H1 2025 FINTECH WRAP-UP 🌯

Discover Fintech Wrap-Up, a newsletter about all things Fintech & Insurtech in Europe, by BlackFin Tech.

Welcome back, dear fintech aficionados!

We're already halfway through 2025 - and it’s been an exciting journey for European fintech. Investor confidence is on the rise, especially within wealth management and payments (still!). In the wider world meanwhile, stablecoins are starting to integrate with traditional finance in the US, and new players like Wero are disrupting the European payments scene.

In this summer edition, we’ll highlight the biggest deals, key announcements, and trends that are shaping fintech’s path this year. Gear up, the second half is set to bring even more excitement!

📊 WHAT SHAPED EUROPEAN FINTECH IN H1 2025

📉 The first half of 2025 shows a modest drop in total funding compared to the same period last year - but nothing alarming.

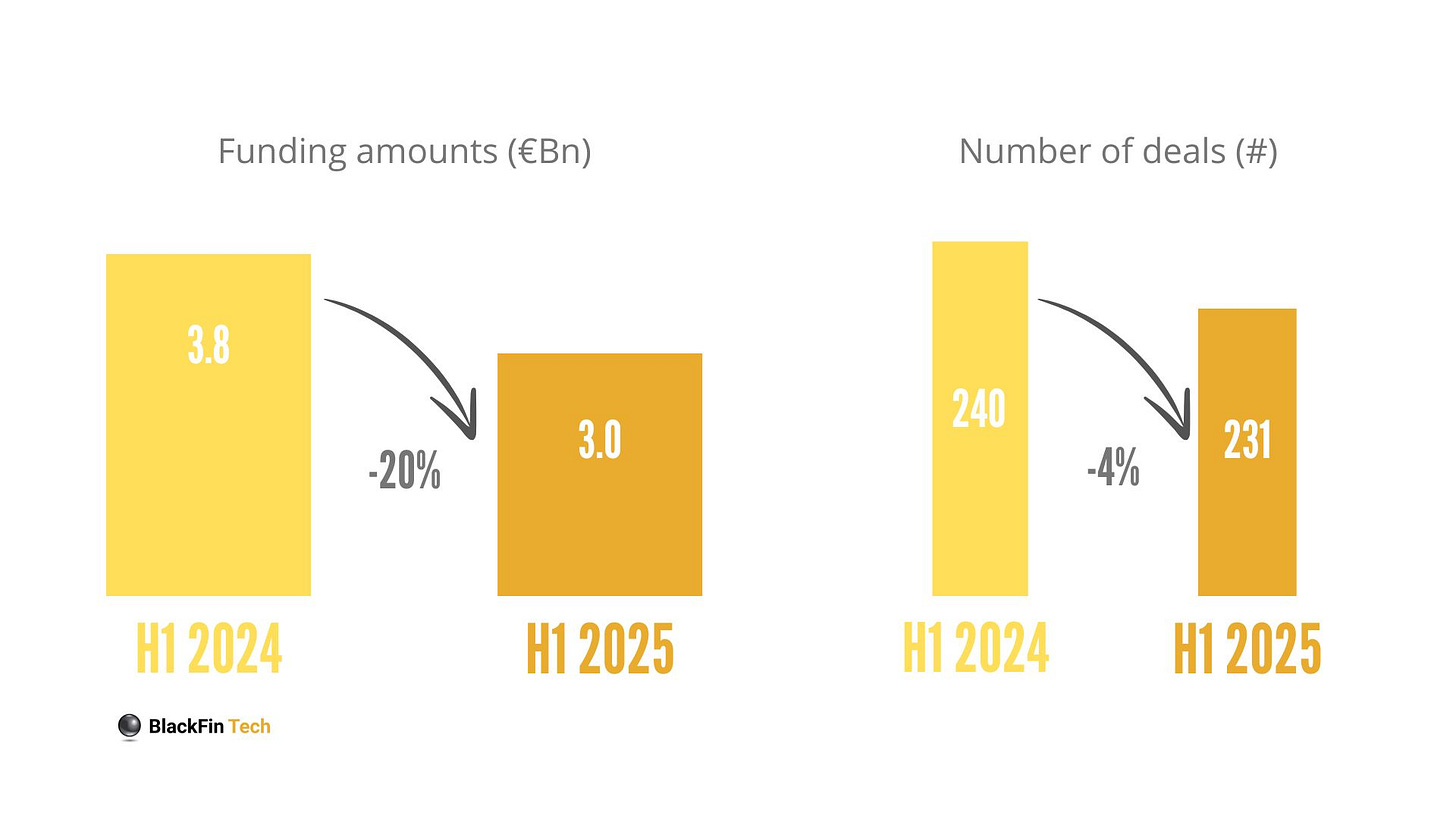

Total funding reached €3.0B, down from €3.8B in H1 2024.

