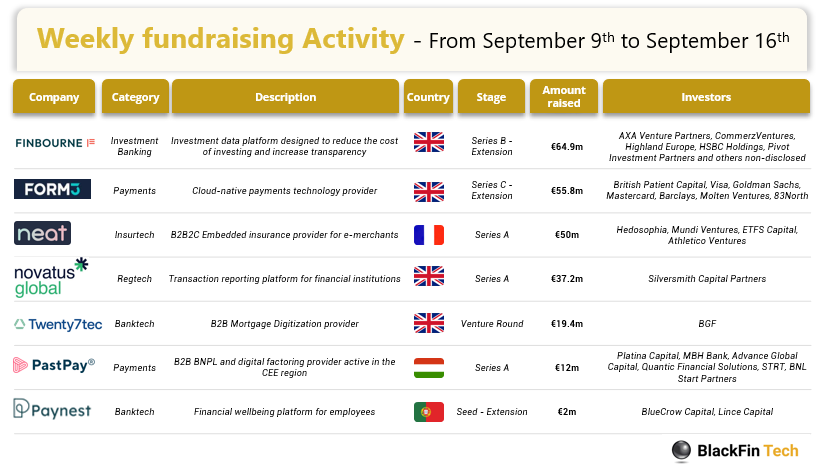

Last week, we saw 7 official fintech deals in Europe, raising a total of €241.4 million, with 5 deals in the UK, 1 deal in Portugal and 1 deal in Hungary.

Congratulations to Finbourne Technology, the UK-based investment management platform, for raising €64.9 million in a series B extension from 6 existing investors and 4 new ones, including CommerzVentures and HSBC. A big round of applause to the UK-based payment platform Form3 for raising €55.8 million in a Series C round led by British Patient Capital. And lastly, kudos to French insurtech startup Neat for securing €50 million in a Series A round, a mix of debt and equity, led by Hedosophia.

Let’s dive in

Finbourne Technology, a UK-based investment data platform, raised €64.9 million, bringing its total Series B raise to over £100 million, making it one of the largest Series B in the UK. The round welcomed new investors, including CommerzVentures and HSBC, who will join Finbourne's Board as observers. The funds will fuel growth of Finbourne's cloud-native LUSID platform, which offers scalable, front-to-back functionality for asset managers, helping boost efficiency, reduce costs, and manage risk. Trusted by leading global financial institutions like Northern Trust and the Pension Insurance Corporation, Finbourne’s platform integrates with AI and ML ecosystems, preparing clients for AI-driven efficiencies.

Read more

Form3, a UK-based payment platform, secured €55.8 million in a series C round led by British Patient Capital, the commercial subsidiary of the UK government’s economic development bank. This brings its total Series C funding to $220 million, valuing the company at $570 million post-money. Form3’s account-to-account payment platform handles over 50% of the UK’s non-cash payment volume, offering services such as instant transfers, payment orchestration, fraud protection, direct debits, and credit transfers. Its clients include major banks like Barclays, Lloyds, and Nationwide, as well as fintechs like Klarna, SumUp, and Thought Machine. The new funding will fuel Form3’s product development and expansion across the UK, Europe, and the US.

The Paris-based insurtech Neat, has raised €50 million in a Series A round, led by Hedosophia with participation from ETFS Capital, Mundi Ventures and others. The funding, split into 60% equity and 40% debt, supports Neat's embedded insurance products, which are sold through partner retailers. Neat helps businesses offer insurance as an add-on to products like smartphones and travel, allowing retailers to earn commissions without handling the complexities of insurance. With over 1,500 distribution partners, Neat has already sold more than 1 million policies.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Cinven, an international private equity firm headquartered in London, has acquired a 50% stake in Policy Expert, a UK-based managing general agent (MGA) specializing in home and motor insurance. Policy Expert serves over 1.5 million customers across several UK locations, supported by a proprietary technology platform and a data-driven approach to pricing and risk management. The acquisition, from a subsidiary of the Abu Dhabi Investment Authority (ADIA), underscores Cinven's strategy to leverage its deep experience in the insurance sector to support and accelerate Policy Expert's ongoing growth and expansion in the UK market. Terms and conditions remained undisclosed.

GTreasury, a global leader in Digital Treasury Solutions headquartered in Chicago, has acquired CashAnalytics, a leading cash forecasting and AR/AP analytics solution used by over 1,000 business entities across 40+ countries. This acquisition enhances GTreasury's suite of treasury solutions by integrating CashAnalytics' advanced cash forecasting capabilities, which are increasingly critical for CFOs and treasury teams focused on optimizing working capital. The combined offering will provide seamless data orchestration and rapid deployment, enabling businesses to gain deep insights into cash flow and working capital, and improve their financial operations more efficiently. Terms and conditions also remained undisclosed.

And finally, here are the news that caught our eye last week:

In August, a secondary sale of staff shares conducted to provide “employee liquidity” netted $500m for several thousand Revolut employees. Shares were sold to Tiger Global Management, Coatue and D1 Capital Partners at a $45bn valuation. Sky News reported that Founder and CEO Storonsky sold 40-60% of the stock sold in this secondary share sale, solidifying him as one of the world’s wealthiest Tech bosses; he retains a stake in Revolut worth ~$8bn.

Lloyds Banking Group plans 292 branch closures in the UK by the end of 2025. Concerns have been voiced about the elderly and underbanked communities, for whom banking services will be less accessible. Most costumers are, however, comfortable using digital alternatives, a trend which these news underline.

eToro has settled charges of operating as an unregistered broker and clearing agency in connection with its crypto asset trading platform with the SEC. The firm will pay $1.5m and cease trading of most crypto assets on its platform in the US. US customers can, however, continue to trade Bitcoin, Bitcoin Cash and Ether on eToro’s platform.

The Amsterdam-based global neobank Bunq, which says they are “built by digital nomads, for digital nomads”, plans to grow their global headcount by 70% to 730 before the end of 2024. Roles are open in marketing, PR, sales, market analysis and business development. Bunq is currently awaiting a license to operate in the US and the UK, respectively, but besides London and New York, jobs are also open in other European countries.

Have a great week!

Sources of the fundraising reports