BlackFin Tech Weekly — September 23rd, 2024

Every Monday, we publish a short digest which sums up last week’s Fintech activity.

Hello FinTech Friends,

Welcome back to our newsletter! It’s been a dynamic week in the fintech space, and we're thrilled to share the latest deals and developments from the past seven days. Let’s dive into the key highlights!

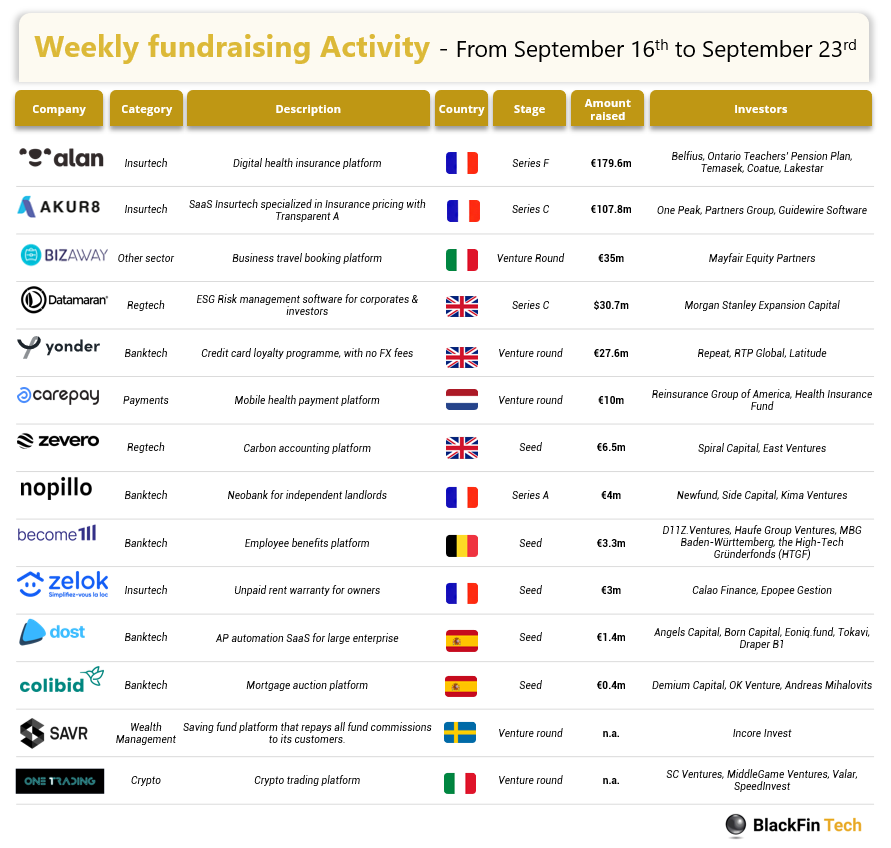

Last week, we saw 14 official fintech deals in Europe, raising a total of €409.3 million, with 4 deals in France, 3 deals in the UK, 2 deals in Spain, 2 deals in Italy, 1 deal in Sweden, 1 deal in Germany, and 1 in the Netherlands.

Congratulations to Alan, the French insurance unicorn, for securing €173 million in a series F from Belfius.

A big round of applause to our portfolio company Akur8 for raising €107.8 million in a Series C round led by One Peak! We’re grateful to be part of the Akur8’s journey since we led their Series A in 2020, and this milestone is a great testament to their hard work and bold vision - congrats!

And lastly, congratulations to the Italian business travel management startup Bizaway for raising €35 million from Mayfair Equity Partners.

Let’s dive in

Alan, the French health insurance platform has secured €173 million in a Series F funding round led by Belfius, one of Belgium’s largest banks, raising its valuation to €4 billion. Other key investors include Ontario Teachers’ Pension Plan via Teachers' Venture Growth, Temasek, Coatue, and Lakestar. Known for revolutionizing health insurance in France, Alan initially launched a product designed to complement the national healthcare system, mandatory for all French employers. Its user-centric approach has outshone traditional insurers, with features like instant claim reimbursements, virtual doctor consultations, prescription eyewear orders, and preventive care content on its mobile app. As part of this new financing round, Alan formed a strategic partnership with Belfius and will offer its insurance products to the bank’s corporate clients and 7,000 employees. Currently, Alan serves 650,000 members and 23,000 businesses across France, Spain, and Belgium, with projected revenues of €450 million by 2024. With plans to hire 25 new strategic employees in Belgium, Alan aims to enhance its growth and international presence.