👉 Let’s keep things in perspective: excluding Monzo’s €580M mega-round from March 2024, we’re essentially on par with last year.Deal count remains remarkably stable: 231 this semester vs. 240 a year ago.

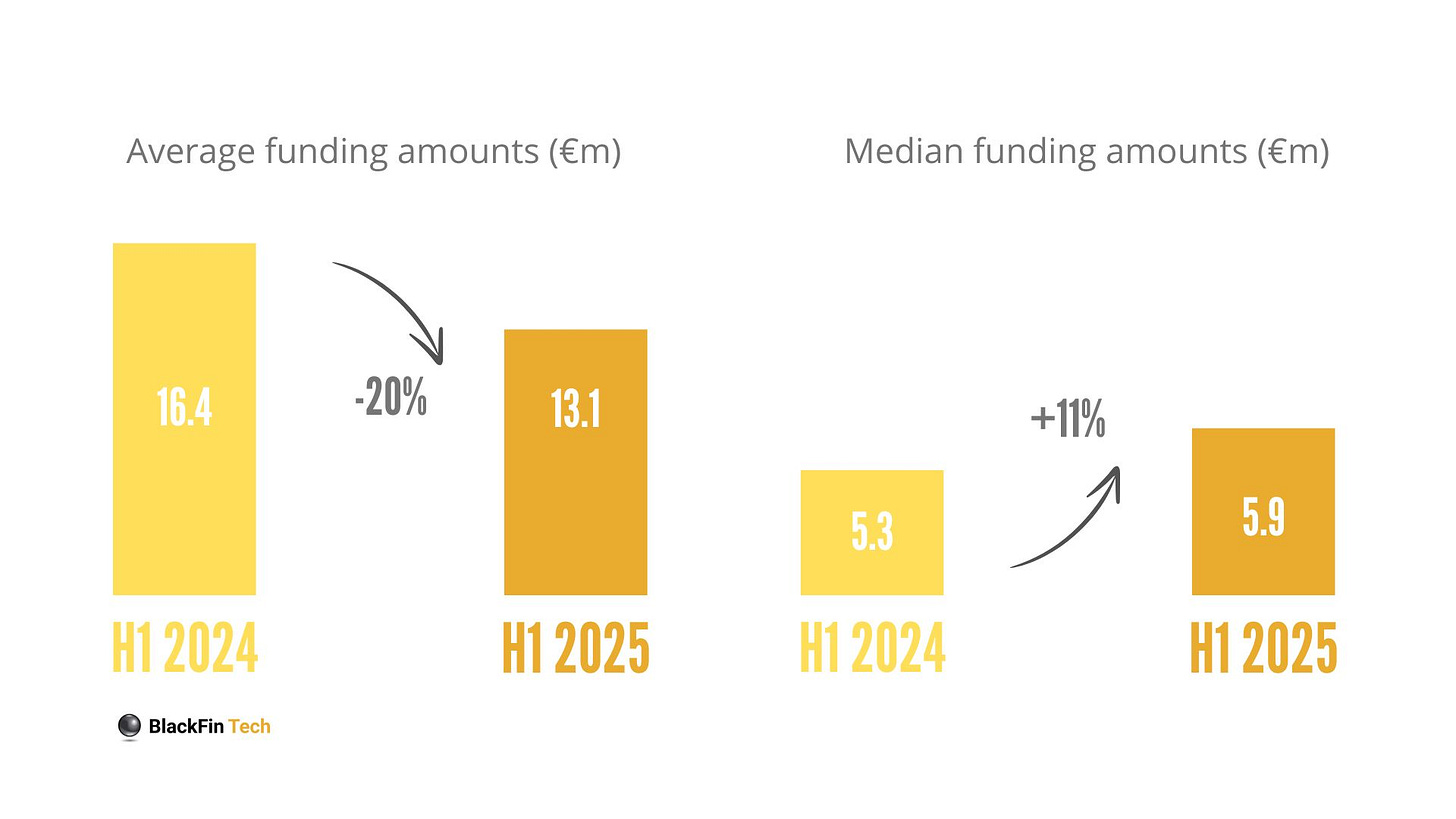

Looking at deal sizes, average and median round sizes paint a picture of continuity from last year:

Average deal size dipped slightly to €13.1M (vs. €16.4M), likely due to the absence of ultra-large rounds like Monzo.

Median deal size rose to €5.9M (vs. €5.3M), hinting at healthy momentum in early and mid-stage funding?

📊 TL;DR: Dealflow holds steady—with fewer mega-rounds, but bigger tickets in the middle. Average down, median up.🌍 Geographic breakdown

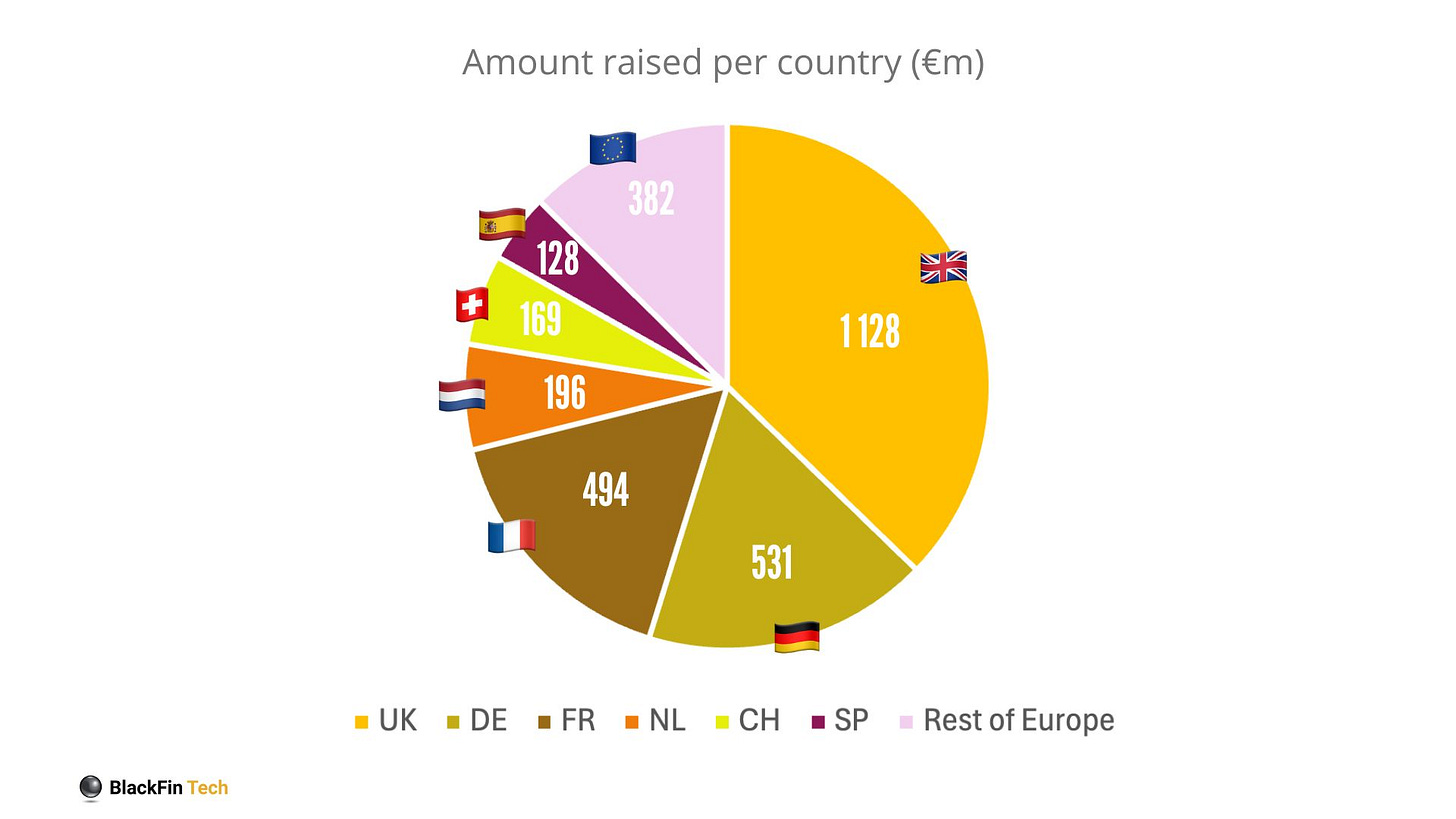

🥇 UK: Leading with €1.13 billion raised — despite a -33% drop from last year, largely due to the absence of Monzo’s mega-round.

🥈 Germany: Stabilising at €531 million, showing a modest +6% increase from H1 2024.

🥉 France: Also steady, with €494 million raised — a +11% uptick, confirming its solid position in the European fintech scene.