Read more

Akur8, the AI-powered insurance pricing platform, has secured €107.8 million in Series C funding, bringing its total to $180 million. Led by growth equity firm One Peak, with participation from Partners Group and Guidewire Software, this funding will drive Akur8's product expansion and global growth. Akur8 has been revolutionizing non-life insurance pricing since 2019 with its transparent, AI-powered platform, allowing insurers to price policies faster and more accurately. The company will use the new funds to enhance its platform with two key modules: Optim, which helps insurers fine-tune pricing strategies, and Deploy, a rating engine that streamlines pricing implementation. The investment will also accelerate Akur8's growth following its acquisition of the Arius reserving platform, allowing it to bridge the gap between reserving and pricing and target new market segments globally. With a strong focus on North American expansion, Akur8 aims to strengthen its presence in key growth markets and broaden its customer base.

Milan-based BizAway, a fast-growing business travel booking platform, secured a €35 million investment from Mayfair Equity Partners. This new partnership is set to accelerate BizAway’s growth in both existing and new markets. Founded in 2015, BizAway has grown into a global travel management company with over 300 employees and eight offices across Europe and the UAE. Its platform features automated corporate travel policy compliance, travel risk management, carbon offset options, and even supports leisure bookings. With its proprietary software, companies can efficiently plan, book, and manage trips while reducing costs and ensuring compliance. Recent innovations include BizzyFlex, which allows cancellations up to three hours before departure with partial refunds, and BizzyPay, a corporate card solution for secure expense management. With this funding, BizAway plans to innovate its travel management system, enhance AI and data capabilities, and expand its offerings for business travellers.

In addition to this week’s fundraising activity, here is the European M&A activity of the week:

Bridgepoint, the UK-based private equity firm, has launched a friendly takeover offer for Lyon-based Esker, an IT services company specializing in financial, procurement, and accounting software solutions. Esker, which employs over 1,000 people, is valued at €1.6 billion through this deal, with a buyout offer of €262 per share, representing a 62% premium over its average annual share price. Partnering with General Atlantic, Bridgepoint aims to acquire at least 60% of Esker’s shareholders by year-end, with the goal of delisting the company to enable greater agility for financing growth, as Esker's management has found public market constraints limiting.

Kepler Cheuvreux, a Paris-based financial services group, has acquired a majority stake in Trackinsight, a fintech specializing in ETF analysis. Trackinsight, headquartered in Sofia-Antipolis, manages a database of 11,000 ETFs, covering 99.8% of the global ETF market in Europe and North America. This acquisition allows Kepler Cheuvreux to enhance its ETF offering, supporting clients from ETF selection to transaction execution. With 600 employees and operations across 14 offices, Kepler Cheuvreux aims to integrate Trackinsight's technological tools to provide deeper ETF insights, focusing on criteria like fees, performance, and sustainability. Terms and conditions remained undisclosed.

And finally, here are the news that caught our eye last week:

According to the Wall Street Journal, JP Morgan has been in talks to replace Goldman Sachs as Apple’s credit card partner. Goldman Sachs and Apple developed the credit card offering in 2018; the partnership was last expanded in March 2023 with the offering of buy now, pay later services.

Deutsche Bank plans to close roughly 50 branches in Germany, harkening back to the closing of Llyods Banking Group branches in the UK as reported on last week. Deutsche Bank plans to replace the branches with video and telephone services, as well as extended investments into their app.

Revolut has applied for a license to take up operations in the UAE. The license would allow the FinTech to become an electronic-money institution and offer remittances in the Gulf state.

PayPal has invested into the New York-based Chaos Labs using its PYUSD stablecoin on-chain. The investment was part of a $55m Series A led by Haun ventures, in which PayPal doubled down on a previous investment. Chaos Labs offers on-chain risk management tools for decentralized finance (DeFi).

Have a great week!

Sources of the fundraising reports