📊 TL;DR: Together, UK + Germany + France represent 71% of total fintech investments.🏷️ Sector breakdown

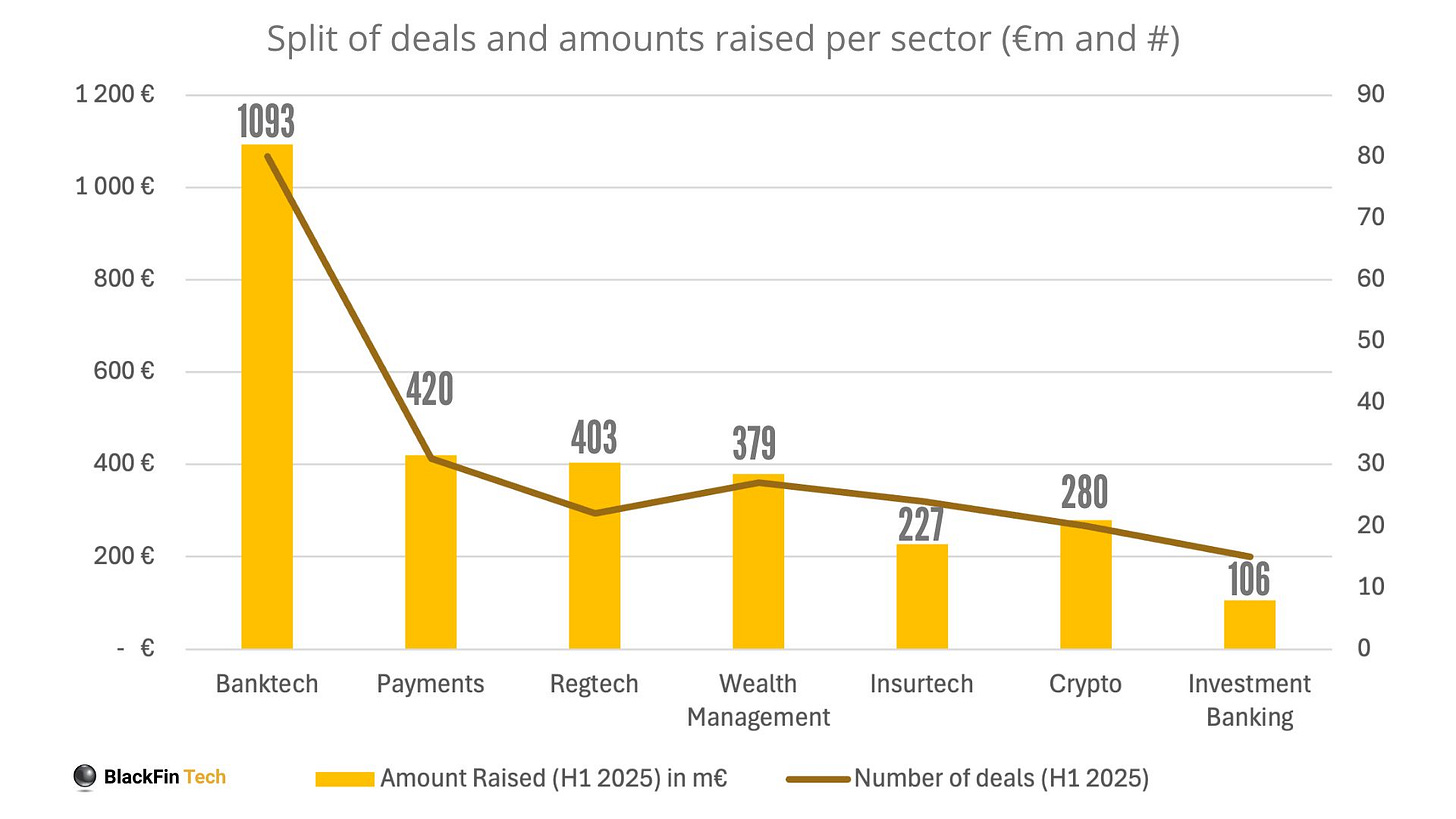

Looking at sector trends, here’s how key areas of fintech have evolved compared to last year:

📉📉 Banktech: Down 51% - but no mega deals to report this year.

📉 Payments: Slight drop of 3.4%, sector remains steady.

📈💥 Regtech: Up 93%, showing strong growth possibly due to stricter regulatory environments (AML, Compliance, Fraud).

🚀 Wealth Management: Surged 362.2%, fueled by the rise of platforms catering to the growing demand for personalized wealth management, especially among young investors and freelancers.

📊 Crypto: +1%, maintaining steady interest despite market volatility.

📉 Insurtech: Fell 25.1%, investment slowdown.

📉 Investment Banking: -56%, marking a sharp decline with a significant slowdown in funding.

📊 TL;DR: Wealth Management and Regtech are seeing strong growth. Banktech remains the dominant sector despite a decline.3 headlines that shaped H1 2025

🚨 Fintech IPOs Might Be Back: Who’s Next?

After a long drought, public markets are once again welcoming fintechs - and this time, the pipeline looks serious. In the US, Chime, Circle and eToro have already gone public in 2025 -and early days have seen stock price surge significantly- while Wealthfront and Navan have filed confidentially.

On this side of the Atlantic, all eyes are on Klarna, expected to go public later this year in one of Europe’s most anticipated IPOs. And while nothing is confirmed yet, Revolut is widely rumored to follow in 2026…

💸 When Crypto Starts Funding the U.S. Government

Behind the scenes of crypto’s rebound, a significant shift is underway: stablecoin issuers like Tether and Circle -already major buyers of short-term U.S. Treasuries since 2021- have accelerated their purchases in response to new regulations requiring them to back their tokens with liquid, safe assets. Beyond regulatory compliance, T-bills are a critical reserve, giving issuers the firepower to defend their peg against speculative attacks and maintain confidence in the stablecoin ecosystem.

With the stablecoin market bigger than ever and U.S. lawmakers moving toward more flexible rules, how long before these buyers overtake Japan and China in T-bill purchases - further blurring the lines between crypto and traditional finance?

🔥 Wero Goes Wild - And Fintechs Want In

Wero is taking European payments by storm as the first pan-European digital wallet, backed by 16 major banks and attracting big players like Revolut. Now available in 15 countries and integrated with top fintech apps, Wero is rapidly becoming the continent’s preferred choice for instant, secure, and sovereign payments - showing that sometimes joint initiatives by pushed by public & private institutions can become successful.

⭐ What are the 1st semester’s 10 biggest rounds? ⭐

The top 3 fintech deals in Europe for H1 2025 all hail from beer-loving countries 🍺, with the UK, Netherlands, and Germany leading the pack, underscoring their dominance in the sector.

So far this year, the largest rounds have been concentrated in banktech, accounting solutions, wealthtech, and crypto, affirming these sectors as the hotbeds of investor interest.

🍳 WHAT SHAPED H1 2025 AT BLACKFIN TECH

Portfolio news

In H1, our portfolio companies raised more than €200m. Congrats to them!

New investments

🇨🇭We led Swiss-based ETFbook’s Series A to enable institutional stakeholders to make sense of increased speed of innovation in the industry 🚀🤓

🇫🇷 We invested in a Bordeaux-based fintech by leading Wealthcome’s €7M Series A

🇫🇷 We led WeeFin’s s €25M Series B to build the leading extra-financial data management platform for asset managers and financial institutions 💚

🇬🇧 We backed TransFICC’s $25M Series B to expand its low-latency connectivity and workflow services for Fixed Income and Derivatives Markets

🇩🇪 We led the Series C of Aufinity - the market leader in payment management for the automotive sector - with existing investors PayPal Ventures and Seaya reinvesting 🚗

🇬🇧 We invested in S64 to transform private market access, joining forces with HPS Investment Partners and Sumitomo Mitsui Trust Bank 🤝

Follow-up investments

🇫🇷 We backed the €16M Series C of Epsor, France’s fastest-growing provider of employee savings and retirement plans

🇩🇪 Hawk raised $56M in Series C as Tier 1 banks adopt its AI to combat financial crime

🇫🇷 Descartes Underwriting has received a strategic investment from Battery Ventures, with Marcus Ryu - partner at Battery and co-founder of Guidewire Software, the world’s most successful insurtech to date - joining the board 🔥

🇬🇧 Timeline reached a major milestone in July 2025, surpassing £10bn in assets under management 👏

Exits

🇬🇧 Ravelin joined Worldpay to eradicate fraud from the internet at scale. We’re looking forward to seeing all the great things this partnership will bring!

Snapshots from FIBE 🇩🇪✨

This year, we made some noise at FIBE - Romain shared his insights on stage, while we welcomed fintech friends over breakfast to kick off the day.

🤝 Where will we shake hands next?

Our team will be:

In IPEM (Paris, 24 Sep - 26 Sep)

In Bits & Pretzels (Munich, 29 Sep - 01 Oct)

and more to come!

Meanwhile, savor the summer, folks 💙